This week, our journey takes us to Latin America ... We present below a round-up of our stats for the region (taken from our global insurance survey) as well as qualitative discussion with insights from two regional contributors:

- Hilario Itriago, CEO at VC fund Bullfrog Ventures

- Luiz Bruzadin, Founder at Brazil-based Insurtech Segure.me

We begin by examining the leading external and internal challenges in LatAm and comparing them with the global trend we identified in our earlier post on Industry Challenges. The tables below show the LatAm-specific ranking for each challenge on our "challenges shortlist", as well as how this compares to the global ranking (considering allsurvey respondents).

"Latin America and the Caribbean together comprise over 600 million people spread across more than 30 countries. From an insurance perspective, this is a hugely varied market that encompasses extremes of wealth and poverty, with abundant opportunities not just in ‘traditional’ insurance but also in the mass-market and micro-insurance categories as well."

Mariana Dumont, Head of New Projects at Insurance Nexus

The External Challenges: LatAm

The external challenges cited by our Latin-American respondents were the least representative of the global trend for external challenges we outlined in our earlier Industry Challenges post.

The global top three were ‘Technological advancement’ (leading on points by some margin), ‘Changing customer expectations’ and ‘Digital channel capabilities’. The top three for LatAm has a rather different complexion: ‘Changing economic conditions’ (4 places higher than globally, at the very top of the table), ‘Technological advancement’(having dropped a place) and ‘Increased regulation’ (3 places higher than globally).

‘Changing customer expectations’ (2nd place globally) plunges to 7th position, and ‘Digital channel capabilities’ (3rd place globally) slips one place to 4th. In the middle of the table, we notice that ‘Increased competition’ has also risen a couple of places.

How might we explain this difference in outlook that we find in LatAm? ...

We should of course bear in mind that we are dealing with a smaller number of respondents for LatAm, so shouldn’t read too much into minor variations from the global trend (details on the overall make-up of our survey respondents are included in the full Trend Map, which you can download whenever you like). Some of the ones we have just pulled out, however, appear quite substantial.

Technology, digital channels and customer expectations (the global top three) are all key challenges for the world’s insurers for the same reason – they are part of the response to today’s customer-driven disruption, something which, across this report, we have traced back to changes to distribution and the arrival of digital channels.

That this triumvirate of challenges appears less important in LatAm might in theory indicate that the trend towards customer-centricity is less pronounced here. However, based on our small sample of responses, we can say – tentatively – that Customer Centricity is the leading priority area for carriers in the region, so this explanation seems unlikely.

See also: Insurance Nexus Global Trend Map #3 Insurer Priorities

Therefore, rather than the trend towards customer-centricity being less important, it is perhaps the case that other factors – which may well be transient – have grown more important and are grabbing insurers’ immediate attention. ‘Changing economic conditions’, ‘Increased regulation’ and ‘Increased competition’ – an alternative "challenge triad" for LatAm – potentially fit the bill as adverse market factors, unglamorous and unrelenting, each of which we discuss in greater depth later in this profile.

Over the past few years, recessionary conditions have weighed heavily on key markets, particularly Brazil, Argentina and Venezuela. However, the regional economic downturn is expected to reverse in 2017, with the IMF forecasting GDP growth of 1.6%. A turnaround in commodity prices on both fuel and non-fuel products will help drive that recovery.

