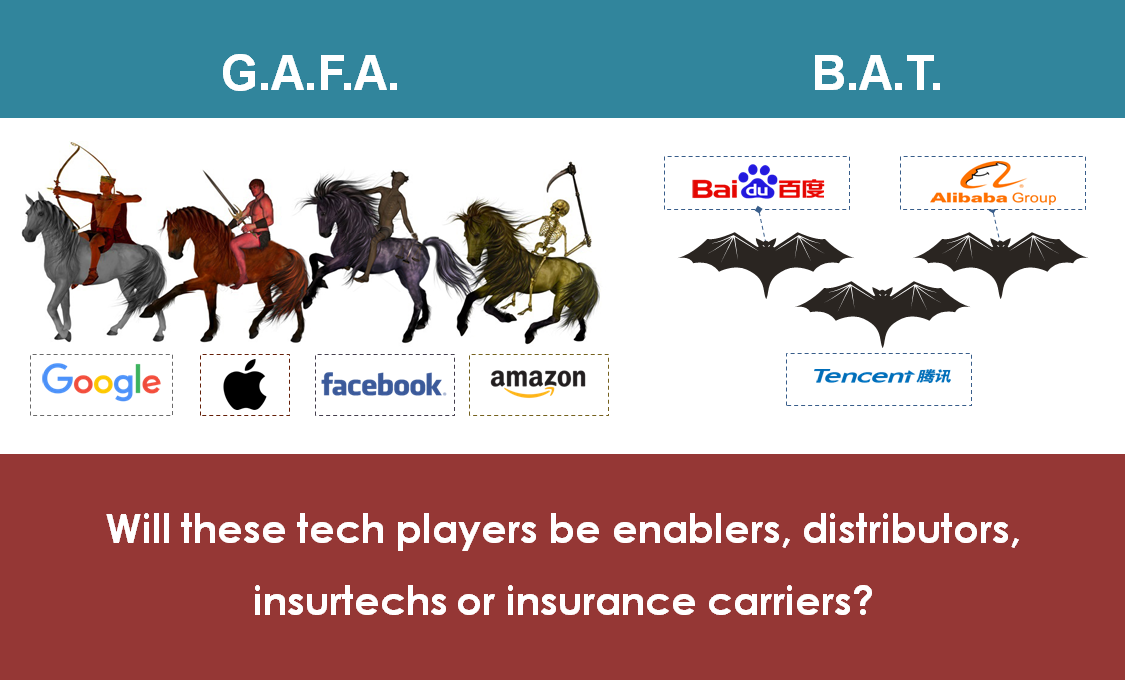

To continue the series, here we are with question no. 2 for our 50insurtech influencers. While they all agreed that the big players, GAFA (Google, Apple, Facebook, Amazon) and BAT (Baidu, Alibaba, Tencent), will act in the insurance industry there are different points of view about how they will actually do that. Let’s see what their answers are.

What role will G.A.F.A and B.A.T. play in the industry and why?

Steve Tunstall: Unless the insurance industry is careful BAT and GAFA will end up owning the customer relationship entirely and relegating the insurance incumbents to becoming ‘dumb pipes’. In this scenario the commoditization we have to date in the industry will be as nothing. The race to the bottom as pure capital capacity plays will change the industry forever

Sam Evans: They will leverage customer relationship and digital capabilities to reach customers at point of demand to provide insurance.

Matteo Carbone: What they will try to do - soon or later - will be to sell insurance or also control a larger part of the value chain as MGA…with the standing ovation from the insurance analyst welcoming any of their actions, they can also be bold enough to become carriers. We will see this wave, but my expectation will be a déjà vu of what happened last year with Google Compare in US…“terminated”. I think in the middle term each of those tech payers on the insurance sector will only do their core job: sell advertising, provide devices to the insurers, partner up on specific services and bundle some insurance covers together with the products they are selling. Nothing so relevant, exciting or disruptive. There is a potential black swan: all the insurance carriers could choose the irrelevancy as their future ambition. In this scenario, the insurance carriers will become “dumb pipes”, invisible and maybe will also be replaced by something else in the long term. But I believe the incumbents have all the levers to design their destiny, a successful destiny: irrelevancy is a choice, not their inevitable destiny.

Jim Marous: They will leverage their databases and customer insight to offer solutions that save time and are built digitally. Like Lemonade, they will find pockets of friction and inefficiency to offer solutions without becoming insurance companies.

