With 90% of carriers actively investing in new data projects, project failure is not an option.

Artificial intelligence (AI) and machine learning (ML) have become mainstays in the insurance industry, equipping insurance companies with tools that can help them to become more efficient and profitable than ever before. But with the stakes so high, carrier executives are immobilized - the volume of cutting-edge data sources has exploded and the vast majority won’t implement a project if they’re not sure of its success.

“Artificial Intelligence will surpass the ability of the human brain to analyze hundreds of data points to make rational decisions, instantaneously”, Vineet Bansal, SVP, Chief Technology Officer, Swiss Re.

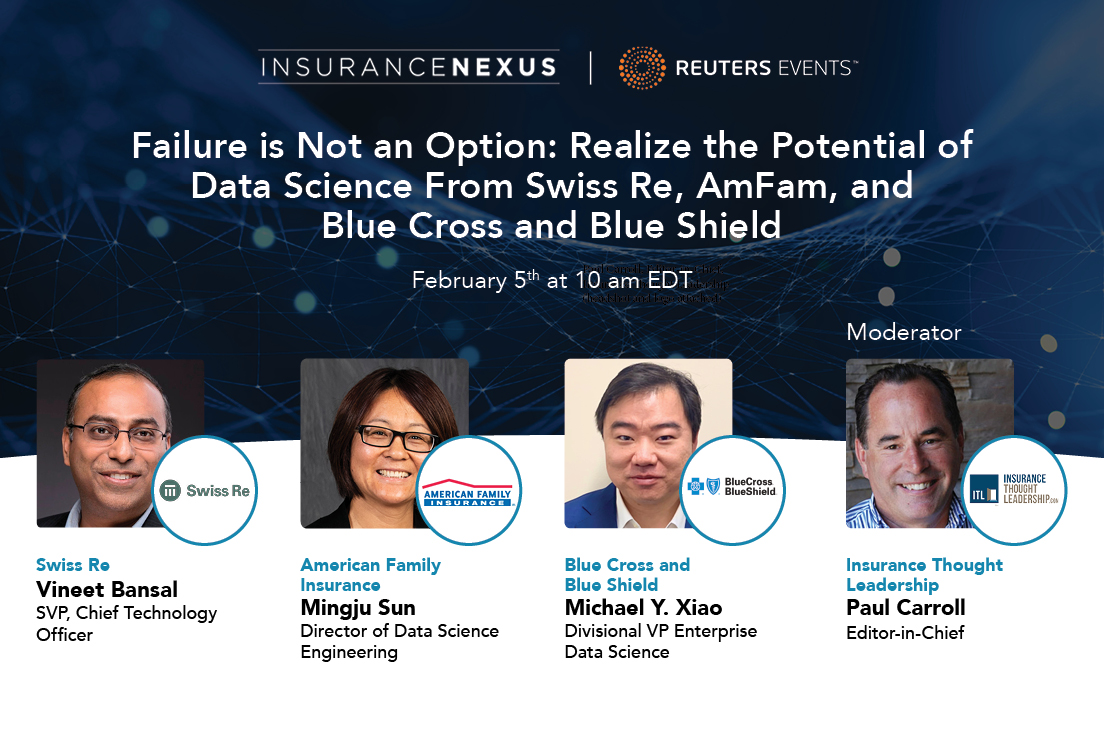

On (date), Insurance Nexus will host a webinar with Vineet Bansal, SVP, Chief Technology Officer, Swiss Re; Mingju Sun, Director of Data Science Engineering, AmFam; and Michael Y. Xiao, Divisional VP Enterprise Data Science, Blue Cross and Blue Shield. This webinar will highlight the relationship between data science and successful project management, helping insurance companies to identify areas for growth and enhanced efficiency.

- Unlock the power of data science to ensure long-term project success: Learn how to identify the key steps to success for data science projects in a world of regular failure. Build the right strategy and ensure data science projects result in successful production and implementation.

- Embed AI across the enterprise and beyond models to impact: Discover how to build an effective and agile data ecosystem to support AI and advanced analytics application across business objectives. Foster coalitions across the enterprise to ensure the success of AI.

- Deploy predictive analytics to gain a strategic advantage: Go beyond predictive analytics. Use more accurate models to optimize pricing in real-time, at the point of sale and achieve a competitive advantage.

- Apply emerging technology to the insurance industry: Identify current and future technological trends. See how new technology can help you achieve ROI and improve existing processes.

Don’t miss out on the ultimate opportunity to incorporate data science, artificial intelligence and machine learning into your everyday business capabilities -- sign up for the webinar today. You’ll receive a free recording of the webinar, even if you can’t attend.

This webinar is being run in association with the upcoming Insurance AI and Innovative Tech USA Summit 2020, an event by Insurance Nexus, a Reuters Events Company. Expecting more than 500 attendees from across the North American insurance ecosystem, the Insurance AI and Innovative Tech USA Summit brings senior innovation and business unit executives to uncover the rewards of embedding technologies such as AI, IoT, blockchain and automation to create valuable, relevant insurance products and services and seamless experiences through the power of tech-enhanced operations. For more information, please visit the website or get in touch with a member of the Insurance Nexus team.

###

About Insurance Nexus

Situated between London's Silicon Roundabout and the City, Insurance Nexus is at the innovative heart of an industry undergoing significant disruption and innovation. Insurance Nexus is the central hub for insurance executives. Through in-depth industry analysis, targeted research, niche events and quality content, the team provides the industry with a platform to network, discuss, learn and shape the future of the insurance industry.