Telematics could be one of the most relevant digital innovation in the insurance industry impacting directly on the technical results. Worldwide diffusion of telematics based motor insurance policies is currently at early stage, but the best practices achieved levels of penetration higher than 20% of all motor portfolio. The diffusion of telematics based motor insurance policies is growing fast, with well recognized benefits for the motor insurance value chain.

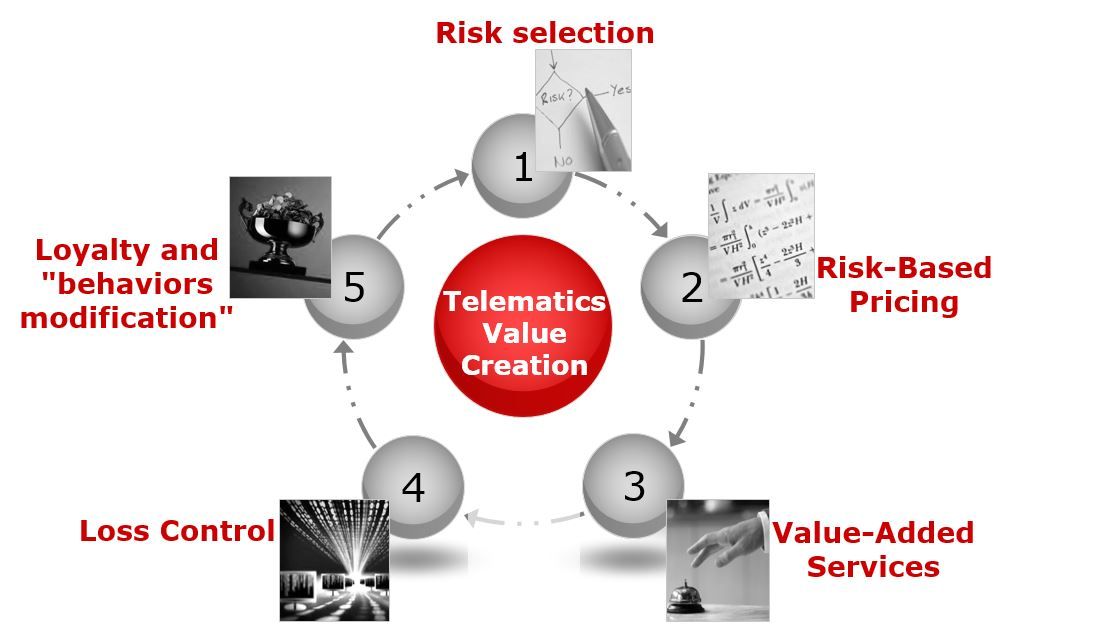

Looking the cross country best practice it is possible identify 5 value creation levers:

- Risk selection

- Pricing risk based

- Value added services

- Loss control

- Loyalty and behaviors modification programs

1. Risk selection

As far as the risk selection layer is concerned, telematics can be indirectly or directly used to select risks at an underwriting stage.

As a matter of fact, products subjected to steady monitoring through telematics indirectly discourage the purchase from risky clients,hence limiting adverse selection and fraudulent intents.

Moreover, data collection, limited to undertaking phase, can directly improve the overall quality of the underwriting process allowing price adjustments or covenants and option related to the monitoring outcome. Progressive's Snapshot approach leverage that approach and concerns:

- a device that measures client driving style and then is given in return;

- a predictive approach based on data collection period;

- a discount based on information gathered during monitoring time.

2. Pricing risk based

Through Telematics, a steadfast monitoring during coverage period of"quantity" and "level" of risk exposition has become possible. In this sense, the risk can be calculated on the basis of gathered information monitor continuously the vehicle covered by insurance, with a direct impact on pricing applied to the single customers. This may regard consumption policies, as well as premium adjustment within the year or discount in the following year.

There are solutions, such as PAYD (pay as you drive) policies¸ that monitor mileage (with different weights for different time and itineraries) and compute a premium adjustment, according to the mileage itself. The reduction can be applied to premiums due in the following year or directly to those to be paid in the same year.

PHYD (pay how you drive) policies, instead, integrate information gathered on mileage with an analysis of the client driving style, defined through both mileage and driving behaviors (the number and the intensity of accelerations and stops, driving timetables, speed and other variables).

3. Value added services

Value added services consist in the proposition to clients of policy related services based on telematics data. In practice, some ancillary services are proposed to the insured clients in order to exploit relevant data detected and sent via telematics; furthermore these services must be directly supplied by the insurance company or by means of specialized partners.

Some examples related to automobile business are:

- Car antitheft systems through installed back box;

- Emergency services with automatic claim detection and/or buttons for direct-dial the assistance center through;

- The possibility to link the telematics device to a payment system (and confirmation via smartphone app) to authorize all transactions car-related such as parks, highways and city centers tolls and refueling at fuel stations.

4. Loss control

Telematics - based on box installed within the car - also allows to use of data detected by sensors to limit the loss ratio of the motor portfolio.

In this sense, it enables the development of claims management processes that permit the Company to act more proactively. Information gathered via telematics allow to make the whole process faster and more efficient, byanticipating:

- The actual verification of the claim (anticipation the First Notice of Loss);

- The direct contact with the client for claim description;

- The attempt to use agreed body shops.

The use of structured information coming from telematics sensors allow to enlarge the objectivity and industrialization of claims management process optimizing claim evaluation, improving fraud detection and disposing of more information during eventual in-court processes.

5. Loyalty and behaviors modification programs

Behavioral programs are basically approaches that exploit information gathered on comportment to direct clients towards less risky solutions.

This purpose can be fairly achieved through the inclusion of telematics devices and risky behaviors measurements, which are fundamental for what concerns risk-based pricing procedures, in behavioral orientationsframeworks. To this scope a reward system that incentives client safe behaviors – monitored by telematics sensors – and can be further developed with the inclusion of a broader spectrum of behaviors besides those recognized by telematics.

Discovery’s Vitality Drive has applied this approach with a proposition proposition based on:

- "Black box" requested by the client to have access to the loyalty system, with monthly fee;

- Drive style monitoring and reporting through feedbacks to improve;

- Incentives to other "virtuous behaviors" (car maintenance, driving courses, …);

- Cash-back fuel expense, related to the score of the drive style and of other monitored behaviors.

The telematics business evolution - from a niche Underwriting solution focused on younger and low-mileage drivers to a mainstream solution broadly applied on motor portfolios – require the creation of an integrated approach based all the five levers previously described. This approach have the potential to be a real game changer in the motor insurance business.