Co-authored by Matteo Carbone, director of the IOT Insurance Observatory and co-founder of Archimede Spac, and Adrian Jones, a #traditionalindustry guy and InsurTech investor who reads insurers’ financials on nights & weekends. The authors write in their personal capacity, their opinions are solely their own, and they used only public data. This article also appears on Adrian and Matteo's LinkedIn pages.

Summary

- Growth rates remain robust but may be slowing a bit – are there issues on customer acquisition or are carriers focusing more on underwriting profitability?

- Gross loss ratios are generally stable or improving slightly but still unsustainable

- Industry veterans are outperforming the newbies on loss ratio but not premium growth.

- Still several years to become scale insurers

- Reinsurers continue to subsidize losses

- Executive compensation appears to be as expected - probably mostly in stock

Context

The networking tips from the great Spanish swordsman Inigo Montoya got us thinking about the InsurTech start-ups climbing the Cliffs of Insanity. While the lumbering incumbents are indeed powerful giants and have a head start on the climb, they are also carrying lots of weight. Violà, start-up vs. incumbent.

The venture-backed full-stack US InsurTech start-ups continued to gain in the second quarter through rapid premium growth and moderately lower underwriting losses. They have yet to show the ability to win at a sword fight, battle of wits, ROUS attack, or to generate a sustainable loss ratio under 100%.

This is the third installment of our review of US InsurTech Start-up Financials. Here are the 2017 edition and first quarter 2018 edition, which generated many social media discussions. For more information on where our data come from and important disclaimers and limitations, see the 2017 edition. Our scope is only Property & Casualty companies, so we don’t cover life, health (sorry, Mario), mortgage, and title (sorry, Daniel). As before, we respect the management teams highly and admire these companies for earning the right to call themselves an “insurance company” - more on that below.

To date we have tracked the three independent P&C start-ups most commonly associated with the label "InsurTech": Lemonade, Metromile, and Root. This quarter we’ve looked at newly-licensed Next Insurance (which wrote no premium) plus four subsidiaries of larger companies with a direct or InsurTech focus.

