Services, Investments & Job Roles

In our previous post on we explored where carriers are focusing their money, time, staff and training resources in their bid to stay relevant and competitive in today's fast-moving insurance market. Today we are continuing that theme, examining some key bellwethers for the general health and future direction of the traditional industry:

- Service-Area Round-Up (in which areas are services are being consumed?)

- Investment Prognosis (how is investment in these areas changing?)

- Job-Role Creation (recent job appointments within carriers)

This selection of statistics is drawn from the extensive survey we conducted as part of our Trend Map. If you'd like to see a full breakdown of our survey respondents and details of our methodology, then please download the full Trend Map here.

1. Service-Area Round-Up

It’s one thing to talk about general industry challenges (post #1) and priorities (post #3) as we have done in previous posts in this series, but it is often the case that people’s money is not where their mouth is. To provide some clarity here, we asked Insurers & Reinsurers where they are planning to use third-party services, selecting from a shortlist of 15 priority areas.

The three most sought-after services among Insurers & Reinsurers globally were, respectively, Digital Innovation (cited by 59% of respondents), Analytics (47%) and Internet of Things (34%). The high percentage of respondents seeking digital and analytics services is hardly a surprise given that these were two of the top three global priorities for our Insurer & Reinsurer respondents, as we saw in our previous post on Insurer Priorities.

The presence of Internet of Things in the top three is more noteworthy. In our previous post, we found IoT ranked 11th out of 15 on our the global priorities list, yet here it appears to be one of the most sought-after areas for third-party services. Unsurprisingly, and consistent again with our previous post on priorities, Investment Management is the least in-demand area for services.

"The importance carriers are attaching to Analytics, Digital and IoT is demonstrated by the numbers that are seeking third-party services in these areas."

Paolo Cuomo, Principal at The Boston Consulting Group (BCG) and Co-Founder at InsTech London

2. Investment Prognosis

We asked our Insurer & Reinsurer respondents to indicate qualitatively, on a sliding scale, how much they expected investment to change in each of the priority/service areas we have been considering.

Respondents saw investment increasing in almost all areas, which may indicate a bias towards bullishness. That said, the order of the different service areas should be a fair indication of which ones are most likely to attract whatever additional budget is available.

In addition to being the key areas carriers are currently seeking services in, Digital Innovation and Analytics are also due the largest increases in investment.

Investment in IoT (3rd place among services sought) shows minimal increase. So, putting our two measures together, it would appear that Digital Innovation and Analytics are attracting large and increasing investment from Insurers & Reinsurers, whereas Internet of Things is attracting large and steady investment.

As we saw in our first chart (under Service-Area Round-Up), Product Development was a relatively unimportant category when considering global demand for third-party services, with only 19% of carriers seeking services in this area – nonetheless, in the table above it displays one of the highest increases in investment (4th place overall), suggesting that it may become a more significant category in the future.

The declining importance of Investment Management is most likely a reflection of globally low interest rates – this side of the insurance business, having become less lucrative, looks set to attract less spending on services.

"Insurers will invest in those areas that will support growth and differentiation or operational efficiency through innovation. These will range from delivering end-to-end innovative digital products to re-inventing the insurance value chain at the front end. A lot of these capabilities though rely on underwriting to achieve optimum results."

Sabine VanderLinden, Managing Director at Startupbootcamp

3. Job-Role Creation

A key proxy for growth in any technology or business area is the creation of new job roles relating to it. This is a useful measure for determining – beyond idle talk – which areas are genuine priorities or concerns for an industry.

Based on our broader research, Insurance Nexus drew up a shortlist of emerging job roles within insurance companies, and asked Insurer and Reinsurer respondents to indicate whether these had recently been – or were soon due to be – created at their company.

The results reflect the recent spike in importance of information security, which has doubtless been fuelled by a series of high-profile cybersecurity incidents involving insurers, such as last summer’s data breach at US-based Banner Health, in which as many as 3.7 million customers had personal data stolen. Thus, Chief Information Security Officer scores the highest out of the roles we considered in all the geographies we assessed (Europe, North America and Asia-Pac).

Comparing across regions we see that Chief Customer Officer assumes a higher relative importance in Asia-Pacific. As we noted in our earlier post Insurance Nexus Global Trend Map #2: Insurtech Perspectives, the real or perceived threat from new market entrants and disruptors was deemed highest in Asia-Pacific, and we speculated that this might be due to a larger proportion of the population being un- or underinsured, lacking ties to the traditional insurance model and thus representing an appetising target for dynamic new players aiming to cut traditional carriers out. If this is true, it makes perfect sense for insurers in Asia-Pacific to place a special emphasis – including a whole new job role – on the customer.

Sometimes the relative prominence of different job roles may reflect variations in naming conventions rather than real differences on the ground...

