Image courtesy:Table based on data provided by Venture Scanner, cumulative through July 8, 2019

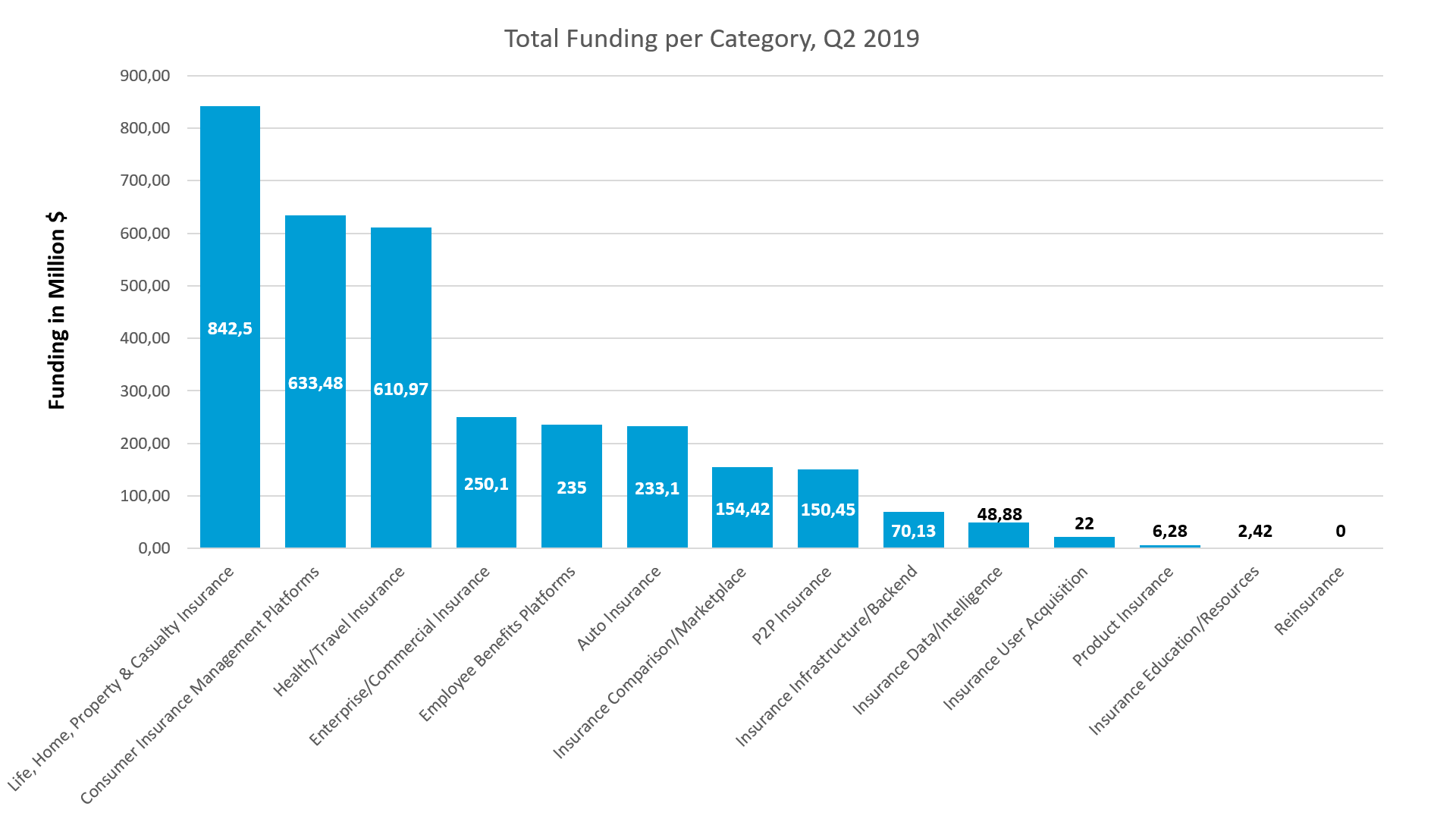

The following graph highlights the distribution of funding across categories. In Q2 2019 the biggest amount raised was in the Life, Home, Property & Casualty Insurance category with $842,5M. Next came Consumer Insurance Management Platforms category with $633,48M followed closely by Health/Travel Insurance with $610,97M in funding. These three categories with growing funding total may be experiencing more innovation.