Overall results

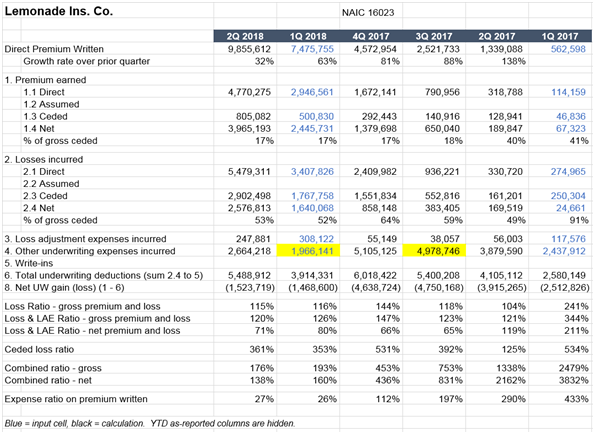

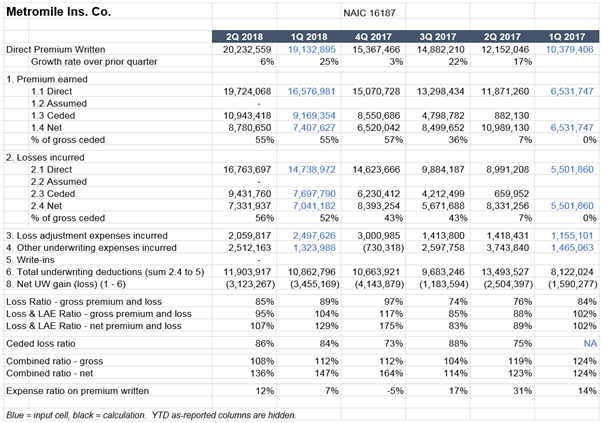

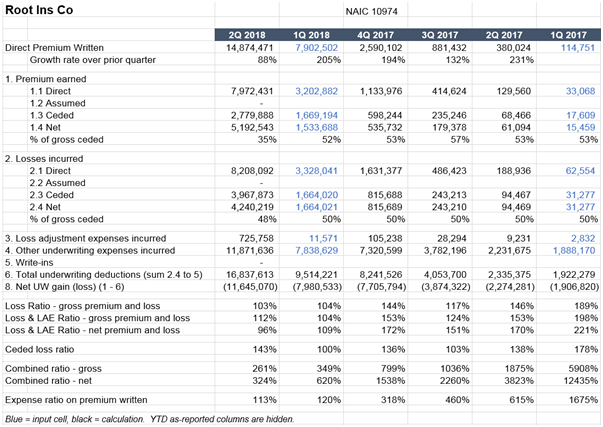

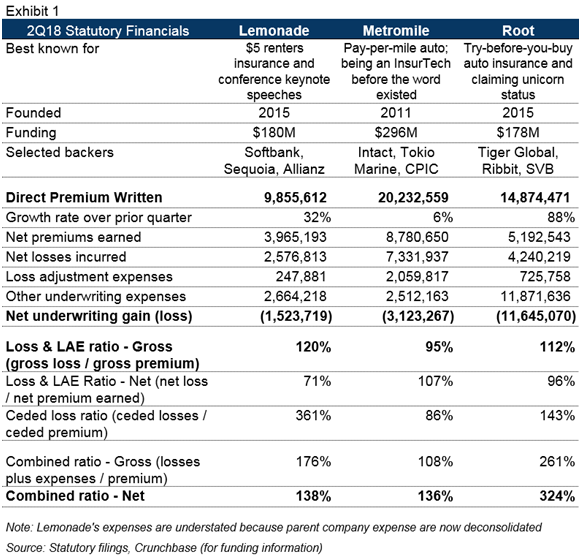

For the real insurance nerds, here is a summary of the 2Q18 statutory financials of three Venture-backed insurance companies. Only “insurance companies” have to file statutory results, not agents and brokers (i.e. most InsurTech underwriters), which are not “insurance companies.” We present the summary here and quarterly details on each of the venture-backed companies at the very bottom.

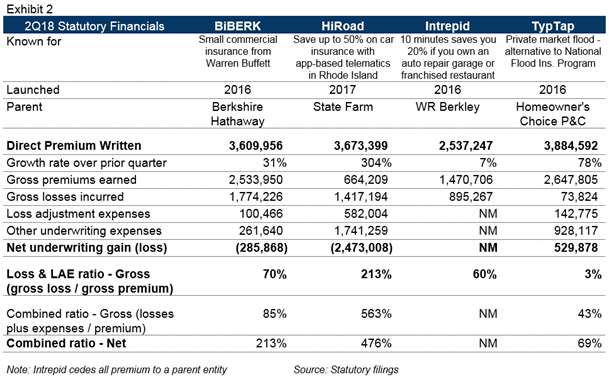

And here are the four subsidiaries of big companies that are selling direct or have a claim on being an InsurTech. These companies often depend on parents for reinsurance and infrastructure, so we show mainly the gross figures.

- Growth rates remain robust but may be slowing a bit – are there issues on the customer acquisition or are carriers focusing more on underwriting profitability?

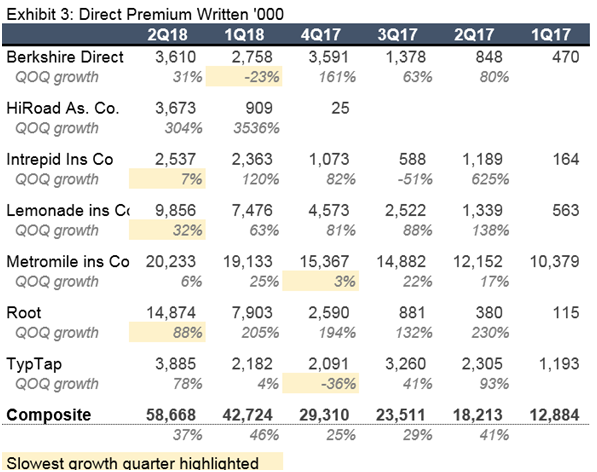

Absolute growth was led by Root, which nearly doubled its quarterly gross premium written in three months. Our composite grew at 37% quarter-over-quarter, but most of the companies had their slowest or second-slowest quarter in the last 6.