For example, we see that Chief Digital Officer is relatively insignificant in North America compared to Europe and Asia-Pacific. On the other hand though, these two regions both trail North America when it comes to the recent or forthcoming appointment of the Chief Analytics Officer role. We know from the stats we have already presented in our previous posts, covering everything from challenges and priorities to investment and spending, that analytics and digital are both highly important in all three of these regions, so this disparity (with the job roles) is probably no more than apparent.

"Marketing/sales, human resources, underwriting, finance and claims are all being impacted by the growing focus on analytics. New roles are rapidly emerging — from a Chief Analytics Officer to Data Scientists and Engineers."

Margaret Milkint, Manager Partner at The Jacobson Group

We asked our carrier respondents to name any other significant roles of recent creation that we had missed. Our most significant omissions were, in no particular order:

- Chief Risk Officer

- Head of Transformation

- Titles around ‘Customer Experience’ and ‘Customer Engagement’

- Chief Strategy Officer

- Chief Innovation Officer

- Head of Disruptive Innovation

- Head of Blockchain

Emerging job roles fall, it would appear, into one of two camps. We see that holistic strategy roles (also framed in terms of ‘transformation’ and ‘customer-centricity’) are becoming more and more important; indeed, one respondent lamented the lack of a ‘Thought Leadership Officer’ position. Then we have roles related to specific emerging technologies, such as Blockchain – and we can expect the same with machine learning and AI.

This spectrum reflects a major issue insurers are likely to face from a staffing and organisational-structure perspective: complex emerging technologies invite and often outright require specialisation, yet the dependencies between divisions, technologies and initiatives within carriers become larger and larger every year.

The ability to strike the right balance between these two camps – deep technical expertise on the one hand and a capacity to conceive and coordinate the ‘big picture’ on the other – will be one of the key factors that separate the insurance wheat from the insurance chaff over the coming years.

Analytics and AI

Having completed the exploration of our Global Trends we now turn to our Key Themes. We will explore 11 key functional and technological areas within insurance, starting with this instalment on Analytics and AI.

The following statistics on big data, analytics and AI are drawn from the extensive survey we conducted as part of our Global Trend Map; a full breakdown of our respondents, and details of our methodology, are available as part of the full Trend Map, which you can download for free at any time.

Insurance, relying as it does on predictions about complex future events, has always been a data-hungry, data-driven industry. The big-data explosion of the past decade is therefore something that insurers have followed with keen eyes:

According to IBM, the world generates 2.5 quintillion bytes of data every day, with 90% of the world’s data having been created in the last two years.

While insurers, and most companies for that matter, have for a fair while had more data than they’ve known what to do with, analytical and machine-learning models are now sufficiently mature and sophisticated for them to start reaping the much-heralded rewards of the big-data revolution. This is not without its challenges though, with silos and legacy systems in particular acting as a drag on innovation.

Analytics is being deployed pretty much everywhere, and by everyone, in the insurance ecosystem, so this post covers:

- Analytics & data usage across various insurance ecosystem players

- Overall data strategy

- Issues with silos and legacy systems

- Contrasting flavours of analytics in use: descriptive, diagnostic, prescriptive, predictive, behavioural and, of course, AI!

"Causing the greatest stir out of all today’s analytics tools is AI, which stands to revolutionise the whole insurance industry over the next 2-5 years, from robo-advisors and chatbots through to claims automation and mitigating fraud. While analytics teams retain the greatest degree of oversight, AI capabilities are currently being embedded across the whole insurance organisation."

Helen Raff, Head of Content at Insurance Nexus

Interesting is, as we shall see, the leadership on many of these measures provided by Reinsurers. This is evidence of their pro-activity in driving the whole ecosystem forwards, and in this they often take the lead over Insurers. We also see this more generally; for example, the giants Swiss Re and Munich Re have been particularly active in accelerator-based innovation over the past two years.

Is your investment in / focus on analytics increasing?

84% of all respondents are increasing their investment in analytics. This conforms to the stats we presented in our earlier post on Services, Investments and Job Roles, where Analytics was second only to Digital Innovation for increased carrier investment. Drilling down further into the responses of different company types, we see that similar proportions of Insurers (82%), Brokers & Agents (76%) and Technology Partners (85%) are increasing their investment. Of interest is the clean sweep by Reinsurers, exemplifying the leadership trend we pointed out.

Analytics has applications across all the major lines. Health and Auto are two obvious examples given the ready availability of connected health devices and in-car sensors, which make data easier to capture and, as an extension of this, models easier to feed. This facilitates Usage Based Insurance (UBI), which we explore in more detail in our forthcoming post on Internet of Things, whereby actual living/driving habits inform policy prices (read ahead straight away by downloading the full Trend Map for free).

