The age of connected insurance is upon us and with it comes big, risky changes that can be hard to predict, even for an industry whose entire expertise relies on predicting, and mitigating against, risk.

Everything the insurance industry knows has the potential to change over the next few years, but for those with the right attitude, organisational structure and customer relationships, this also represents immense opportunity.

Indeed, connected auto insurance is steaming ahead of other insurance lines for product adoption - 78% of auto insurers have a connected product on the market. As the pioneer for insurance IoT, where will auto insurers look to in the future?

Insurance Nexus and the IoT Insurance Observatory spoke with industry experts and surveyed insurance leaders to assess the state of play of connected technologies within auto insurance.

Download the Connected Auto Insurance Industry Snapshot today for exclusive insights into:

- How connected insurance can become a natural extension of the existing auto insurance business, not its replacement

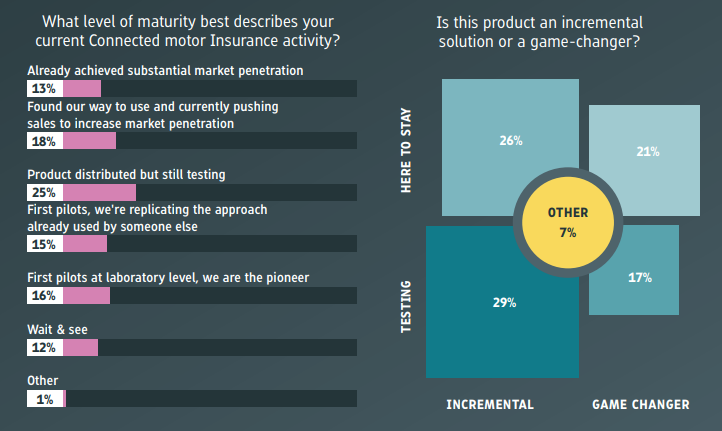

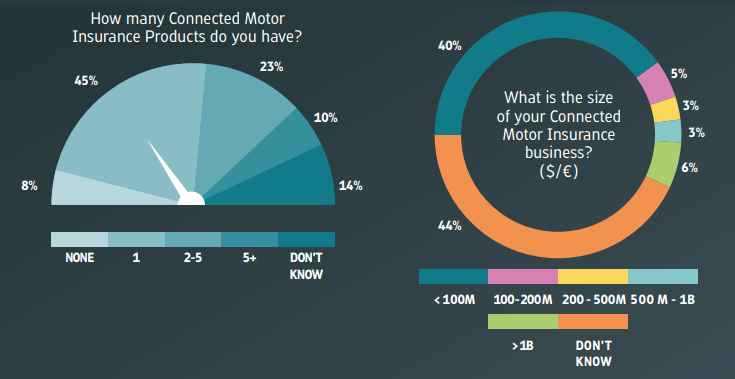

- Statistics on the various stages of connected product development amongst leading global insurers

- Why it is important to act now, with telematics already having a significant impact on business models

- How connected insurance will see auto diverge from commercial, home and health/life lines

Download the Connected Auto Insurance Industry Snapshot today