Andrea Silvello: I believe that there will be different models that these tech giants will approach. One of the most immediate models is selling products with insurance cover included - Amazon and Alibaba are great mediums for such an approach. Other players could leverage their huge communities of users in order to become distributors.

Tim Attia: They will own the customer. The customer will demand to be able to buy insurance from them.

Danielle Guzman: I believe they will play a big distribution role. Consumers are more and more open to new ways of buying insurance. Both complex products and poor buying experiences have contributed to consumers’ growing openness to consider alternative ways to acquire insurance. That coupled with the movement in technology weakening the barriers to buying from non-traditional providers.

Nigel Walsh: Partnerships and joint ventures, distribution agreements, client insights for better underwriting and ultimately marginalising the traditional carriers core business. From a retail perspective this is quite obvious to most already as the rate of disruption has taken almost all industry’s head on.

However, as these organisations continue to dominate, define and optimise their own distribution and supply chains – it’s only a matter of time before they can leverage every ounce of data they hold behind their visible store fronts to the benefit of insurance, be it direct or otherwise. However all very easy in a non-regulated commodity product perspective. If we can replicate just some of the success in the areas above that these folks have mastered then we will improve on what we have today. We also need to be clear, we are not trying to be the Amazon of or Google of, it’s up to us to define our own destiny and march that path before someone else gets there before us and redefines it, period.

Across each sector, they are already heavily invested, be in Self Driving Vehicles, Medicine and Health care and so much more – it’s only natural for them to extend their current reach in each of these sectors with many examples already emerging.

.

Robin Smith: I think it will be both on the insurance product and sales side. It may be more on the advertising side at the moment, but we will see more product development in the long-term as these internet giants move into more disruptive technologies like autonomous vehicles, drones, smart homes, and even health care with smart health devices (thinking of Apple here). To be clear, this will all be on the consumer side, rather than commercial insurance.

Paolo Cuomo: Starting to offer more "customer friendly" covers which may not even look like insurance.

Spiros Margaris: The insurance industry will become a white label provider (dumb pipes) to tech giants and large companies that will offer banking or insurance solutions. Insurance companies can’t compete with the aggressive price models the tech giants can and will offer their clients.

Denise Garth: These companies are going to play a wide range of roles … from enablers and partners for insurance companies … to new channels and even as competitors.

InsurTech startups are using Facebooks’ messenger capabilities to develop innovative digital interactions using AI and chatbots. In our consumer research we are seeing increasing numbers using ApplePay and as a result want it for insurance payments as well. And some insurers are looking to partner with Apple to provide Apple watches to monitor their health. And then we have Alibaba embedding the purchase of insurance into the purchase of things (Amazon seems to be exploring this too in the UK), something that our consumer research shows great interest in from the next generation of insurance buyers .. millennials and GenZ. They also setup (along with Tencent and Pingan) ZhongAn Online P&C Insurance as an online Internet insurer set to disrupt the industry.

These third party platform businesses have more customers and reach, and therefore more bargaining power than insurers. Insurers looking to partner with these platform businesses will need to be digital transformed organizations to be able to reach these new markets for significant growth opportunities. An interesting point is we asked consumers if they would be open to having purchase data (like Amazon) used in the pricing where Gen Z was very open to the possibility.

Mark Breading: While it is possible that one or more of these tech titans will launch an insurance company or other insurance-specific venture, it is more likely that they will leverage their data/analytics and networks to participate in the insurance industry in other ways. As the world becomes more connected, two big changes occur in insurance. First, the advent of smart homes, connected cars, smart farms, cities, and buildings, etc., will result in massive amounts of real-time data about everything the industry insures, (including people). The big tech companies will play a major role in collecting, storing (via cloud), and analyzing this data. They will likely offer solutions for safety and risk management to individuals and businesses – perhaps in partnership with insurers, but perhaps without insurer involvement. Secondly, the frequency and nature of communications with policyholders and agents will increase dramatically. These global tech companies already excel at frequent, real-time communication, enabling communications that are 1:1, 1:many, or many:many. They are likely to join in ecosystems with a variety of other providers of devices, data, and services to enable interactions.

Stay tuned for the next two posts featuring answers from our 50insurtech influencers to pressing questions for the insurance industry. Remember to subscribe to our newsletter in order to stay updated.