Analytics also has obvious applications for predictive maintenance and security in Commercial, Auto and P&C/General lines, particularly where valuable assets (like property) are in play. Analytics is also growing in Home insurance thanks to the increasing prevalence of connected-home devices, with Berg Insight estimating that there were approximately 18 million smart homes in Europe and North America by the end of 2015.

"There will be much more data from structured and unstructured data sources in the future – a huge challenge! 'Past developments are a good representation of future uncertainty' will not be replaced but solutions with AI-tech (big data) in combination with smart data strategies will enable insurances to make decisions based on models and evidence."

Andreas Staub, Managing Partner at FehrAdvice

Is your analytics strategy coordinated across your organisation?

The uses and advantages of analytics have been obvious for a long time, and we have seen analytics initiatives sprouting up in nearly every corner of the insurance business, from underwriting through to counter-fraud. An ad-hoc approach, often inevitable in the early days of a technology, quickly becomes unwieldy, and the benefits from coordination are substantial.

It is encouraging therefore to see 57% of all respondents indicating that their analytics strategy is coordinated across their organisation. The trend across our different company types is similar to the one we saw in the investment/focus question above – unsurprisingly,as coordination is vital to gain maximum value from increasing investment and focus, and often represents a large investment in and of itself. We thus see 59% of Insurers coordinating, 54% of Brokers & Agents and 55% of Technology Partners, with Reinsurers once more taking the lead (77%).

Are you utilising external data sources?

Plenty of data is available for analytics use beyond that directly captured by insurance companies themselves, both publicly available (like social media) and for-purchase (from third-party aggregators). There is no clear trend across our ecosystem players on this measure, with 77% of Insurers, 67% of Brokers & Agents and 81% of Technology Partners affirming their use of external data sources (Reinsurers had a small though insignificant lead).

Segmenting by region, we can tentatively identify Asia-Pacific as trailing on this measure, and our broader research and industry engagement does indeed suggest that the third-party data culture is less well developed here than it is in North America and Europe. That said, public sources of data remain available, from unstructured social media through to data generated/collected by incipient smart-city infrastructure (like in Singapore). More details to follow in our forthcoming Regional Profile on Asia-Pacific, or read on straight away by downloading the full Trend Map here.

Do you have a formal data-governance strategy?

Insurance companies are being borne along on an exponentially growing tide of customer data, which has brought data governance to the forefront of people’s minds; yet, as of today, only 57% of Insurers, 51% of Brokers & Agents and 58% of Technology Partners possess a formal data-governance strategy. We expect this figure to rise sharply in the years to come. Reinsurers once again appear to lead (with 77% affirming the existence of a data-governance strategy).

Are legacy systems and silos a problem for your business?

Capturing data is only the first part of the story to building out an analytics-based business. In many cases, analytics and big-data projects within insurance companies come unstuck not because of a lack of investment or strategic focus but for reasons more prosaic in nature: silos and legacy systems. If infrastructural bottlenecks strangle rather than feed analytical models, preventing them from operating at scale across all the relevant data pools, then the output will be etiolated and limited in use.

We asked respondents whether legacy systems and silos represented ‘somewhat’ or ‘very much’ of a problem for their businesses, and then created a ‘burden score’ based on a weighted combination of these two figures. Insurers clocked up a burden score of 138, Brokers & Agents 103 and Technology Partners 105 (Reinsurers score 123).

There are two key takeaways from this. Firstly, that silos and legacy systems are a problem for the entire insurance ecosystem. And secondly, that carriers are generally harder-hit (comparing Insurers & Reinsurers to the Rest of the Industry), which may well reflect their position as the central node of the industry into which all the other players feed.

From descriptive analytics to AI: what's your flavour?

With all new technologies or methods, there is generally a gap or lag between what is theoretically possible and what finds its way into commercial practice. We asked Insurers & Reinsurers what forms of analytics they were deploying out of a possible six options:

As we can see, every form of analytics has attained at least a modest level of penetration, and we can tentatively construe from this an adoption curve of different analytics formats running roughly from predictive, descriptive and diagnostic (high degree of current adoption) through to behavioural, prescriptive and machine learning / artificial intelligence. So, while most respondents have developed capabilities to describe and predict, only a minority have advanced beyond this towards prescriptive and AI capabilities.

"The rise of InsurTech, the analytics explosion and the new face of insurance has created a birth of new roles and impact points across the industry. No longer is analytics and data relegated to just information technology and actuarial — we are now seeing it being integrated into the business culture and DNA of insurance organisations."

