According to Venture Scanner there are 1540 insurtech companies that have raised $28B in funding since 2012 to date, from a total of 1427 Investors globally.

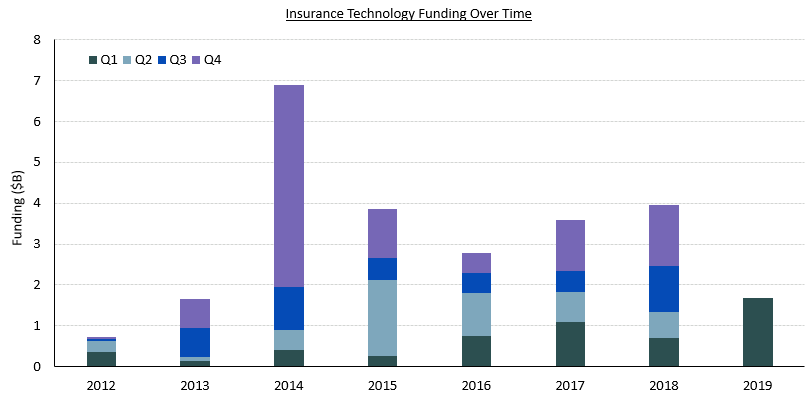

Funding in the 1st quarter of 2019 was $1.7B, which means an increase of 141% compared to Q1 2018 funding. This is mainly due to Clover Health’s funding round of $500M on January 29th led by Greenoaks Capital. If we take a look at the first two months of Q2, 2019 it seems that investments continue to flow in, though at a lower rate, with $0.68B of total funds invested to date.

Source: Venture Scanner, data cumulative through March 2019 (Q1 2019)

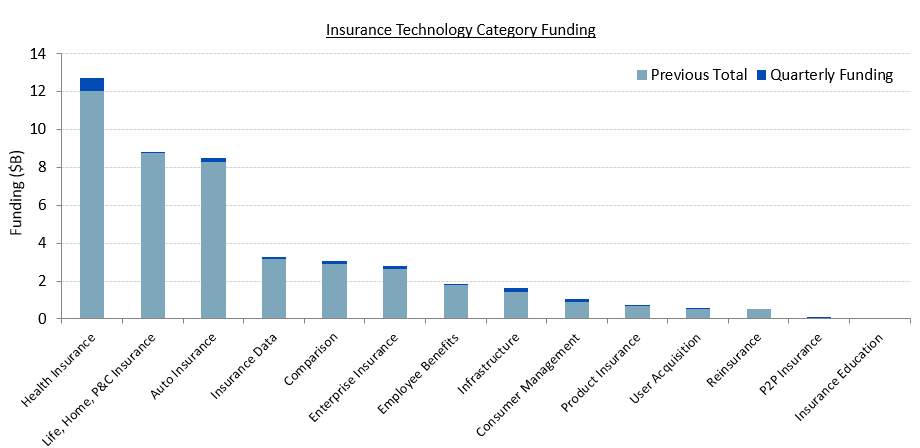

The Health Insurance category saw the most funding last quarter with $656M, followed by Auto Insurance with $250,58M.

Source: Venture Scanner, data cumulative through March 2019 (Q1 2019)