2017 Latin American insurance outlook, EY

The Internal Challenges: LatAm

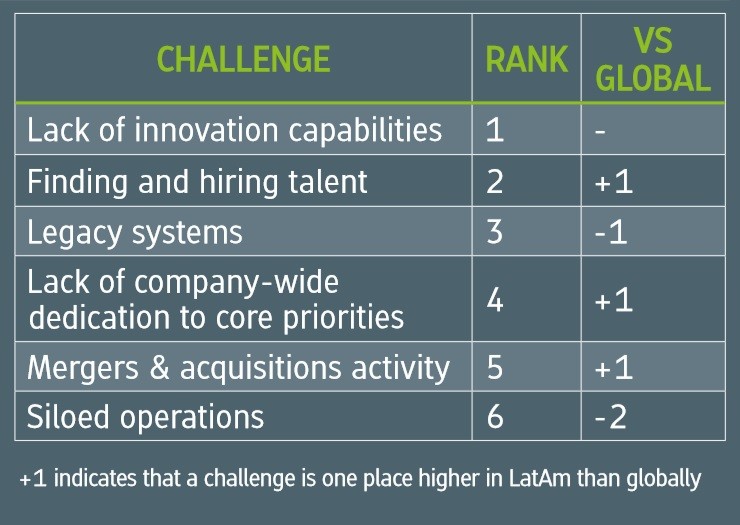

The top internal challenge among Latin-American respondents was, in line with the global trend we identified in our Industry Challenges post, ‘Lack of innovation capabilities’. ‘Finding and hiring talent’ appears one place above the global trend in second position, pushing ‘Legacy systems’ down one spot.

Of note is the bottom place attained by ‘Siloed operations’ in LatAm, below ‘Mergers & acquisitions activity’ even though this had a significantly lower score than ‘Siloed operations’ on the global internal-challenges table (see our post on Industry Challenges).

This may be more a case of other factors seizing insurers’ attention than of silos being unimportant, or a consequence of our smaller number of respondents from Latin America (details of all our respondents are included in the full Trend Map). We have no reason to suspect that silos are significantly less of an issue here than elsewhere around the globe. Indeed, we will see in the second half of this profile on LatAm that M&A activity is not just a factor in past company expansions and future company growth but also, notably, a cause of much back-end complexity (like silos!) among incumbents.

Historically, high growth potential has attracted global insurers, reinsurers and brokers to the region through M&A. With economic conditions likely to improve, international players may reinforce their positions, particularly in key markets such as Brazil.

2017 Latin American insurance outlook, EY

Insurer Priorities: LatAm

From the limited data our survey gathered on LatAm, one priority area that particularly stood out for this region (relative to others) was Fraud (out of the shortlist of 15 priority areas introduced in our Insurer Priorities post). Other stand-out areas were Product Development and Cybersecurity.

We touch on the foregoing challenges and priorities in our qualitative discussion with regional contributors Luiz Bruzadin and Hilario Itriago — which follows below. This discussion falls into three broad thematic areas, the first of which we cover today (saving the remaining two for our follow-up post, which completes our LatAm Profile):

- Latin-American insurers’ efforts around digital transformation

- New models of innovation involving Insurtechs

- LatAm’s positive growth factors and the outlook for the market over the coming years

1. Market Characterisation: Digital Transformation in LatAm

Asked to comment on the main challenges facing Latin-American insurers, Segure.me's Luiz Bruzadin cited his top three as a lack of economic growth, the decline in interest rates and a lack of insurer productivity. These conform to the picture of dominant market factors we sketched out earlier (they are essentially the ‘Changing economic conditions’ that came out as the region’s top external challenge).

Since sluggish growth and low interest rates are global phenomena, this raises the question as to why both our survey respondents and our industry contributors from LatAm assign them such pre-eminence. Part of this may be to do with the third challenge listed by Bruzadin, namely the lack of insurer productivity – this makes extraneous market factors, which are putting pressure on (re)insurer margins worldwide, doubly painful.

With slack yields from financial markets and, often, minimal foreseeable policy growth in the short term, insurers all around the globe are having to learn to do more with less, and poor productivity simply leaves them with even less to do it with. One obvious way to make up for this shortfall, not just for Latin-American insurers, is to drive lower costs and greater efficiency.

From a cost-savings perspective, one area of low-hanging fruit would appear to be fraud, which needlessly siphons off millions of insurance dollars every year. As we noted earlier, Fraud was indeed an important priority area for Latin-American respondents – Bruzadin acknowledges it as a big issue for the region and one of the 'costs of doing business', and he believes that the transformation initiatives already underway within insurers will go some way at least towards alleviating the situation. Our other regional contributor, Bullfrog Ventures' Hilario Itriago, agreed on the primacy of technology for meeting the fraud challenge head on:

‘Speaking about LatAm in general terms might be unfair, as fraud changes by country,’ he clarifies. ‘Companies need to be aware of it, but equally I think technology will play a great role in helping insurance companies to protect themselves against it.’

