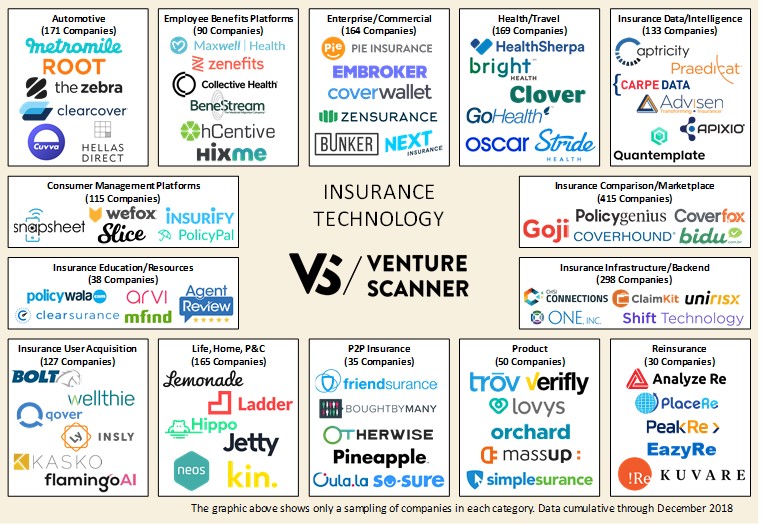

According to Venture Scanner there are 1522 insurtech companies that have raised $26B in funding over the years from a total of 1332 Investors globally.

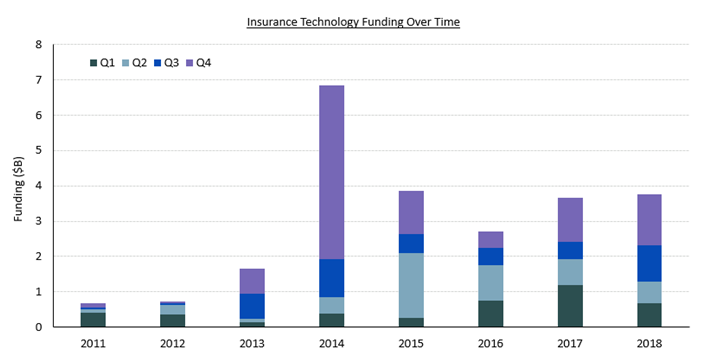

2018 saw a total of $3.80B in investments, +3,5% compared to 2017, while 2019 had a good start with $755.07M invested as of Feb. 5th.

Compared to the 3rd quarter of 2018 the last quarter saw funding rise by 43% to $1.4B while the number of Investments went down by 11%. The number of exits was significantly higher, a 250% increase compared to the previous quarter.

Source: Venture Scanner, data cumulative through December 2018

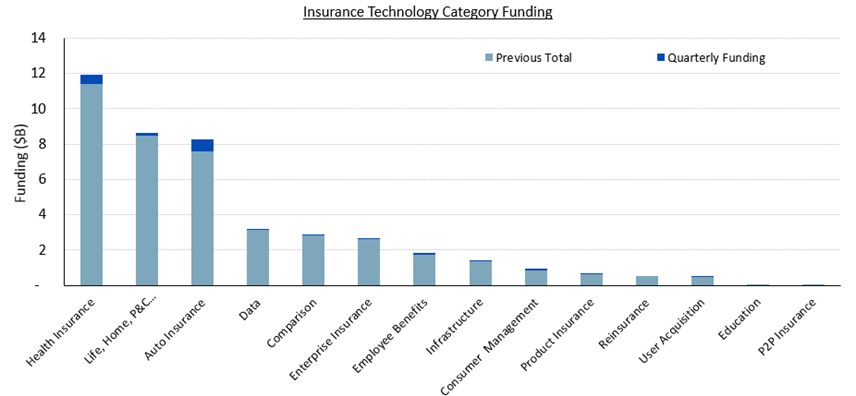

The Auto Insurance category saw the most funding last quarter with $0.7B

Source: Venture Scanner, data cumulative through December 2018

Counting 172 companies the auto insurance category has accumulated a total of $8.29B in funding with $1.21B raised in 2018. It has been the second best year after 2014 when auto insurance saw the highest numbers when it comes to investments – that is $4,88B, due to the Ping An effect. If we are to look at the number of companies founded it seems that 2016 has been the most productive by far with a total of 20 companies, while 2018 has seen only 1 company being founded.