Is this a slight slowing trend? Maybe. Some of the carriers may be seeing seasonal effects. If the pace of growth is really showing the first signs of slowing and not just a blip, the question is whether the slower growth is despite insurers’ efforts to grow or if they are deliberately focusing on profitability. The CEOs of Root and Lemonade have hinted that they are focusing more on underwriting (here, here), so is this affecting growth rates? Here is a point/counter-point. Decide for yourself and add your thoughts in the comments.

Point: InsurTechs are finding grown more difficult

- Early adopters of direct insurance may already have been won; consumers with a high propensity to buy online may be located in the states that carriers chose first, and future customers are harder to win.

- It may be harder to sell the value proposition than expected, particularly if underwriting is being tightened and differentiation is narrowing (e.g. Lemonade’s giveback declined from 10% of premium in 2017 to a less-compelling1.6% this year.)

- Retention rates may be less than expected - either because customers defect or the carrier non-renews unprofitable customers.

- Focusing on state expansion, team growth, or fundraising distracts management.

Counter-point: InsurTechs could grow faster but are throttling growth to focus on profit

- It is unlikely that companies with near-zero brand recognition have penetrated even a fraction of potential customers

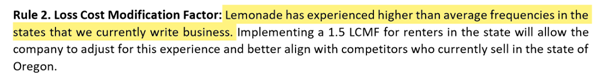

- Start-ups, their investors, or their regulators may have realized that early customers were attracted to unsustainably low prices and produced high loss ratios. As they learn more about their customers, start-ups are being tougher on underwriting and/or are raising price in new state filings, meaning they turn away more potential customers through price or declining the application. Lemonade has admitted as much - see page 594 of their recent Oregon filling for this nugget:

The LCMF is a Loss Cost Modification Factor, and higher LCMFs may indicate higher pricing. In spot-checking some of Lemonade’s recent filings, they are still filing a $5 minimum rate but are pricing higher than incumbents such as State Farm in certain zones, perils, etc. The company’s frequency being higher than average could be a function of either (1) a bot-driven claims system inviting fraud, (2) having shlimazels for customers, (3) problems with the coverage or form, or (4) a sign that the behavioral economics assumptions aren’t working as intended. Recall Lemonade saying: “If you tried to create a system to bring out the worst in humans, it would look a lot like the insurance of today … We’ve spent recent years deepening our understanding of honesty and trust ... Lemonade aims to reverse the adversarial dynamics that plague the industry, transforming both the economics and experience of insurance”.

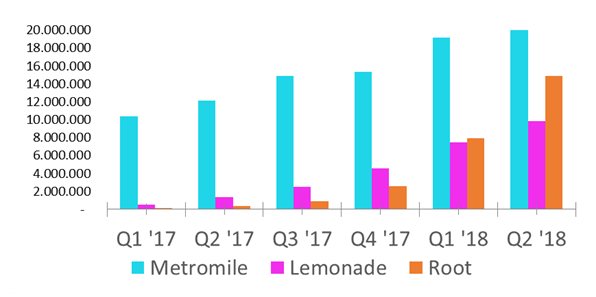

Status of the climb up the Cliffs of Insanity (direct premium written $)

Focusing on the protagonists of our previous analysis Bigger and Redder, Root’s extraordinary growth means they have opened a big gap on Lemonade and are closing the gap with Metromile. This dynamic has helped Root achieve unicorn status with the last $100 million round of funding at the iconic $1 billion valuation.

Root is not the first insurer to test a “try before you buy” (TBYB) approach based on an app, but they are the first insurer in the world to build a sizeable portfolio that way. Will Root succeed where others have abandoned their efforts or chosen different approaches such as usage-based pricing or discounts at renewal?

We commend Root for hitting the symbolic unicorn status so quickly. They appear to have a few years of runway to prove their model. By the time of an exit for the most recent investors, we believe that Root will be evaluated in greater part on the traditional KPIs that we look at in our analysis. A few weeks ago, Bain Capital – we are Bain & Company alumni – offered $1.55 billion to buy the Esure, a P&C insurer (mainly motor) selling online in the UK. Esure wrote £880 million (annualized) premium in the first half of 2008 (or about US$1.1 billion) -- and did so at a profit. Looking very simply at price-to-sales ratio (though we prefer ROE and price-to-book), Esure sold a bit over 1.4X, which simplistically corresponds to $700 million of premium for a valuation of $1 billion. Investors will need Root’s management to continue to grow rapidly – their 2Q18 run-rate is $60 million. Whether they can do so, and achieve profitability along the way, will be a bellwether for demonstrating if current valuations are a bubble or smart bets on a rapidly-changing industry.