From an efficiency perspective, Itriago points to automation as a key area of interest for Latin-American insurers:

‘Anything and everything to do with automation that simplifies the existing processes is driving new ways of doing things,’ he observes. ‘And the main example there would be AI – AI is driving the claims process to levels that we never imagined, particularly in the personal-lines space.’

While automation is mainly associated with driving efficiencies within personal lines, Itriago believes that the same tools can massively streamline work in the commercial space as well:

‘Clearly it will take more time, because we’re talking about properties, about engineering, about large risks, so you need a lot more know-how,’ he explains. ‘That said, even those underwriters need tools and mechanisms to make those processes work a lot faster than they’ve typically been, and the same is true for claims.’

We should bear in mind though that simply finding ways to make the old cogs of the business turn more smoothly is rarely enough to achieve higher overall productivity in the long term. Another imperative for Latin-American insurers is to maintain – and grow – the relevance of their insurance products and services to modern consumers, or else the shifting sands of the market may simply run away between their fingers.

‘The main challenge clearly has to do with adapting to newer customer needs,’comments Itriago. ‘It’s a lot more online, it’s a lot more mobile, it’s a lot more about trying to get greater clarity and simplicity out of the products that people want to purchase. So customer-driven innovation and different ways of consuming the insurance products is the first big driver happening at the moment, and Latin America is no exception to that.’

Bruzadin is also quick to highlight changing consumer consumption patterns, placing particular emphasis on the on-going shift to mobile:

‘Customers want to buy using their mobile, so today there is a need to build different channels from scratch to connect with the new client,’ he explains. ‘Generation X are not buying anymore – the new generation of consumers want simpler products quicker, faster solutions, and direct contact with insurance companies. Companies that are not investing in customer-centricity, user experiences or improving customer value will lose the game in my opinion.’

Access the full Regional Profile for Latin America here ...

What we see here then is that the paradigm of customer-driven disruption that we have returned to time and time again throughout this content series is indeed alive and well in LatAm, immediately underneath insurers’ perhaps more day-to-day concerns with market factors.

"The common denominator that’s sweeping the industry right now is this whole wave of Insurtech. It applies to anybody and anywhere in the world."

Hilario Itriago, CEO at Bullfrog Ventures

A key stat we have invoked across this series is the ‘disruption score’, or the proportion of carrier respondents acknowledging loss of market share, which we introduced in our post on Insurtech Perspectives. We have limited data for LatAm on this measure but we can say with reasonable confidence that the figure is more in line with the higher score of Asia-Pacific than the lower scores of Europe and North America. The heightened competition this implies is in any case borne out in the higher rank of ‘Increased competition’among LatAm’s external challenges, to which we drew attention above.

"Currently, I don’t think we have the capabilities to transform the way of doing business using digital technologies in Brazil… There is a lot of talk on investments in digital transformation but little action. I cannot see the players on the market really investing in digital transformation."

Luiz Bruzadin, Founder & General Director at Segure.me

Both Bruzadin and Itriago believe that it is only through increased focus on, and investment in, new technology that insurers will be able to make the life-affirming leap in productivity and relevance. In this sense, LatAm is very much a part of the broader trend we see at work in insurance globally:

‘The common denominator that’s sweeping the industry right now is this whole wave of Insurtech,’ notes Itriago. ‘It applies to anybody and anywhere in the world.’

In Part 1, we reviewed our general stats (gathered as part of our Global Trend Map survey), including the leading internal and external challenges for insurance players in this geographically and socially diverse region encompassing over 600 million people and 30+ countries.

We now move on to Themes 2 and 3. Get the full Profile on LatAm, as well as those on Europe, North America, Asia-Pacific, the Middle East, Africa and Central Asia by downloading the full Insurance Nexus Global Trend Map whenever you like (it's free!).

2. Transforming Insurance in LatAm: from Systems to Ecosystems

As in other geographies, once the need for technology-driven business change becomes apparent, the question of implementation becomes paramount. And, as elsewhere, there is more than one approach. Often, what prevents innovations from coming to fruition are legacy back-office systems, and Segure.me's Luiz Bruzadin believes that insurers’ business transformation efforts should start here:

‘We may be more than 1 or 2 years behind the leaders,’ he acknowledges. ‘The legacy systems that we have here are well outdated – we built those systems 20-25 years ago.’

