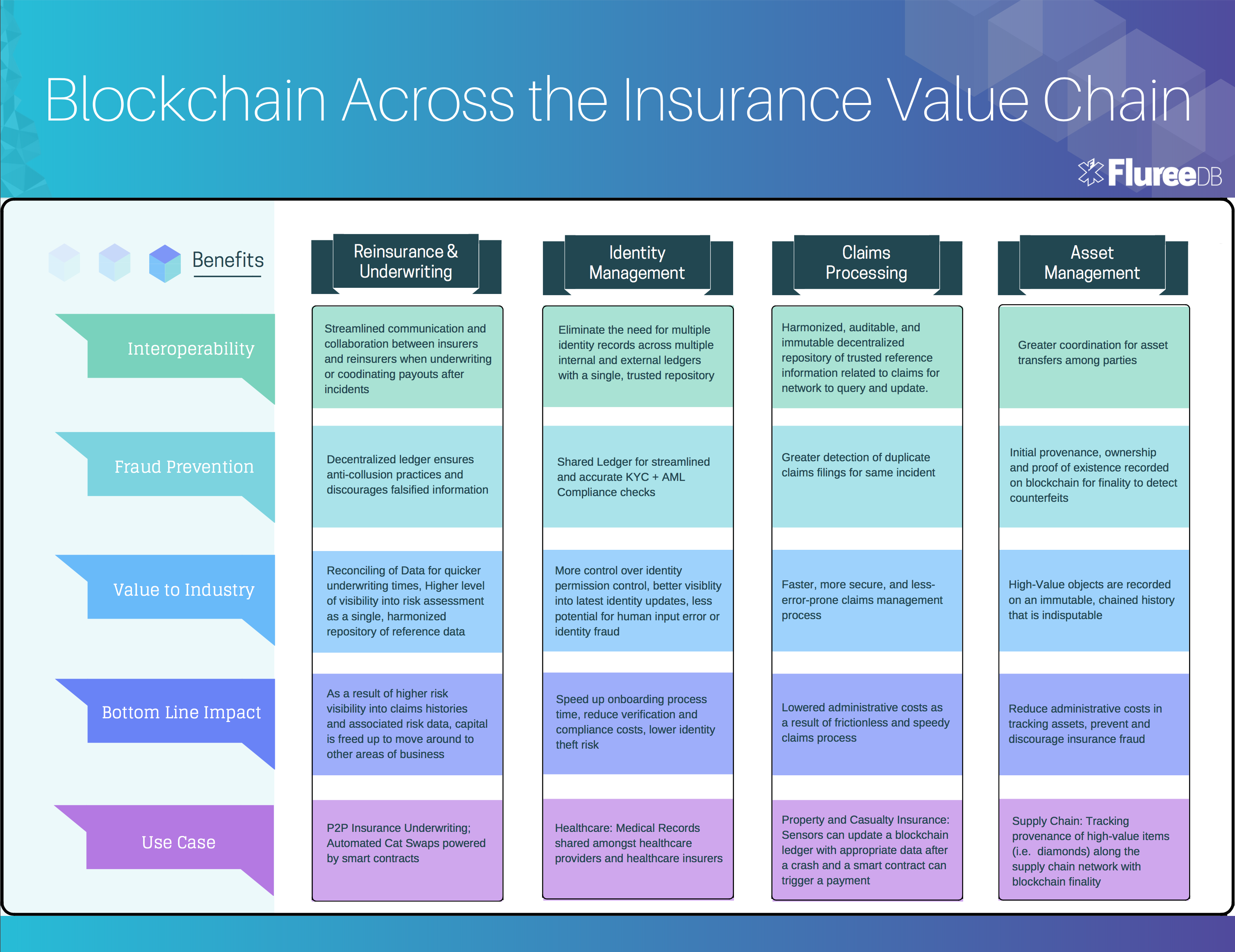

From better risk visibility & faster claims processing to collectively fighting fraud, blockchain can provide comprehensive benefits across the insurance value chain.

