Image courtesy: Photo by Kanenori

Over these last three years we have seen how the essence of ‘insurtech’ has evolved. The 300 insurtechs that we had on stage so far, and the 2,500 that we have in our insurtech database, give us a pretty good picture of what has changed. But also of how things will develop in the coming years. Looking back and ahead, we distinguish four waves of insurtech. With each wave driving the future of insurance in a new direction.

Lemonade co-founder and CEO Daniel Schreiber speaking at the DIA Amsterdam 2019

THE FIRST WAVE OF INSURTECH: CHALLENGERS

Three years ago, in 2016, ‘insurtech’ mostly meant ‘challengers’. New entrants were out there to attack the established order. Everyone spoke about ‘Disruption’.

The main driver for this first wave? Eroding entry barriers - due to new technologies. New entrants took the lead in intelligent and innovative use of technology and data, designing new ways of working. New ways of working that solved the frictions that customers experienced when working with incumbents.

Oscar, the famous US challenger, put it this way “We didn’t start this company because we love health insurance. Quite the opposite in fact.”

We actually took a closer look at the value proposition of many of these new players. Almost all of them promise that they solve the main reasons for dissatisfaction. We listed those issues below. Across the globe, customers have the same kind of complaints about insurance firms. We concluded that virtually all pain points that customers experience are related to ‘simplicity’ and ‘being personal’.

Of course, there is still sufficient room to improve here. But all these issues are in scope of operational excellence. So, it would be fair to say that all these issues should be solved shortly, and in fact quite a few are solved already. We already see that Net Promoter Scores are improving. Perhaps not everywhere, but we’re getting there.

Maybe this is the reason why so far only a few of these new players succeeded in acquiring a significant market share. Apparently, focus on solving operational issues only, simply is not enough to create a sustainable competitive advantage. The few winning new entrants are the ones that not only solve pain points, but which have a truly distinctive new business model on top of that.

A great example of a new entrant with such a winning distinctive business model is of course Lemonade. We were honoured that Daniel Schreiber, the co-founder and CEO of Lemonade, shared his vision at our recent DIA Amsterdam edition. Lemonade combines AI with behavioural economics into new business models, and moreover, new value for customers.

The impact of Challengers in terms of market share may still be limited. But that does not mean that the Challengers are not important. The impact they have on market dynamics is significant, but on a different level. Their focus on less frictions and new service levels has changed the expectations of customers. New entrants set new standards. Customers expect the traditional players to offer comparable innovative services as well. This makes incumbents realise, that they really need to step up to the plate, if they want to keep up.

THE SECOND WAVE OF INSURTECH: ENABLERS

This sense of urgency fueled the second wave. Many carriers are exploring the potential of new data streams; to improve pricing, to automate claims, to reduce fraud. Or they are launching all sorts of new proactive services, especially in the online and mobile space, often inspired by new challengers. Many realize that teaming up with insurtechs is essential to accelerate innovation.