Root’s $1 billion valuation (looking abroad, Chinese start-up carrier Zhong An has a $7 billion valuation despite a 124% combined ratio in the first half) along with Zhong An's $7 billion valuation despite a 124% combined ratio in the first half, should cause companies in low-margin commodity lines like home/renters and auto who are operating as MGAs to consider becoming a carrier. One of the strongest arguments for being an MGA, not a carrier, is that MGAs are more highly valued because they trade on a multiple of earnings rather than book value. For the time being, the most valuable recent start-ups in insurance underwriting appear to be carriers, not MGAs.

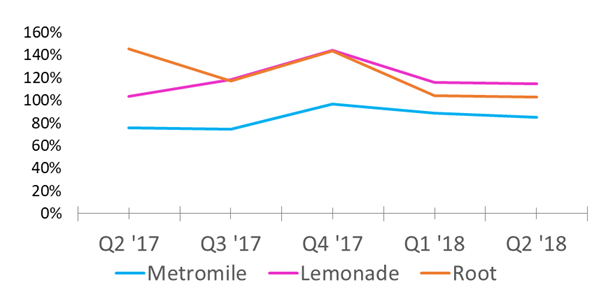

- Gross loss ratios are generally stable or improving slightly but still unsustainable

We prefer to look at gross loss ratio, i.e. before any premiums and losses are ceded to reinsurers, since sticking losses to reinsurers isn’t a sustainable long-term strategy. Eventually gross loss ratios need to be sustainable. This quarter’s numbers are basically unchanged since last quarter, though Lemonade and Metromile have adverse development in this quarter, which raises the reported loss ratio. If our subject companies are shifting management attention towards profitability, it is not yet obvious in the figures. Improving underwriting results is like steering a slow-moving boat. You can turn the tiller, but the boat may not go the way you want, and it will take some time. Insurance policies last a year, rates are regulated by states, and unsettled old losses can get worse if the legal environment changes.

Gross loss ratio evolution

Of the three venture-backed startups, Metromile’s figures have always showed the greatest profitability, and the company shows an improvement on the last quarter, shaving 4 points off the loss ratio.

Not all start-ups are experiencing unsustainable loss ratios. Hippo - a homeowner’s MGA - claimed to have produced better-than-market underwriting straight out of the gate, although we have no way to verify this. However, conference chatter is increasingly turning to profit, not just premium. We welcome these signs of maturity in the InsurTech market, which were a big reason we started writing these articles and presenting at conferences.

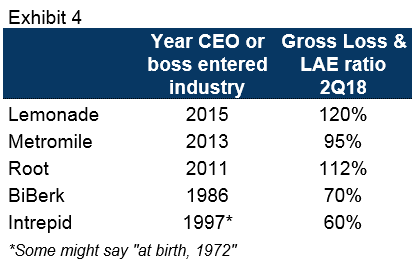

- Industry veterans are outperforming the newbies on loss ratio but not premium growth.

Two of the start-up carriers sponsored by highly-regarded underwriters are performing very well in terms of profit. BiBerk, which ultimately reports to Ajit Jain, recorded a respectable 70% gross Loss & LAE ratio in the quarter. Intrepid, where Rob Berkley sits on the Board, turned in a 60% loss ratio (without LAE). Neither company has cracked even $4 million in quarterly premium, compared to Root at nearly $15 million, but is there something that Ajit and Rob know that the newbies don’t? Or are big public companies just less motivated to grow than venture-backed companies? Or is growth first really the right answer?

We’re not showing State Farm’s HiRoad entity because we’re less clear on how it reports and is managed by State Farm’s executives.

- Still several years to become a scale insurer

All three venture-backed insurers increased expenses in the quarter. Root in particular lost $11.6 million, a burn rate of $129,000 every day. That still gives two years of runway if the burn rate can be maintained. We get details on expenditures only in annual statements, so we cannot know for sure whether Root is spending on headcount, advertising, or other overhead. LinkedIn pegs the company’s headcount at 117, with 30 people joining just in the second quarter. The company runs a referral program which has paid $860,000 to date. We speculate that $25 is the average referral bonus (so $50 since both parties get the bonus), which equates to 17,000 referrals. If the average premium is $750 (again a guess; a bit below the national average), then the referral program has generated over $13 million of premium at a CAC of $50, which would be an impressive 40% of all the premium in these first 18 months.