Introduction

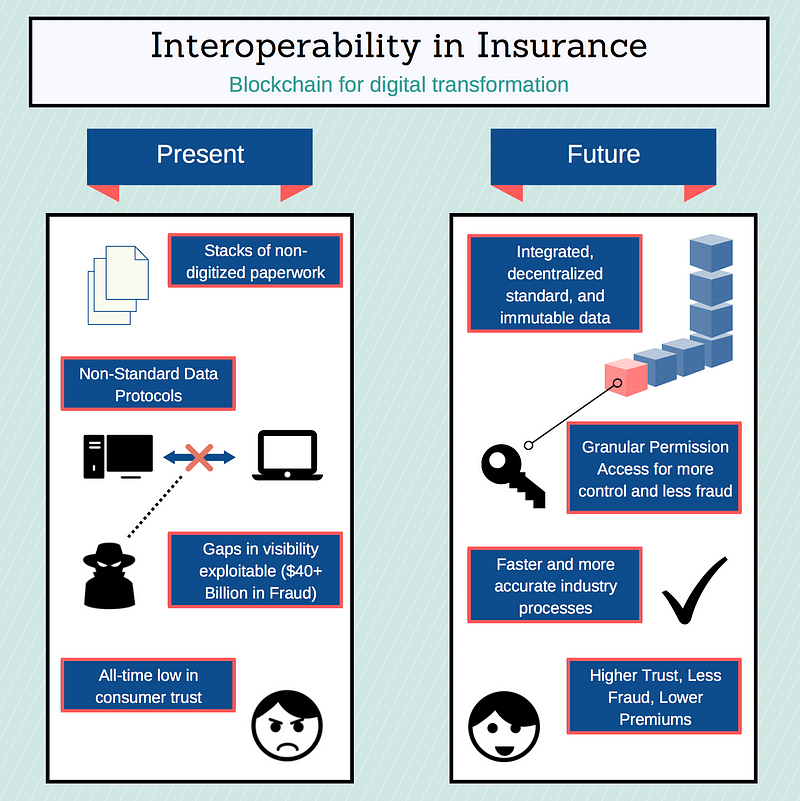

Insurance is a multi-trillion dollar industry, but the workflow in brokering trust, insuring parties, and reinsuring risk items today remains an expensive, slow, and fraud-prone process.

Although the digital age has inevitably brought about technological innovations, the centuries-old insurance industry seems to still be heavily drowning in paperwork and redundant manual procedures. Layered with the required collaboration from a multitude of parties needed to execute certain industry tasks like enforcing policies, processing claims, underwriting contract items, or drawing up new contracts, the insurance process remains far from transparent, coordinated, or secure. Each new party engaged in a particular insurance transaction — be it insurer, reinsurer, broker, consumer, or vendor — adds a compounding set of paperwork and potential for fraud, cyber attack, lost data, misinterpretation, and human error.

Challenges arise in verifying this data without breaching trust, so auditing is a widely used process to ensure consistency and accuracy. But even still, trust is at an all-time low, according to a recent Edelman industry poll.

The current insurance industry landscape in a snapshot:

- The insurance industry is widely known to be slow in adopting technology, and is behind digitally. [Source]

- Legacy systems have perpetuated a closed-off insurance information environment with data silos and resulting operational inefficiencies. These gaps of knowledge between insurance stakeholders are exploitable.

- In terms of fraud and fraud prevention spending, the numbers are unfortunately astronomical. In addition, human error also finds its place wherever manual entry and paperwork is involved.

A quick refresher on blockchain

A blockchain is a permanent and immutable ledger of transactional records distributed across a network of participants in a decentralized manner. This network can be unknown and completely decentralized (i.e. bitcoin), or known with permissioned access (consortium).

Blockchain’s system of hashing a new transaction by cryptographically tying its metadata to previous transactions gives the ledger its immutable nature — where the entire history of transaction is transparent, available, and indelible. Blockchain’s mechanism of arriving at consensus with no central authority allows for the decentralization of data — where no central party can control or manipulate information. This is attractive to many applications that interact with sensitive data; because there is no central authority, DDoS (Distributed Denial of Service) attacks are futile.

Blockchain is typically well-suited for environments where transactional records must be time-stamped, immutable, trust-worthy, shared, and readily available.