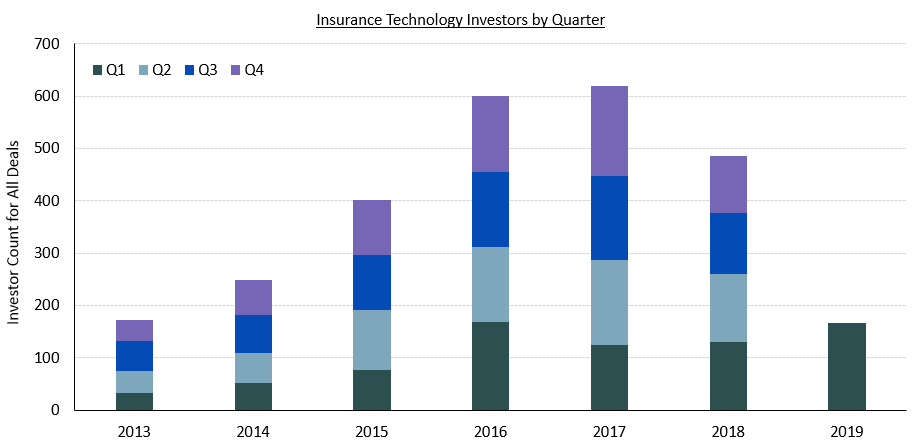

Insurance technology investor activity started decreasing in 2018 after years of growth. There were 167 investors in all deals last quarter, which increased by 28% compared with Q1 2018.

Source: Venture Scanner, data cumulative through March 2019 (Q1 2019)

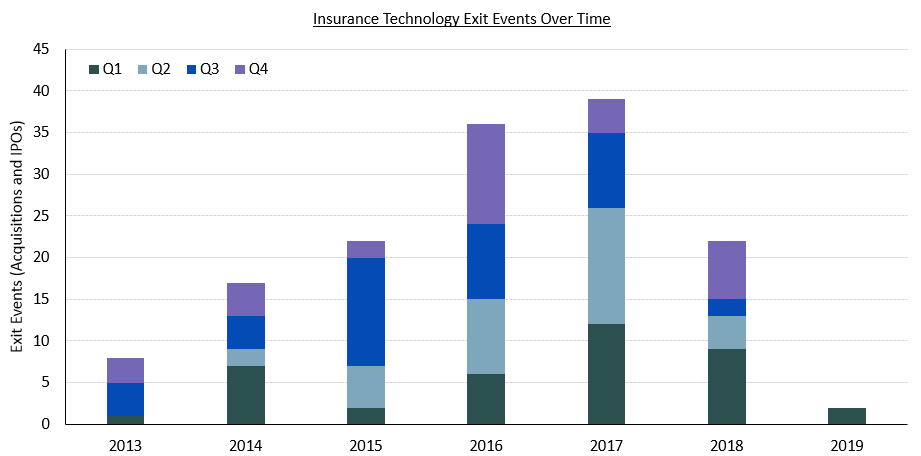

There were 2 exit events last quarter, which was 78% lower than Q1 2018.

Source: Venture Scanner, data cumulative through March 2019 (Q1 2019)