As the company expands exponentially to grow into its unicorn valuation, the question for investors is if the company can maintain exponential growth and bring down the loss ratio simultaneously, so growing without raising losses exponentially. It’s a difficult balance. In the meantime, investors added $45 million to the insurance company’s statutory surplus, but - because of losses - surplus stands at $43 million at the end of the quarter.

Root’s CEO notes that the company is getting better at pricing and predicting their business, and that “conservativeness” in reserves means prior results were better than they appeared. We agree with Root that there is increasing evidence of conservative reserving, but not based on the figure they cited in the blog. Root says that only 66 cents on the premium dollar was paid as claims in 2017 (net) – which appears to exclude payments expected for open claims and losses incurred by not reported (“IBNR”). The more meaningful number, in our view, is that Root has recorded $344,000 of favorable development this year - meaning they have decided that their estimates of prior-year losses were indeed too high. The company earned $792,000 of premiums in 2017 and stated their losses at 12/31/17 at $1.33 million for a net loss ratio of 168%. If 2017 actual losses were in fact $986,000 as they are now estimated, then the developed loss ratio would be 124% = better but doesn’t greatly change the overall view of the year, which was small and volatile and hence of limited use to understand the company (but the best any outsider had at the time).

Root also deserves credit for being the only of the three venture-backed companies to have made conservative loss picks. Lemonade continues to see its reserves be inadequate. The company had $2.1 million of reserves at the start of the year and has seen $245K of adverse development this year. Even a more experienced underwriter, Metromile, started the year with nearly $14 million of reserves and has recorded nearly $1.5 million of adverse development.

Stepping back from the noise of quarterly reserving, we still believe that the companies have to prove underwriting quality and do so with sustainable overheads and expenses. There’s still a long journey ahead, but the companies have the resources (in the form of cash at the holding company) to work on the challenge for years to come.

- Reinsurers continue to subsidize losses

Lemonade continues to hand reinsurers $3.61 of losses for every $1 in premium in the quarter. Root handed reinsurers $1.41 of losses for every $1 in premium. Metromile - as with other metrics – is playing a safer game, and its reinsurers even made a bit of money in the quarter, getting $0.86 of losses for every $1 in premium.

Root disclosed that it changed its reinsurance program, reducing its quota share from 50% to 25% of premium effective June 1 through the remainder of 2018, meaning it will keep more premium (and losses) and possibly get less capital relief. The company retains a $1M xs $100K per-risk excess of loss treaty(*). Terms were not disclosed.

(*) Explanation of reinsurance basics: In quota share reinsurance, an insurer reinsures a percentage of its book – a fixed percentage of every dollar of premium and loss. The reinsurer pays the insurer a ceding commission to cover the insurer’s expenses and may assume unearned premiums (a liability), which may increase the insurer’s statutory capital. In excess-of-loss reinsurance, the reinsurer covers every dollar above a certain amount (the attachment point) up to a pre-defined limit. Excess of loss reinsurance can be written per event (such as a storm) or per risk. In Root’s per risk reinsurance, the reinsurers appear to take each and every loss over $100K to the extent that the loss exceeds $100K, up to $1.1M. Here is a technical resource on the subject of using reinsurance for capital optimization.

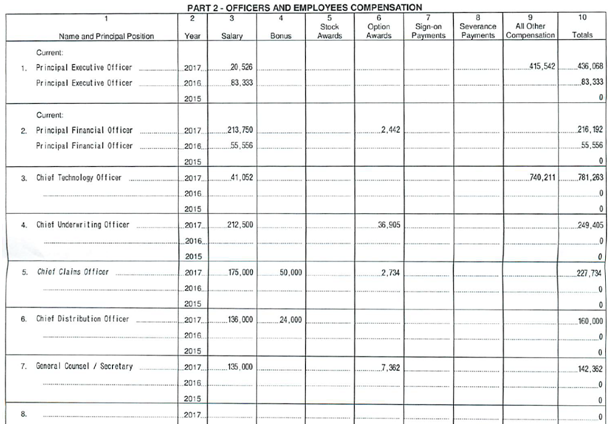

- Executive compensation appears to be as expected - likely mostly in stock

Many insurers are required to file an annual Supplemental Compensation Disclosure listing the name, title, and compensation of their top 10 executives. The requirement was triggered by an investigation in 1905. (Here’s some trivia for a cocktail party at InsurTech Connect: that’s the same year Las Vegas was founded.)