These characteristics lead blockchain to be very desirable across the industry spectrum as:

- A trusted repository of accurate, transparent, and updated data with comprehensive read/write access controls

- An effective measure against fraud, data manipulation, and human data input error

- A champion of interoperability between data systems, thus an enabler of more efficient collaborative processes

- A facilitator of trust between parties that may have competing interests, different incentives, or separate data compliance standards; a mechanism for cross-boundary and cross-industry collaboration on workflows; an eliminator of the need for intermediaries as a trusted central authority

- An efficient provider of quick and accurate auditing

Within the context of insurance, these features not found in traditional databases have great potential to effectively empower operational efficiency, trusted collaboration, transparency, and fraud prevention. As a result, blockchain can help insurers and other insurance stakeholders reduce overhead spending, decrease margins, and regain consumer trust.

Blockchain can drive the insurance industry shift towards digitizing industry processes, encouraging cross-industry collaboration for visibility & compliance, and collectively fighting fraud. Paired with additional emerging technologies such as IoT and smart sensors, blockchain can be a facilitator for increased automation in capturing and acting on claims data, analyzing risk more thoroughly, and streamlining payment processing.

Let’s dive into some areas of impact:

1. Streamline Reinsurance and Underwriting times

In reinsurance, each risk in a contract requires individual underwriting — and in many cases, insurers engage with multiple reinsurance parties to secure the best negotiation for each contract item. Each institution has its own data system and standards — and these differences in process can lead to discrepancies in interpretation of the contract. Thus, currently, reinsurance and insurance institutions need to constantly engage in reconciling their books to ensure consistency in interpretation for each individual claim.

In sum, the complexity of different data systems and consequent wrangling between multiple third parties to secure individual risk reinsurance leaves the reinsurance process slow, expensive, and subject to misinterpretation.

Blockchain technology should be leveraged in the reinsurance process to increase interoperability. With a shared digital ledger, no longer can there be the discrepancy in data format, process, and standards that currently plague the industry.

A permissioned blockchain ledger can be used to streamline communication, flow of information, and data sharing between insurers and reinsurers as an available and trusted repository of contract information. This becomes a faster, more efficient, and less-risky process as data related to loss records, asset ownership, or transaction histories is recorded on a blockchain that is trusted to be authentic and up-to-date. Access to this information can be heavily permissioned with granular access controls, with exhaustive rules governing read and write capabilities per user. Reinsurers can query a blockchain to retrieve updated, real-time, and trusted information rather than rely on a centralized insurance institution to report on data relevant to items (i.e. losses or transfer of ownership). This can massively expedite underwriting times.

The risk transfer process is delicate: insurers need to ensure they are appropriately rebalancing capital exposures against specific risks, and be confident and calculated in offloading their contracts. The newfound visibility from participating in a permissioned blockchain ledger provides confidence and flexibility in moving capital to other areas of business, as well as a more accurate and expedited risk assessment. If blockchain is leveraged to provide more visibility into risk information, reinsurers can more accurately and confidently take on the calculated risk.