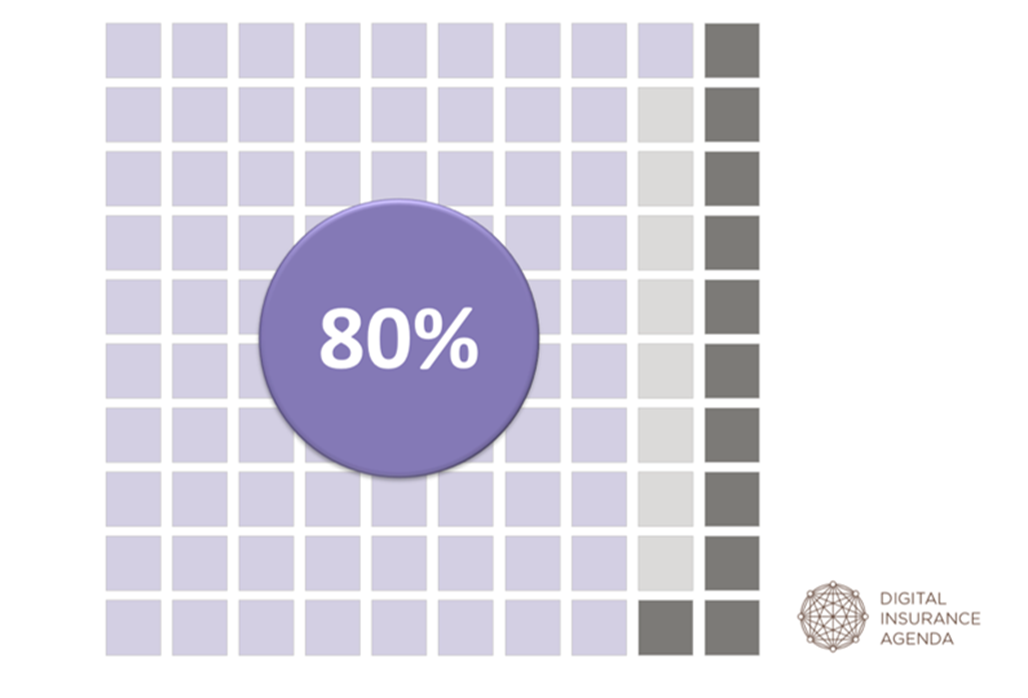

Obviously, this second wave reflects in the insurtech landscape. We can easily see this in our Insurtech Database. Among the 2,500 young tech companies worldwide around 80 percent are Enablers. They focus on assisting stablished carriers, to improve or renew specific parts of the value chain, or even help them to create new ones.

And if we take a closer look at the 20% Challengers, we notice that, in this 20%, there are quite a number that also offer a white label solution. So that incumbents can almost instantly introduce a new business model.

As said, in our view the importance of The First Wave of Insurtechs, the Challengers, is how they set new standards and created a sense of urgency. The value of The Second Wave, the Enablers, is the impact on the top line and bottom line of incumbents.

Now, having said that, when we meet with insurance executives to discuss ‘the state of innovation’, quite a few say they worry. They are totally on the same page when it comes to how important insurtechs are to accelerate digital transformation and innovation. But they are humble when we discuss the scale on which these new solutions are being used. Inside their organization, but also with regard to the visibility in the market.

In spite of all the investments, and pilots and proof of concepts with insurtechs; the impact on the top line and bottom line is still limited - so they say.

Obviously, we really need to tackle this issue. If not, we run the risk of throwing out the baby with the bath water.

This is why we’ve asked several industry leaders to share their experiences and success factors to create adoption at scale, internally and in the market. We also asked 300 insurtechs to share their experiences with us. We asked them for anecdotes, why projects didn’t fly. And for best practices, on how to scale successfully. We’ll share the results in a white paper later this year.

Although The Second Wave of Insurtech hasn’t reached its full potential yet, we’re already looking at the Third Wave.

THE THIRD WAVE OF INSURTECH: ECOSYSTEM PARTNERS

In our view ‘Ecosystems beyond insurance’ is the overarching trend for the years to come, the mega-trend if you would like to put it that way. This is the key driver for the Third Wave. More and more insurers realise that the most effective way to reach out to customers is to be part of relevant platforms and ecosystems. Often, they are inspired by what’s taking place in Asia, for instance at Rakuten and Ping An. It is one of the reasons why ‘East meets West. West meets East’ is a main theme at DIA this year.

‘Ecosystems beyond insurance’ is about being present and active in the platforms where people go to, to solve the real challenges they have in life. Not only platforms around home, mobility, work and health. But also around important life events such as study, marriage, divorce and retirement; moments that include making important financial and risk decisions.

A perfect example of an ecosystem platform is Mobly, launched by Baloise in Belgium. When people wake up in the morning their first thought is usually not a car insurance. The real customer need is mobility. And to fulfil this need many customers purchase a second-hand car. So, Mobly started to help customers precisely with that. They provide all the information to make a good decision, much more than is usually available. And they even offer a real expert that comes along with you, to check out the car that you like. Mobly already introduced other mobility services as well, including insurance. But at the end of the day, the car insurance is a derived demand.