The State of Nebraska will mail the information for all companies that operate in Nebraska to anyone who sends them $80. The hardest part is finding a computer with a CD-ROM drive. This is a sore point among insurers (the disclosure, not the need for a CD-ROM). Some insurers risk a fine instead of being transparent, such as by putting zeros for their compensation or putting a blank piece of paper over the data before mailing it. We like numbers, and there are reasons for the disclosure in an insurance context. Most insurers are subject to extensive regulation and disclosure of their rates, which need to be reasonable, which means not paying executives excessively and passing costs through in the rate. And, as Lemonade says, insurance is a business of mutual trust, which requires reasonable executive compensation practices, even if not overseen by shareholders. For more on the disclosure, click here.

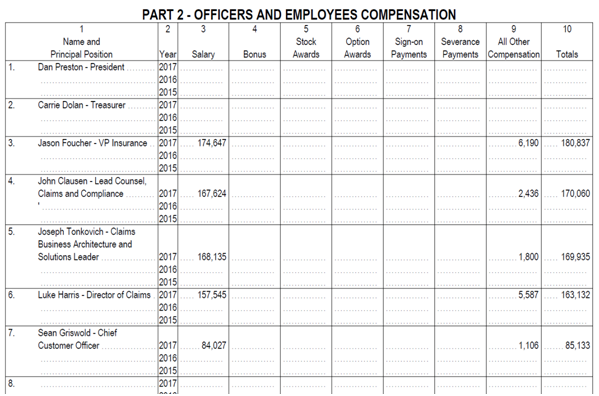

Lemonade and Metromile are required to complete the disclosure, though Lemonade’s commitment to transparency doesn’t extend to putting the required names on the form. Their disclosures are below. The numbers are not huge - indeed they are within what one would expect for a start-up, where founders and early joiners get big equity grants with salaries that pay the bills but are often dramatically less than what a senior executive at an insurer typically earns. Interestingly, two of Lemonade’s founders sold shares in 2017, which is reflected under “all other compensation.” Metromile seems to have forgotten a few figures in their filing.

Note that both Lemonade and Metromile “allocate” compensation to companies within their holding company system, and in absence of information on how this allocation works, it is possible that these figures are materially understated because of the allocation.

Here is Lemonade Insurance Co:

Metromile Insurance Company:

One last note on compensation. Metromile filed their disclosure electronically, while Lemonade apparently walked down to the post office. We don’t know how to explain why a high-tech company like Lemonade would use snail mail. They mailed the disclosure on March 1st, a Thursday, so it must have been #TBT in Lemonade’s offices.

Next Insurance US Company

Digital small business insurer Next announced in May a plan to form a new carrier, and they have. The company was formed in September 2017, which indicates that the plan will have been in the works for a year before the carrier writes business. Next’s filing was all zeros except the surplus (or equity) in the company, which is over $10 million. As of November 2017, the company’s business was described as follows:

“The Company will initially offer Contractors Insurance in three levels of coverage for 190 classes including Handymen, Carpenters, Electricians, HVAC Technicians, Landscapers, Janitors and Plumbers. All Contractor Insurance plans will include general liability ($5 million limit), professional liability ($3 million limit) and inland marine ($3 million limit) coverages. The Company will eventually write other types of small business classes including restaurants, daycares, personal training and photographers. These products are currently produced by licensed producers of Next Parent on other insurance carriers’ paper. … The company will eventually offer the following additional types of commercial insurance to small businesses with $3 million maximum limits, unless indicated otherwise: commercial property, commercial auto, director and officer liability, employment practices liability, business interruption, surety bond ($1 million limit), liquor liability, cyber, data breach ($5 million limit). The Company’s planned net retention for all lines will be 20% of the maximum limits.”

The remaining 80% of limits will be ceded to Munich Re Americas (MRAm).