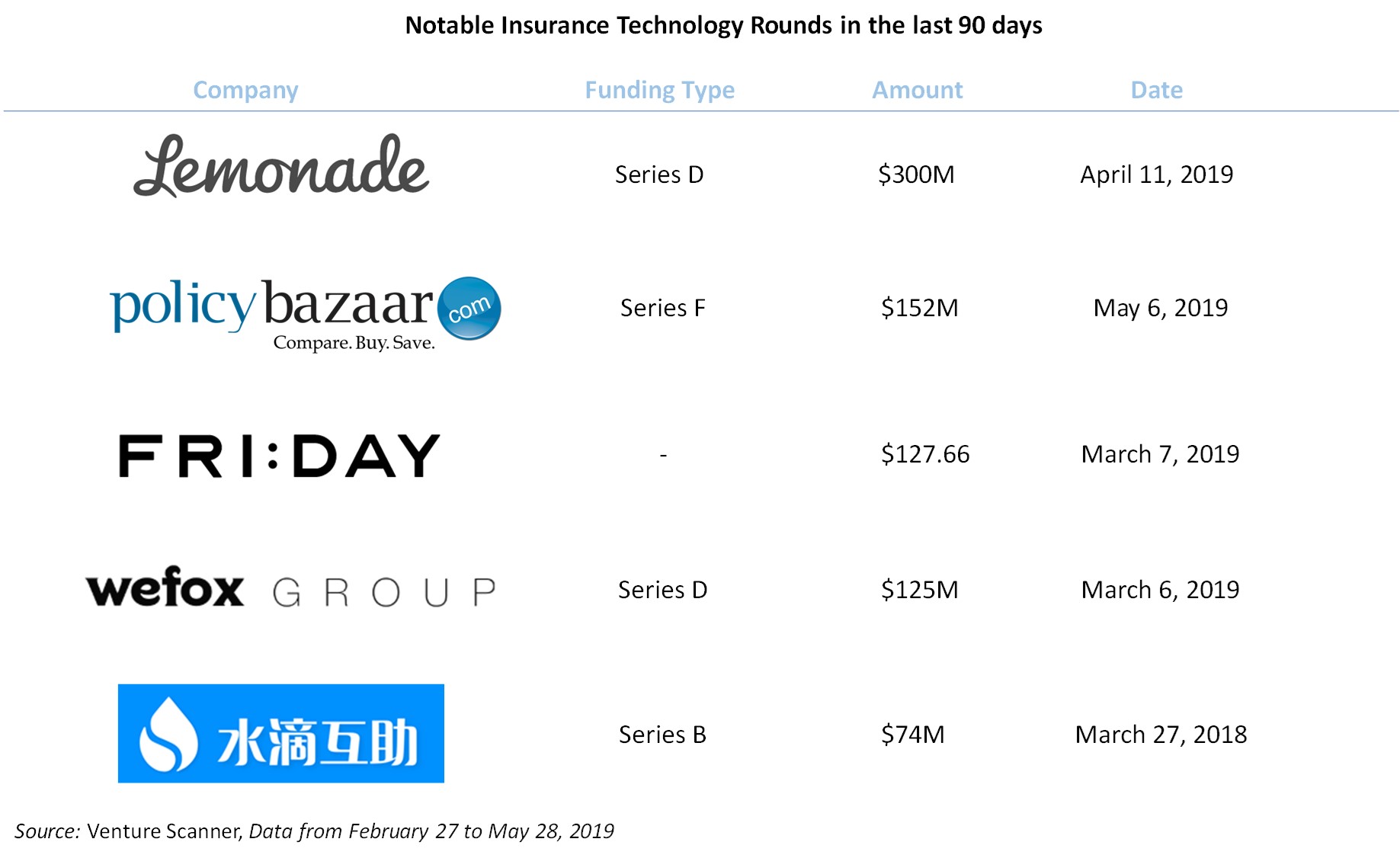

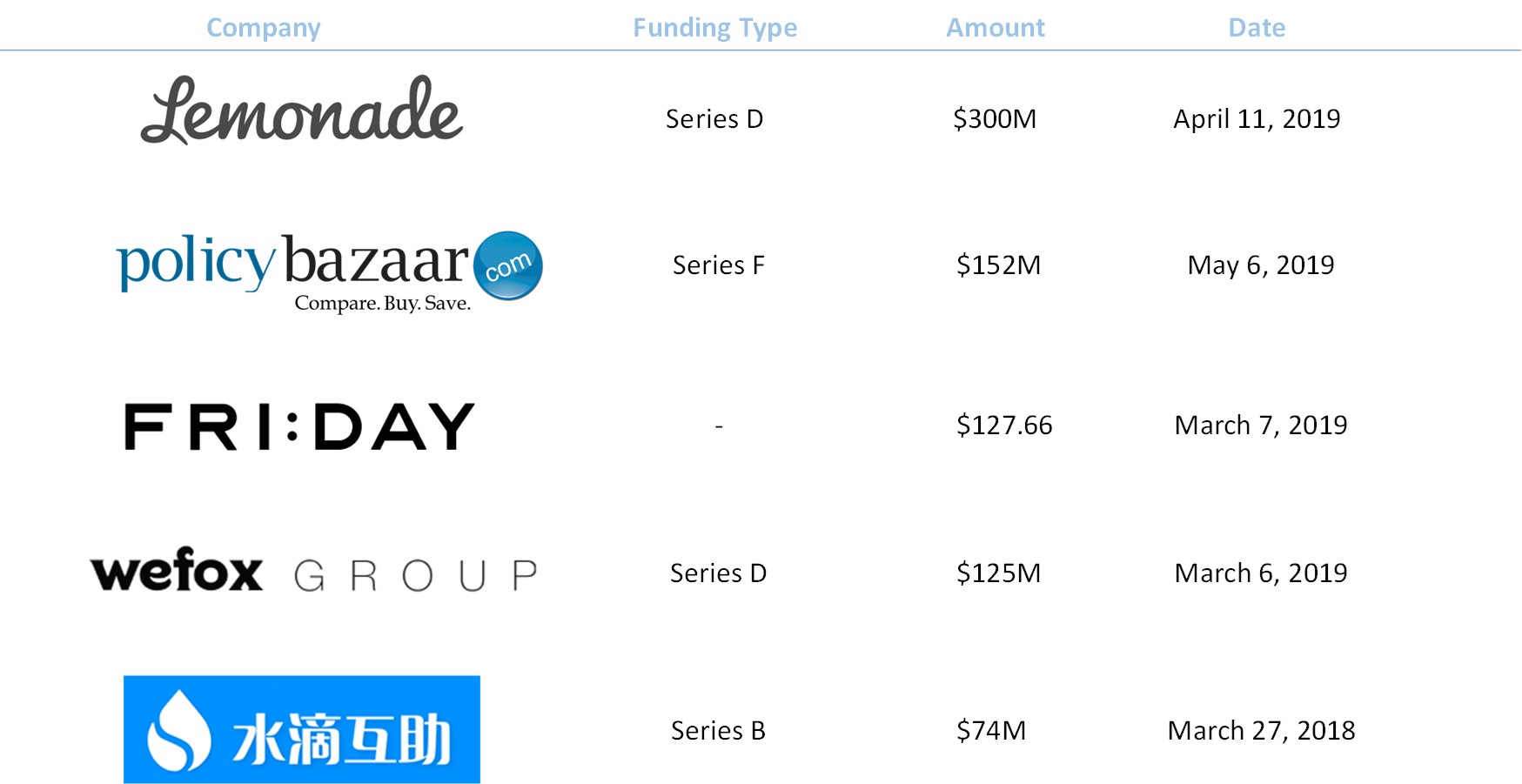

The following companies have raised the largest rounds in the past 90 days.

Source: Venture Scanner, Data from February 27 to May 28, 2019

Insurtech Lemonade raised $300M in the latest Series D funding round led by SoftBank Group on April 11th 2019, bringing the company’s total funding up to $480M. Lemonade uses an AI-powered bot to digitize the insurance-buying experience for renters and home owners making it easy for anybody to purchase insurance with the help of a smartphone. The aim of this investment is to help Lemonade expand beyond the U.S.

With a total of $498.6M raised to date, Policybazaar is India's largest insurance aggregator website. They are specialized in making comparative analysis of the insurance products of various insurance policies based on price, quality and key benefits, combined with solution driven customer service. The latest round of $152M was closed on May 6th, 2019 and even in this case SoftBank Group was the lead investor.

Friday is an insurtech start-up based in Germany that specializes in digital car insurance operations and has acquired more than 45,000 new customers for its car coverage since it was founded in 2017. Their platform is cloud-based and it’s able to offer completely paperless, mobile and fully digital insurance products. In the month of March, the start-up completed a funding round of $127.66M.

Wefox Group’s latest financing round of $125M on March 6th, 2019 was led by Mubadala Ventures. Wefox Group is a Berlin-based insurtech startup which stands behind the consumer-facing insurance app and carrier One and the insurance platform Wefox. According to TechCrunch the money raised will be used for expansion into the European broker market and to grow its product and engineering teams, specifically in relation to applying “advanced data analytics”.

With $74M raised in a Series B round lead by Tencent Holdings, Shuidihuzhu is a Chinese insurance platform founded in 2016 that plans to solve the problem of high medical fees faced by most patients, especially those with a critical illness. When a user is diagnosed with a serious disease like cancer, the platform will crowdfund the medical fees from all its users. According to Forbes, patients can receive a maximum donation of $43,000 on the site and the company works with local hospitals as well as government agencies to verify patient information before putting them online. Shuidihuzhu offers three products through their official WeChat account: mutual insurance, crowdfunding and commercial insurance.