Solving the real needs behind the insurance need, usually requires more than insurance. Ecosystem thinking is about ‘services beyond covers’, even ‘beyond the boundaries of the insurance industry’. Now, if you had like to become a relevant partner in an ecosystem, you need to work together with the other companies and organisations that are playing a role there. In particular all sorts of new innovative tech companies in that space.

Take the IoT and health space. We see numerous young tech companies that purely focus on improving health care and offering more relief for patients. Their primary focus is not on insurance.

Somnox, for instance, created a ‘sleeping robot’, to help people sleep better. Their mission is to make sleeping pills obsolete. In The Netherlands, 10 percent of the 17 million population consumes around 170 million sleeping pills every year. Although insurance is not the primary focus of Somnox, it is evident that this startup is very interesting to health insurers who want to improve patient care and decrease costs simultaneously.

So, when sector boundaries blur, we need to broaden our view. Every company that improves our value proposition is interesting to partner with. This also adds a new perspective to discussions about the definition of ‘insurtech’. In view of the importance of ecosystems, it becomes totally irrelevant if a tech company is a ‘genuine insurtech’ or not. More and more insurers recognize this. Embracing these other tech companies, from adjacent industries and relevant ecosystems, is The Third Wave of Insurtech.

Whereas the value of The First Wave, the Challengers, is the change in customer expectations and the sense of urgency they created; and the value of The Second Wave, the Enablers, is the impact on the top line and bottom line of incumbents; the Third Wave of Insurtech is about increasing relevancy, opening up new business models and new revenue streams.

Since we are convinced that ecosystems beyond insurance’ is the overarching trend for the years to come, the line-up of DIA conferences always includes inspiring speakers from adjacent industries. Think of BMW, Hyperloop Technologies, ING Bank, Rakuten and Bayer. The Future of Insurance is determined by The Future of Mobility, The Future of Health, The Future of Living etcetera. And among the 50+ handpicked insurtechs you will notice a lot of innovative tech companies that make the link with other verticals.

THE FOURTH WAVE OF INSURTECH: PURPOSE REBOOT

We believe that there is already a Fourth Wave on its way. Of course, new technologies are critical to reposition the industry as more customer centric. But they also offer carriers the opportunity to increase their social and economic impact and reboot themselves as a Force for Good. New technologies not only lowered the entry barriers for new players. They also take away the hurdles that existed for insurance firms to play that bigger part. We see more and more insurtechs with the mission to tackle important global challenges: Applying new technologies, with significant social and economic impact as a result.

Think of how health insurers apply all sorts of connected devices and advanced algorithms to improve patient care, while decreasing total health care costs, which is so relevant in, for instance, regions with an ageing population. Or think of new technologies that are helping to offset the damage caused by natural catastrophes such as hurricanes and floods.

Take Understory, from Minnesota USA. They are a smart weather hardware and analytics company that creates unprecedented details of how weather affects people and businesses. Insurers can use their white-label solution, so that their customers know what to do, to prevent potential property damage. No less than 500 billion dollar of the US economy fluctuates with weather. So you can imagine that the value of their sensors and data applications is enormous.

Or think of micro-insurance solutions, such as offered by BIMA. This gives access to protection to hundreds of millions of low-income families that were previously considered uninsurable. BIMA already has around 25 million customers in 14 countries, of which more than 90% is living on less than 10 dollar a day. They show that it is possible to reach the bottom of the pyramid at scale.

The added value of The Fourth Wave is again totally different. The possibilities to increase the social and economic impact of the insurance industry with new technologies seem almost endless.

What differentiates The Four Waves of Insurtech is the scope of application of each wave. And with each wave the impact increases significantly. Offering new horizons to the future of insurance. We’re all still working on realizing the promise of the Second Wave, but at the same time we’re on the verge of the Third and even the Fourth Wave.

This means we got exciting and promising times ahead. If we know how to seize the opportunities. And that’s exactly what DIA is all about.

The article was originally pubslihed on Digital Insurance Agenda