Source: Venture Scanner, data from April 1, 2019 to June 30, 2019

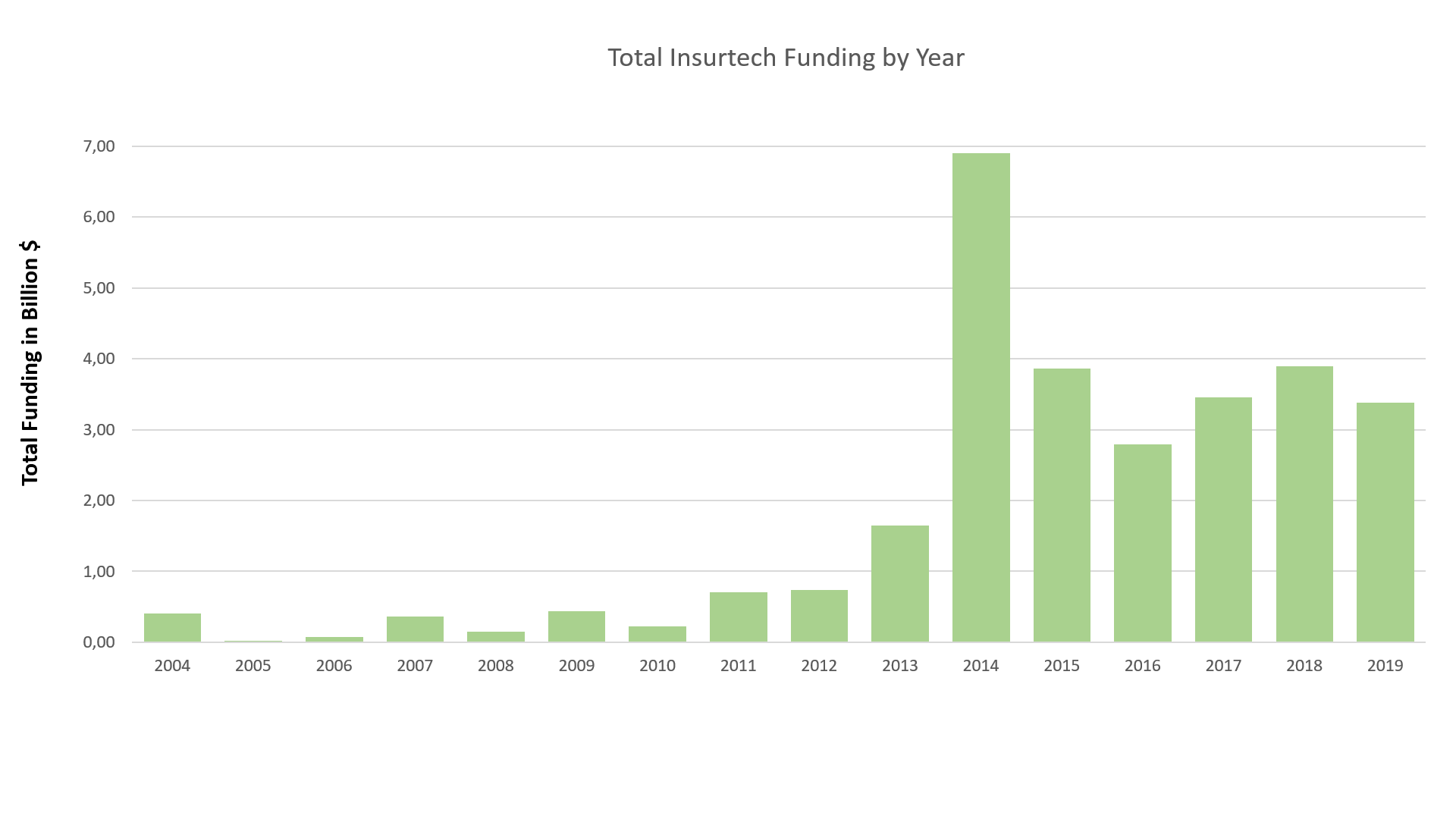

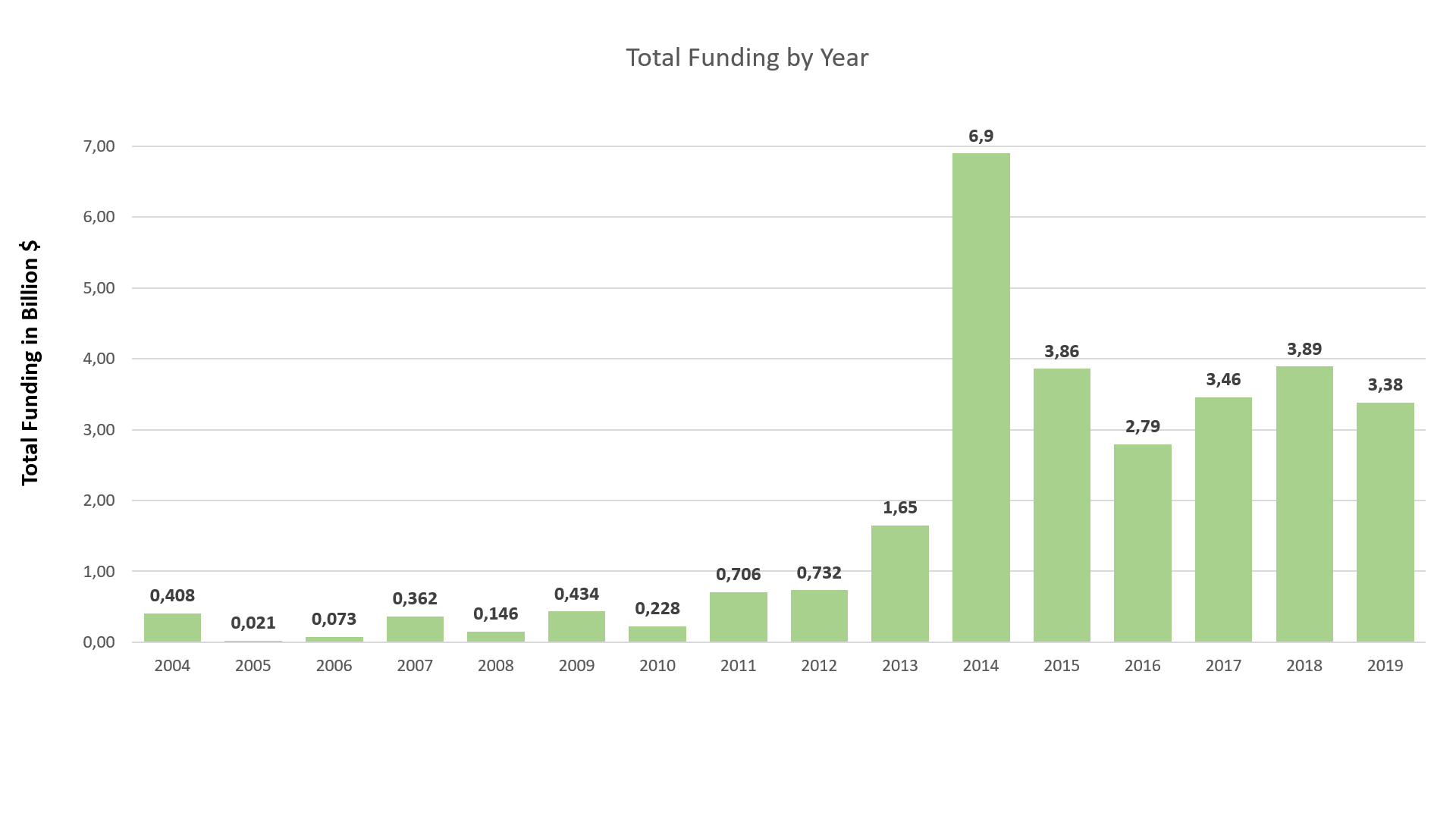

The below graph highlights recent trends in Insurance Technology startup funding activity, showing the total funding raised for each year. Funding in Q2 2019 reached $1,68B based on Venture Scanner data, almost catching up with the previous Q1 2019 when funding was $1.7B. Compared to Q2 2018 when total funding was $603M, we can see a significant increase of around 178% in Q2 2019. This confirms that 2019 is more dynamic year for insurtech investments compared to 2018.