"A strong core platform for the big players is a strong core platform for running the company. But if they do want to run their business better, insurers need to invest in the smaller, specific and focused capabilities that would allow them to really differentiate their processes where it matters the most to the consumer. It’s the discretionary spending on improving specific processes that is making the big difference for the consumer."

Hilario Itriago, CEO at Bullfrog Ventures

However, overhauling legacy systems is much more easily said than done, and there are several local considerations which may be making this more onerous. Bruzadin points out three.

— Firstly, the fact that many Latin-American insurers have grown over the past decades via mergers & acquisition has led to a proliferation of different systems, each requiring integration.

— A second issue is financial, with insurers’ current low margins limiting investment. Bruzadin comments that those insurers with deeper pockets are much better placed than others to meet the current challenges.

— A third factor impeding insurers’ digitisation efforts is the lack of comprehensive solutions on the market, a state of affairs that Bruzadin traces back to the regulatory environment in the region (consistent with the prominence of the regulatory challenge, which we highlighted in Part 1).

‘The regulators are pro-consumers, not pro-market; they tend to create rules that hinder the ability to improve productivity for the carriers,’ says Bruzadin. ‘So it’s difficult for companies to build a total digital solution. Global providers need to adapt for the local regulations that are pretty much different from country to country, so you don’t end up with a solution that fits all players.’

This lack of available solutions, Bruzadin believes, is leading carriers to postpone their decisions on digital transformation. He concludes somewhat pessimistically in relation to his native Brazil:

‘Currently, I don’t think we have the capabilities to transform the way of doing business using digital technologies in Brazil… There is a lot of talk on investments in digital transformation but little action. I cannot see the players on the market really investing in digital transformation.’

The impasse many carriers have reached regarding full-scale system upgrades may signal that a different style of thinking altogether is called for in the face of today’s challenges. Hilario Itriago, CEO and Co-Founder at Bullfrog Ventures, believes that insurers now need to move beyond the monolithic approach to systems that worked in the past:

‘A strong core platform for the big players is a strong core platform for running the company,’ he explains. ‘But if they do want to run their business better, they need to invest in the smaller, specific and focused capabilities that would allow them to really differentiate their processes where it matters the most to the consumer. It’s the discretionary spending on improving specific processes that is making the big difference for the consumer.’

Asked to specify which capabilities insurers should focus on building out, Itriago gave some examples of things he sees making a difference already:

‘It’s fast underwriting, so that people get their policies right there and then, on any device that they want, and even faster claims processing – so that the consumer can see the value of having been insured at the moment they actually need it the most.’

The model that Itriago sees emerging is an ecosystem of tools – a DevOps or API culture – that will allow insurers to be innovative and adaptable to fluctuating consumer trends, with neither the big down-payments nor the functional lock-in of traditional infrastructure investments:

‘I believe that we will end up decoupling a lot of functionality and running functions on the platforms that actually do the best job for that, while keeping a smaller centralised core that is easier to maintain and less costly to run,’ he reflects.

At least a part of this process, Itriago believes, will be completed via the incubator/accelerator route. Many insurers and their holding companies may not be best placed to innovate internally, although Itriago points to Colombian Grupo SURA, which has developed its own P2P insurance solution internally (Wesura).

"Your Open API approach has to become the main principle/ strategy of all your business and technical ambitions. You have to evolve your systems to an open platform and ecosystem – like the ones Amazon and other digital retailers have made very successful - selling everything to everybody, not only your own products."

Oliver Lauer, former Head of Architecture / Head of IT Innovation at Zurich

One of the key issues faced by incumbents attempting to innovate is the change-management requirement. It is not enough to create innovative new technologies; there also needs to be a new mindset. As Itriago points out:

‘At the end of the day, the platforms are only there to empower a set of individuals, who are the ones that actually run the business... We don’t want people running the efficient new processes in the same way they used to run the old ones.’

For this reason, we are likely to see a variety of different collaborative frameworks emerging between insurers and Insurtechs, everything from investment and ‘coopetition’ to outright acquisition. Indeed, Itriago ultimately envisages a hybrid model:

‘I do think that many big incumbents are going to end up acquiring some of these smaller players and integrating them within their product offering before these guys grow too big and actually take their lunch away,’ he concludes.