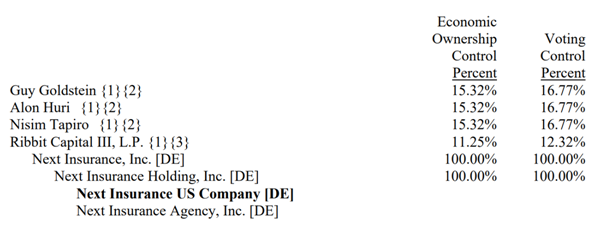

The company’s directors are Guy Goldstein (the CEO), Nisim Tapiro (co-founder), and Dawn Puro. As of November 2017 (before the most recent $83M fundraising), the company’s ownership was as follows:

What’s in a name?

A recent startup proclaims: “[Company name] Insurance is a [line of business] insurance company that provides [line of business] coverage to small businesses through a simple online experience. Offering A.M. Best A rated insurance… direct to customers since 2018...”

That wording makes consumers think they’re dealing “direct” with an insurer, not an agent or broker, which is what this company is. Words matter in insurance, as illustrated in the first section of the California Insurance Code.

- Insurer: “The person who undertakes to indemnify another by insurance.”

- Broker: “A person who, for compensation and on behalf of another person transacts [insurance] … with, but not on behalf of, an admitted insurer.”

- Agent: “A person authorized, by and on behalf of an insurer, to transact [insurance] … on behalf of an admitted insurance company.” [emphasis added].

#themoreyouknow

“Congratulations, you’re innovating in a highly regulated industry”

Still on the subject of regulation, let’s have some fun with deficiency letters. Part of the joy of getting a new insurance program licensed in a new state is the exchanges with regulators. The insured makes a filing of a few hundred pages, the state reviews it and states their objections, and ‘round we go for, potentially months. If you’re an insurance nerd, you might find these letters interesting. Particularly Lemonade’s, if only because of how the sausage-making of insurance contrasts with public statements about doing better for consumers.

A recent letter from Oregon to Lemonade had language like this: "Please explain why the insurer is choosing such broad exclusionary language; and if possible, provide an example of why this is necessary to have."

Hmm…

A letter from Virginia last month listed 9 pages of objections, even objecting to Lemonade’s definition of “hovercraft.” A sample of the objections:

"The Company will need to withdraw under the Special Limits, items (g), (h), (i), (j), and (k). The limitations the Company has outlined in these sections are more restrictive than the provisions in the minimum standards set forth in the [Virginia Administrative Code]. It is not permissible for the Company to place limitations or impose special limits that are more restrictive than the minimum standards set forth in the VAC. For items h and i, it is acceptable to impose a special limit or to exclude business property but it is not acceptable to impose a special limit or to exclude property used for business purposes. For example, if I take my laptop (business property) home to do some work, the business property can be limited or excluded. However, if I use my personal computer at home to do some Bureau of Insurance work, that is personal property being used for a business purpose and coverage cannot be limited or excluded."

Score a point for the Virginia Bureau of Insurance for using human language.

All this and we haven’t even gotten to Policy 2.0.

Maybe dealing with US regulators is why Lemonade is now keen on international expansion?

Meanwhile, the interviewers at Bloomberg TV have been reading our articles.

Looking forward

The third quarter, which includes most of the summer, could be a big one for the companies in our coverage, since insurance often changes when people move. We are gratified by the increasing focus on insurance fundamentals in InsurTech, and the lofty valuations recently seen in the sector will require satisfying both venture metrics as well as solid insurance fundamentals. The start-ups have the time and the resources but a long way to go to clime the Cliffs of Insanity. They are gaining on the incumbents, but will they make it to the top of the cliffs before running out of power? It’s not inconceivable. Tell us what you think in the comments.

***

You can find the authors at conferences including these:

Adrian: Rendez-Vous de Septembre (Monte Carlo), Willis North American Energy Conference, Insurance 3.0 by Market Minds, InsurTech Connect

Matteo: Connected Car Insurance USA, Rendez-Vous de Septembre (Monte Carlo), 10th Annual North America Re/Insurance Conference, InsurTech Connect

Adrian’s team back at the office is hiring for a Ventures Associate in the US or Europe.

***

Appendix: quarterly details of the 3 venture-backed start-ups.