Source: Venture Scanner, data cumulative through July 8, 2019

Source: Venture Scanner, data cumulative through July 8, 2019

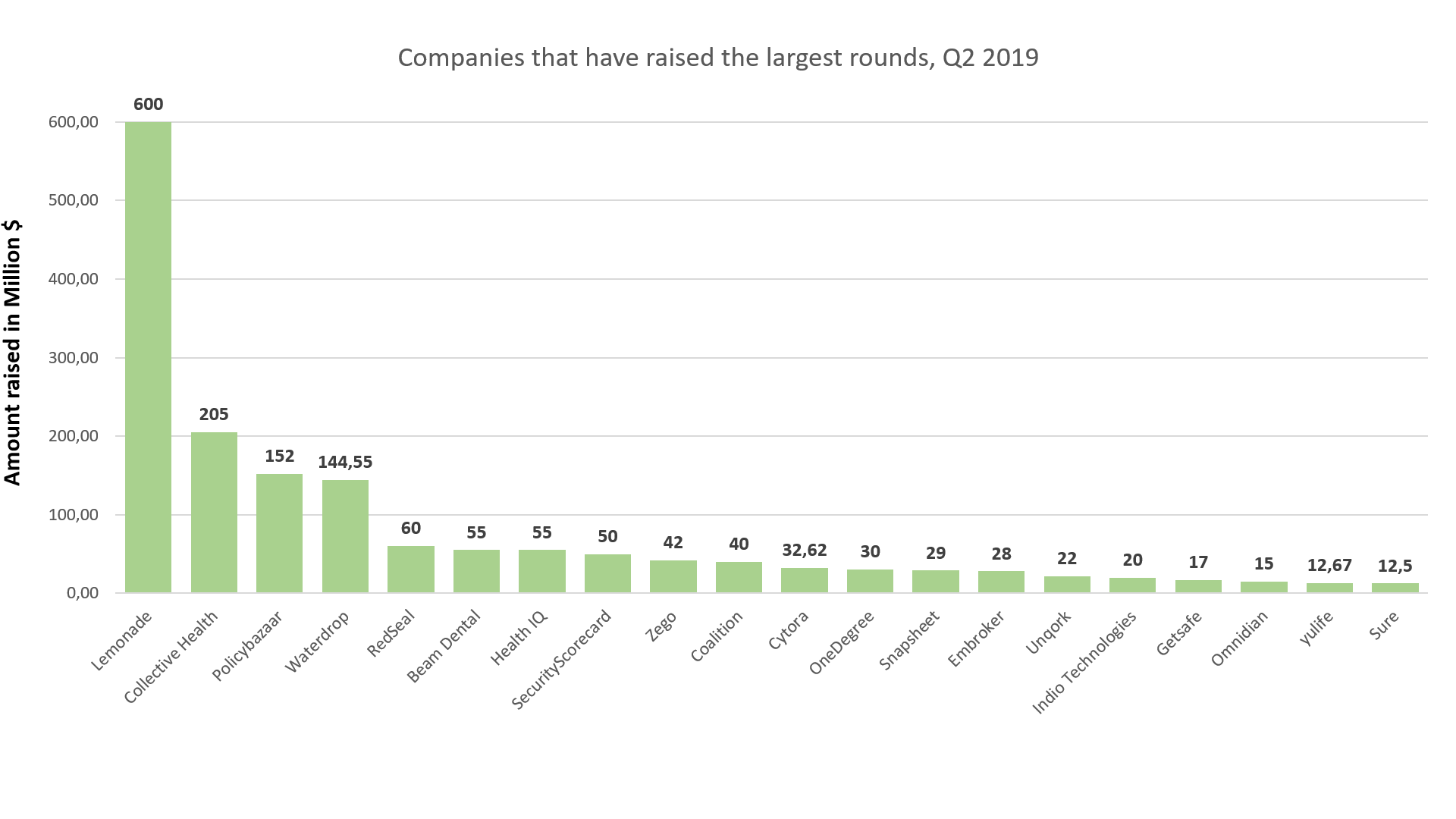

The table below highlights the companies that have raised the largest rounds in Q2 2019.

Source: Venture Scanner, data from April 1, 2019 to June 30, 2019

Insurtech Lemonade raised $300M in the latest Series D funding round led by SoftBank Group on April 11th 2019, bringing the company’s total funding up to $480M. Lemonade uses an AI-powered bot to digitize the insurance-buying experience for renters and home owners making it easy for anybody to purchase insurance with the help of a smartphone. The aim of this investment is to help Lemonade expand beyond the U.S.

Once more SoftBank Group comes to our attention as lead investor for the latest $205M Series E round by Collective Health on June 17. Collective Health’s client list includes among others Red Bull, Pinterest and Zendesk and it counts GV, NEA, DFJ Growth and Sun Life among its financial backers. Its platform is an integrator for the various insurance and benefit providers that large employers offer to their employees, and provides access to info, as well as claims filing, eligibility checks and data sharing across vendors.

With a total of $498.6M raised to date, Policybazaar is India's largest insurance aggregator website. They are specialized in making comparative analysis of the insurance products of various insurance policies based on price, quality and key benefits, combined with solution driven customer service. The latest round of $152M was closed on May 6th, 2019 and even in this case SoftBank Group was the lead investor.

Waterdrop (Shuidihuzhu) has raised around $145M according to technode.com in its latest round led by Boyu Capital with participation from Tencent, CICC Capital, Gaorong Capital and others on June 12th. According to technode.com the money will be used to build a team focused on health insurance and to explore artificial intelligence applications in health insurance. With a total of $219.4M raised to date, the Beijing-based company offers a mutual aid and a crowdfunding platform via WeChat alongside insurance services.

The following table presents the companies that have been acquired, gone public, or shut down in Q2 2019 according to Venture Scanner data.

Source: Venture Scanner, data from April 1, 2019 to June 30, 2019