2. Fraud Detection & Fraud Prevention

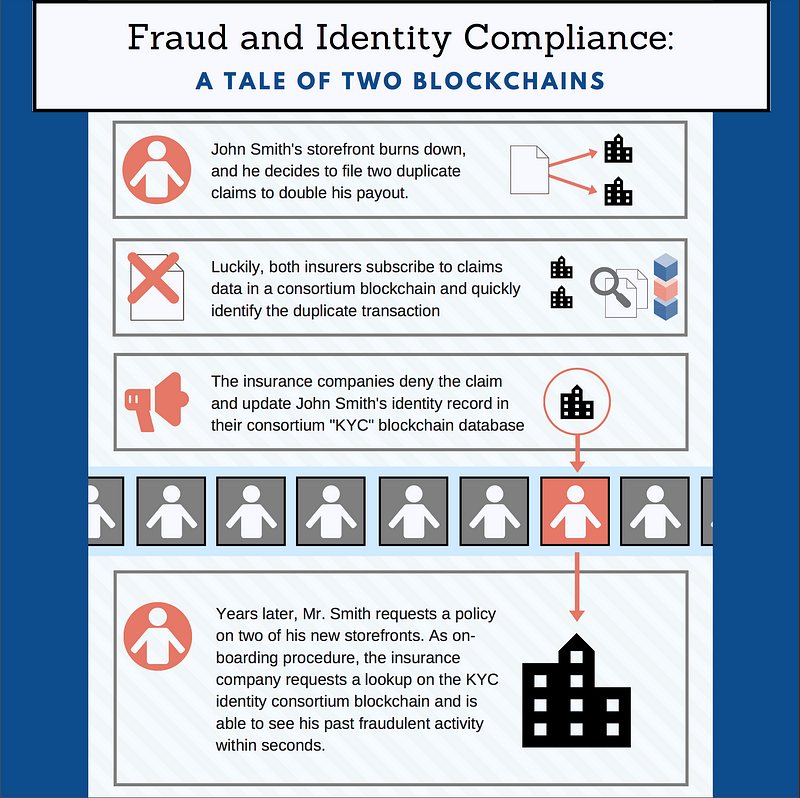

The total cost of insurance fraud (non-health insurance) is estimated to be more than $40 billion per year. That means insurance fraud costs the average U.S. family between $400 and $700 per year in the form of increased premiums. [Source: FBI]

The lack of interoperability within the insurance industry doesn’t just kill efficiency — it also hinders progress towards the digital collaboration required to identify patterns, trends, and known actors in preventing fraud. These gaps in visibility leave consistent vulnerabilities for fraudulent activity, where brokers can pocket premiums, individuals can make multiple claims for the same loss, or capital can illegally move offshore. The centralization of data within the four walls of each institution leaves little room for the industry to collectively fight these common insurance crimes.

Blockchain implementation could support this needed coordination, while also providing granular access controls to ensure data security. As an immutable ledger decentralized among all parties in the insurance process, blockchain closes the paperwork gaps and bridges the data silos, allowing for fewer potential areas for exploitation.

Blockchain within a consortium of insurance entities could facilitate the sharing of fraudulent claims for heightened visibility into known actors and for better preparedness. Blockchain provides validation and verification on an unalterable ledger, which can be leveraged for the identification of duplicate transactions, repeat actions by suspicious parties, fraudulent movement of funds across borders, and more. Pairing this technology with machine learning would make an excellent fraud detection strategy.

Blockchain can also be used as a ledger to track ownership of assets through digital certificates, and then be queried to validate their authenticity, ownership and provenance. This can reduce counterfeiting while also improving the efficiency of the entire claims management process.

As a shared, transparent, and decentralized ledger, blockchain will inevitably discourage future attempts at fraud, as the opportunity for exploitation is smaller and the potential for detection greater.

Less fraud = higher margins = cheaper premiums for consumers. A win-win situation, indeed.