Margaret Milkint, Managing Partner at The Jacobson Group

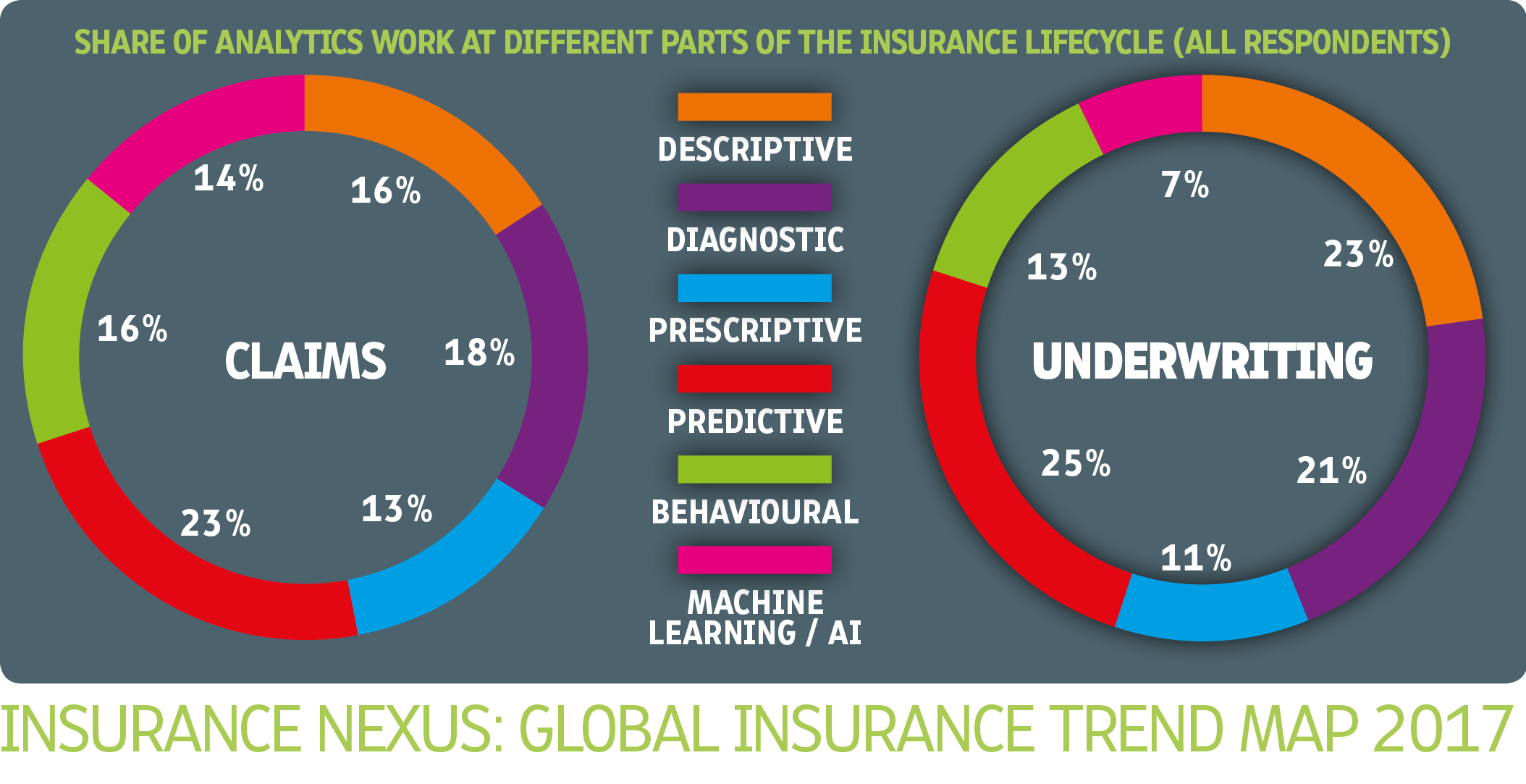

Analytics is a very broad category with applications across almost every part of insurance, from underwriting and marketing through to fraud and claims, as well as on the investment side of the business. For sake of clarity, we have chosen to focus in on two areas of insurance work, Underwriting and Claims, in order to capture a snapshot of analytics maturity at the start and at the end of the policy ‘lifecycle’...

The donuts above indicate the share of analytics work (as a proportion of the whole) being undertaken by respondents working in the areas of Underwriting and Claims – this is an intuitive way to compare the prominence of different flavours both within, and between, these two areas.

A larger proportion of the analytics work undertaken by Underwriting respondents appears to fall at the early stage of the adoption curve (descriptive and predictive) and a smaller proportion at the later stage (moving towards machine learning and AI), when compared to respondents working in Claims. This implies that Claims either encourages more advanced analytics than Underwriting – which may be oversimplifying things – or that, for whatever reason, it leads Underwriting on analytics maturity.

The original articles were published by Alexander Cherry at this link.

For any inquiries relating to the Insurance Nexus Global Trend Map, this on-going content series or next year's edition, please contact:

Alexander Cherry, Head of Research & Content at Insurance Nexus (alexander.cherry@insurancenexus.com)