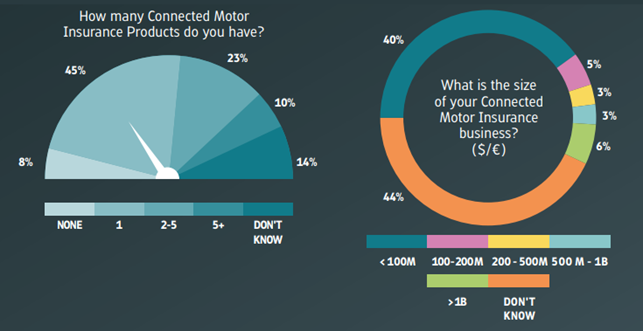

Connected Auto Insurance Industry Snapshot

Connected Auto Insurance Industry Snapshot

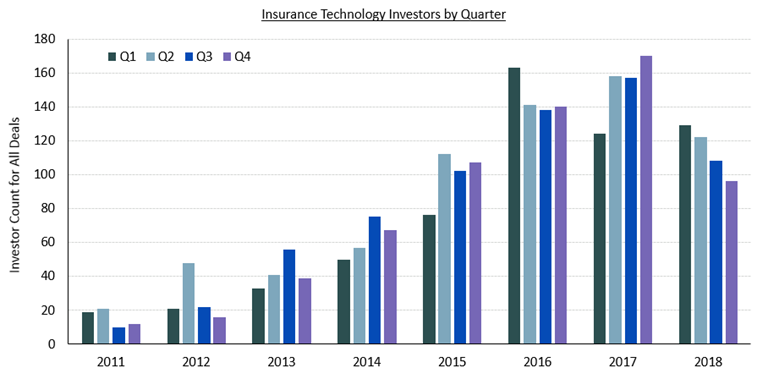

There were 96 investments in Q4 2018, which is a drop of 44% from Q4 2017, but this can be read as a sign of maturity for this sector which is moving away from small deals and moving towards less deals charactarized by larger amounts of money.

Source: Venture Scanner, data cumulative through December 2018

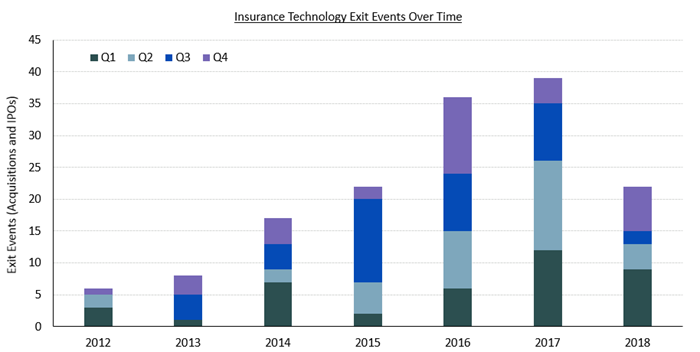

There were 7 exit events last quarter, which was 75% higher than Q4 2017

Source: Venture Scanner, data cumulative through December 2018

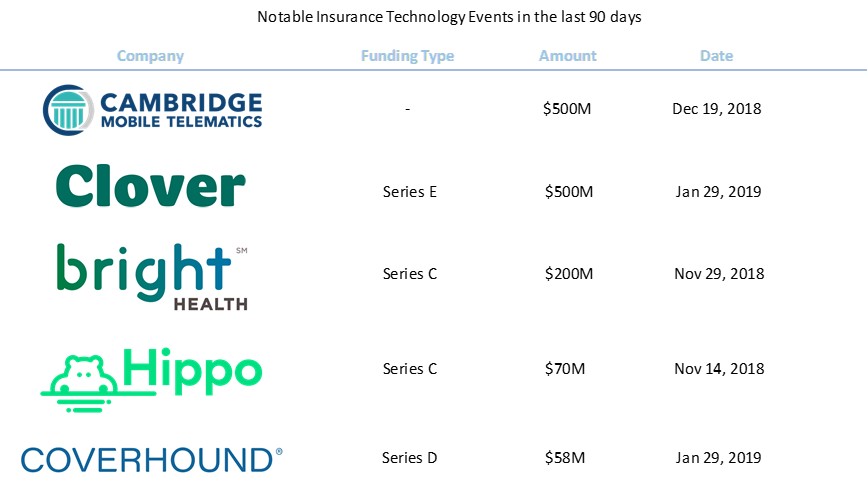

The following companies have raised the largest rounds in the past 90 days.

Source: Venture Scanner, data as of Feb 1st, 2019

Cambridge Mobile Telematics, based in Cambridge, MA, raised $500M from SoftBank Vision Fund in December 2018. The company had completed one other funding round in 2014 of $2.5M. According to CMT the new funds will help the company expand its DriveWell business. DriveWell is CMT’s analytics platform meant to help people drive better through feedback, rewards, and peer-to-peer competition. The result was, according to CMT, reduced phone distraction by an average 35 percent within 30 days.

#telematocs fake news@nigelwalsh @JimMarous @insurtechtalk @SpirosMargaris @guzmand @FGraillot @alvinfoo #insurtech https://t.co/6bRSKYebGw

— Matteo Carbone (@MCins_) January 29, 2019

Medicare Advantage insurtech startup Clover Health to raise $500M in series E round: the Greenoaks Capital-led round is expected to close within the next period. Garipalli, Clover CEO, said the company will be looking into “growth, innovation, deepening our already strong ties with physicians and improving the quality of care our members receive.” Clover Health uses data analytics to provide preventative care to patients, improve health insurance for seniors and keep them adherent with treatments.

Insurance startup Bright Health raises $200M in a Series C round at ~$950M valuation. Launched in 2016, Bright Health initially focused on selling individual market health plans that comply with the federal Affordable Care Act (ACA) and has since added Medicare Advantage plans for seniors.

California-based insurtech company Hippo secured $70M in Series C funding, led by Felicis Ventures and Lennar Corporation. Having raised $109M, Hippo is aiming at reimagining homeowners insurance with a customer-centric model by leveraging big data, like municipal building records, and innovative technology, such as IoT for preventing perils.

CoverHound recently raised a $58M Series D funding round led by Hiscox. The company is an insurtech which enables consumers and businesses to easily compare and purchase insurance, built to deliver fast, accurate and actionable rates. The funding round aims to push the growth of its subsidiary, CyberPolicy, to expand its offices beyond San Francisco and Westlake Village, California to Charlotte, North Carolina and to support its expansion efforts into Japan and other global markets.