"An important consideration is competing priorities and incentive. If it’s critical to get systems online and integrated then this must be made clear in terms of tone at the top, prioritisation, financial incentives, dedication of resources and rigorous project management. Businesses will often put 'IT projects' on the back burner to work on their bread and butter product and services roles."

Damon Levine, CFA, CRCMP, ERM Practitioner, Writer & Industry Speaker

3. LatAm: Powder Keg of Growth?

While the Insurer-vs-Insurtech debate will potentially have a less radical conclusion than some industry pundits suggest, with collaboration in the running to be the win-out model, this is not the only area that can be transformative for insurers’ business. Indeed, in some ways, framing the debate in these terms – Insurers vs Insurtechs – is missing the point for insurers, who may sometimes do better by not trying to own all the components of their stack directly.

A key channel for LatAm insurers – and an area for growth in the eyes of our contributors – is the affinity channel. Trust makes the wheels go round on the modern data-driven insurance business, and trust-building can be a laborious process, especially if you don’t offer customers a tangible, everyday sort of product. Piggybacking insurance distribution on the back of major trusted brands has been, and will continue to be, an effective way for insurers in LatAm to fast-track growth and access new swathes of potential customers.

‘I think the insurance companies are playing their cards everywhere they see the opportunity to generate revenue,’ comments Itriago in relation to affinity channels: ‘in this regard, we are more aligned with the UK and the European market, ahead of the US.’

Thanks to the development of these ‘quasi-direct’ channels, Itriago believes that much of the mindset and infrastructure is already in place in LatAm should the industry eventually move more towards a direct-to-customer model.

Considering all the ingredients, Itriago characterises the Latin-American market as having an auspicious mix of large, well-established regional companies and international-level technology and investment, and believes for this reason that LatAm is as well-positioned to take advantage of the Insurtech wave as anyone. He goes further still and presents a compelling case for investment in the region, citing the scale that can be achieved through access even to just a handful of the larger national markets:

‘If I want an opportunity to reach a strong market, with growth opportunities and innovation as its DNA, then from a regulatory point of view it would be way easier to do that in Latin America, with only 6-8 markets, than to go to the US and try to take on 50 separate states.’

As Itriago sees it, the lure of LatAm is not just in its large established markets but also in the longer-term potential to reach into areas that hitherto have been relatively closed and under-penetrated.

‘Everyone gets really excited about Brazil and Mexico by virtue of the size of their populations,’ he elaborates. ‘And they’re absolutely right – they’re in their own league. But then, if you go to smaller countries with smaller populations and look at the insurance penetration, you’re still looking at a tremendous opportunity in places like Colombia, Peru, Argentina and Chile.’

However, he advises against the perception that a single player could roll up the entire region, stressing the local differences that exist from country to country. ‘The way you’d disrupt Mexico is not necessarily the same way you’d disrupt Peru,’ he cautions.

"Brazil, with a population just over 200 million people and making up roughly half the Latin-American insurance market, has the potential to become a major Fintech hub. According to ABFintechs, the Brazilian Fintech association, Brazil currently hosts over 200 Fintechs; some examples of this – on the insurance side – are online purchasing platforms Bidu, Minuto Seguros and Youse."

Mariana Dumont, Head of New Projects at Insurance Nexus

Both Bruzadin and Itriago foresee strong insurance growth in LatAm over the coming years, Bruzadin citing among other positive factors the move towards more open-market policies at a government level in several countries.

Itriago believes that as we head towards 2020 things will be a lot more interesting for Latin-American insurance than over the past decade.

‘The acquisitions that have happened, certainly in the last 24 months, give you an idea that big investors think the same way,’ he adds. ‘Hopefully that’s the case and brings good opportunities for everyone.’

That concludes our Regional Profile on Latin-America... If you'd like to read the full profile in one go (along with the latest stats on almost every insurance topic under the sun), then simply download the full Trend Map here. Otherwise, join us next week as we head to Africa; topics include making microinsurance work, tech-driven innovation in low-end markets and the long-term insurance outlook for Earth's fastest-growing continent!