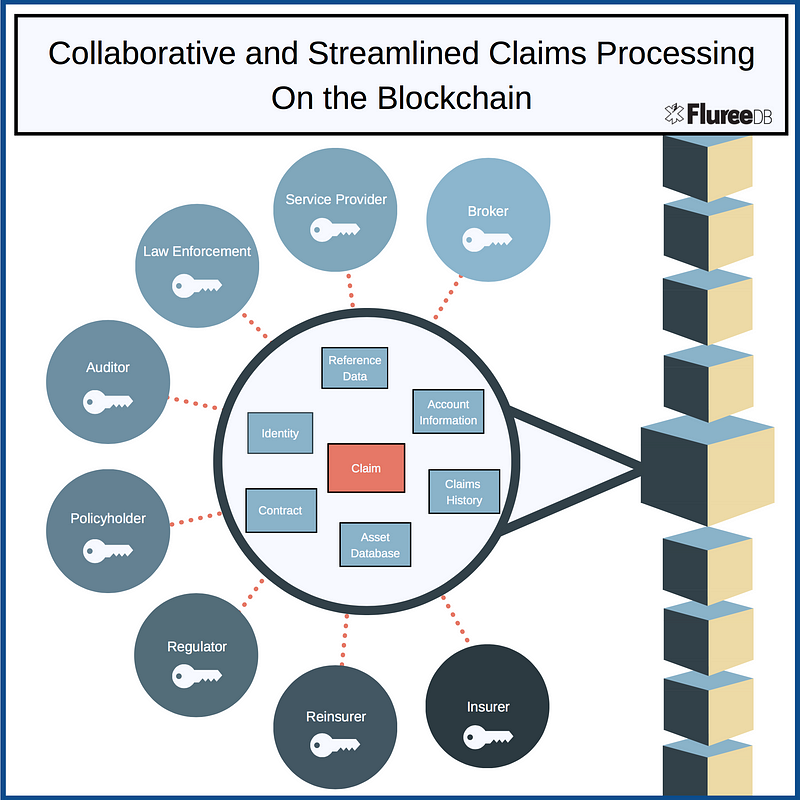

3. Improve Claims Processing for Property and Casualty Insurance

Processing a claim in today’s insurance environment is a complex, multi-party task. To evaluate and process an insurance claim, insurers, regulators, and third parties (like a private healthcare institution or an auto repair shop) need to coordinate and arrive at consensus across a host of data points. For example, a car accident between two drivers necessitates a loss assessment that assembles information from an asset database, weather statistics, credit reports, inspections providers, authorities report, and other sources. Each drivers’ insurance company likely collects and analyzes this data in an entirely different system and process.

Because each entity has its own data standards and processing technique, the claims process typically involves significant manual data re-entry and duplication across the value chain. This not only increases needless redundancies & inefficiency, but also widens the opportunity for human error and even fraud.

A distributed ledger can be used by insurers and third parties to digitally access and update data relevant to claims for a faster, more secure, and less error-prone claims management process.

Blockchain facilitates the interoperability needed for this level of collaboration without the associated risk of DDos attacks or falsified transactions. This level of visibility is not only advantageous for institutional efficiency and accuracy, but also helps consumers firmly trust in the fairness of the claims process.

Paired with streaming data sources, such as sensors, mobile phones, or IoT technologies, blockchain can also help significantly streamline a claims submission, reduce settlement time, and reduce loss adjuster costs. Adding to the auto wreck example above, an IoT sensor in one of the cars involved could automatically initiate a claim with the necessary reference data. A smart contract could automate coverage confirmation and consequent settlement payouts with programmable code — with essentially no human intervention along the entire payment process. While digital contracts like this exist already, the benefits of a blockchain-power smart contract lies in its transparency and credibility.

4. Immutability for Efficient Auditing; Trust

Auditors evaluate scores of ledgers — both online and offline — to reconcile reports and data spanning multiple locations and years. Needless to say, the process to ensure consistency and reliability in transactions and generate a compliance certification is lengthy and complicated.

Digital signatures, sequences of events, and actors of a particular transaction can be easily and efficiently audited if those events were to be recorded on a blockchain ledger. Institutions need to simply add access for an auditing party to their relevant permissioned blockchains. Blockchain immutability and finality guarantees the integrity of the entire transaction history, all in one place.

Companies like Docsmore have announced pilot programs for recorded signatures on a blockchain.

5. Increase security and share-ability of identity information

With recent, massive data breaches from some of the largest institutions over the past few years, improving the security of personal data — and thus customer trust — should be the forefront initiative for insurance institutions. Manual data entry — often repeated — should be replaced with a better, decentralized system with no single point of failure.

Blockchain is a perfect tool for sharing identity information while ensuring the privacy of consumers. Specifically, KYC (Know your Customer) and AML (Anti-Money Laundering) laws require institutions onboarding new clients to go through expensive and comprehensive steps to ensure compliance with these laws. This is traditionally accomplished internally, with multiple ledgers resulting in multiple certified identity versions across the entire insurance network.

However, Blockchain technology could provide a secure, distributed ledger for network participants to engage in cross-institutional client verification for KYC/AML compliance. In addition, a simple query of the blockchain can reproduce an immutable history of identity data, making regular compliance checkups and monitoring for changes an easy and inexpensive process.

Query permissions could be set in place to ensure consumer privacy and that access to information is appropriately handled. The distributed nature of the blockchain ledger is also attractive for storing sensitive data — like identify information — because it limits the viability of DDos attacks.

This standardization in identity management would require collaboration from not only the insurance industry, but also governments, tax authorities, bureaus, banks, and other financial corporations as well. However, the savings for all would be well worth the coordination.

6. Tracking assets along a supply chain

As demonstrated comprehensively in our previous blog post, insurance fraud can be prevented when assets along a supply chain are verifiably tracked with blockchain finality. Auditing becomes a breeze, and risk provenance can be proven for better estimates, faster claims processing, and a reduction in fraudulent underwriting.

Where FlureeDB fits in

As an enabler of consortium blockchains, FlureeDB can provide a single source of truth for harmonized insurance data to be stored, queried, and transacted with blockchain characteristics.

Data Centric — Most blockchains operate on the “business logic” tier, where enterprises still need to push data and metadata related to blockchain transactions to a static, centralized legacy system. FlureeDB brings blockchain to the data tier — allowing for an entire database to be distributed across its network. Network participants can query at will and know they have the full data set.

Modern Database Characteristics for Enterprises — FlureeDB is first and foremost a powerful database with familiar, SQL-like syntax. Any development team would be able to set up a blockchain database without having to learn a complex set of new skills. With modern database characteristics like ACID compliance, a RESTful API, and a graph-style query structure, FlureeDB is optimized to meet traditional enterprise requirements.

Granular Permission Logic for Access Control — Because insurance information is stored in a decentralized manner as one record, granular and highly functional access/permission models are essential to protecting data security. FlureeDB uniquely builds permission information (both read and write) directly into application data at the most granular of levels. This simple and flexible approach to data accessibility lends itself perfectly to blockchain environments — where a distributed ledger is shared across third parties in a network. Companies using FlureeDB can even hand a customer or vendor a direct line of access to the database without needing to use multiple API endpoints — queries only return the information for which a particular user has explicit read access.

Blockchain Immutability — FlureeDB builds every transaction into a block within an immutable, append-only blockchain. This allows for massive auditing savings. Holding a complete and indelible history of transactions also enables institutions to throw highly-advanced analytical queries to return increased visibility into practices like fraud prevention measures, internal compliance validation checks, or risk assessments.

Time Travel — “Time travel” is enabled by the blockchain’s immutable history: queries can be issued at any point in time, empowering an application to reproduce any instance of the database with no extra development effort. This capability strongly reduces waste in dev time and allows for apps to “rewind” to any database state with ease.

Composite Consensus — With varying relationships and diverse data, insurers need to partition information to be read by only the appropriate parties. FlureeDB allows data to be segmented onto multiple databases — both publicly and privately held — but join together to query as one set from an application point of view. This means a singular application dealing with insurers, reinsurers, third parties and consumers can keep private information out-of-sight, but still leverage blockchain without having to figure out multiple integrations.

Conclusion

Blockchain technology, its believers, its vendors, and its growth in adoption won’t wipe out the $40+B fraud, nor will it “fix” the insurance industry in one fell swoop. Such silver bullet claims are over-zealous. But blockchain does pose unique characteristics that should be included in the discussion for industry transformation.

Blockchain — simply in its very existence — won’t disrupt anything unless it is leveraged by and collaborated within the insurance industry, its secondary players and its technological partners. Brokers shouldn’t be paralyzed by blockchain’s potential to disintermediate their industry, but should rather embrace and harness its value to drive costs down and remain competitive.

The few entities that take the bold step forward to early adoption will be rewarded with consumer trust, lower margins, and larger market share.

Now is the time for industry leaders to drive a sweeping transformational agenda with digital collaboration as the key theme and blockchain as the key mechanism.

Insurers unwilling to participate in new collaborative systems powered by blockchain will be left with higher operational inefficiencies, wider margins, and a slow, but inevitable, corporate demise.

Blockchain technology can be leveraged to pioneer the insurance industry through the imminent data-driven industrial revolution towards a more transparent, efficient, and — dare I say it — egalitarian ecosystem for insurers, insurees, and brokers.

Originally published on Medium.