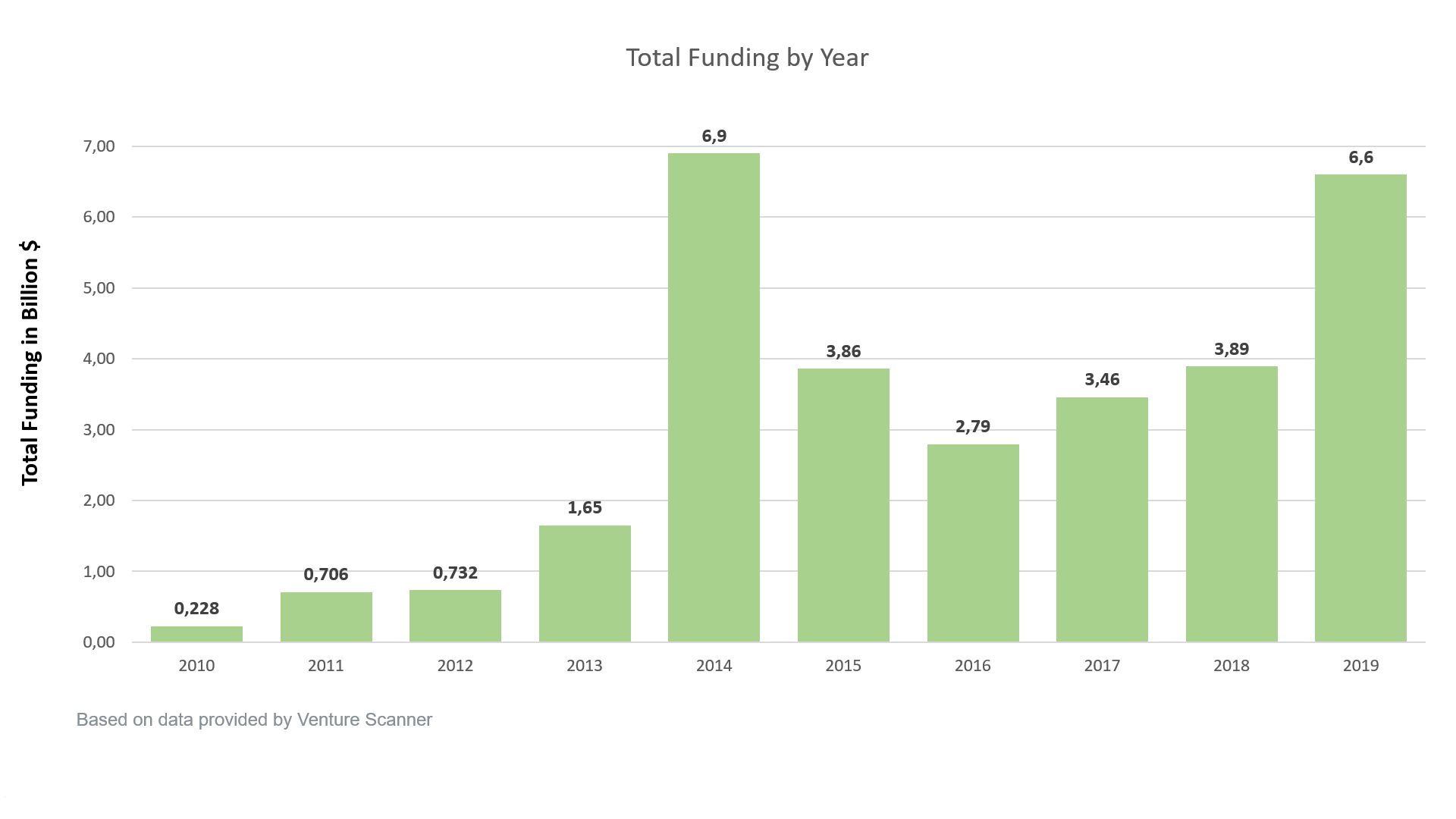

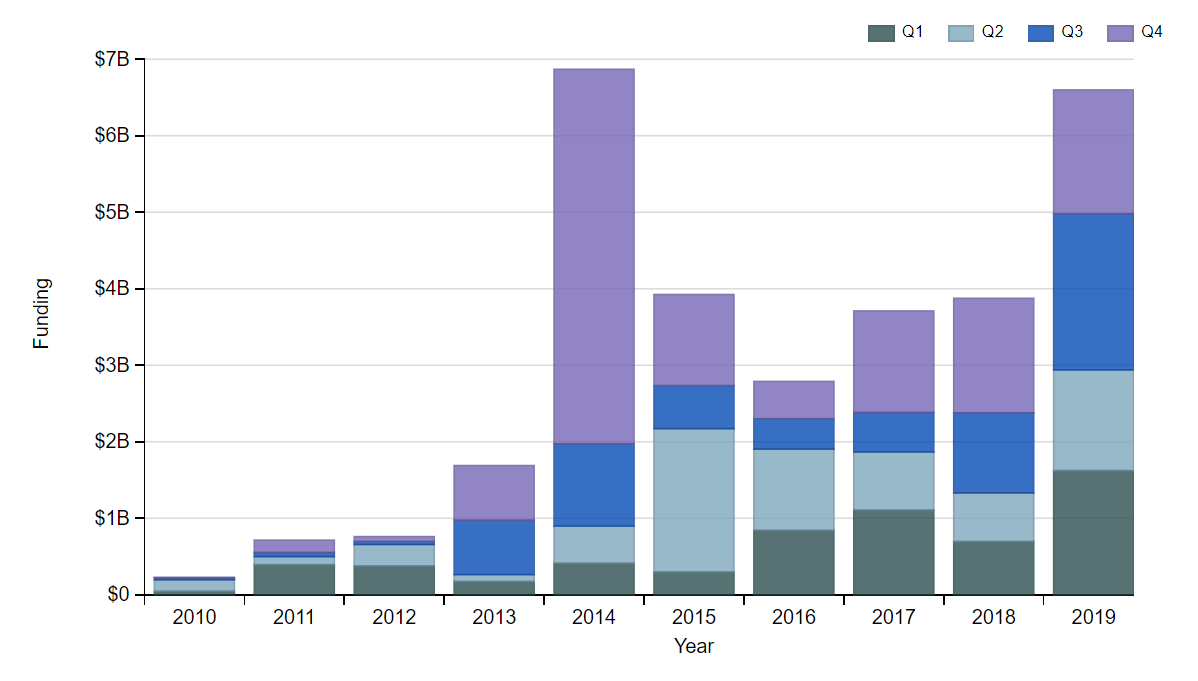

Summing it up, 2019 was a great year for insurtech investments with a total of $6.59B in funding, making it the second best year in the last decade. 2014 remains the best year to date with $6.85B raised according to Venture Scanner data. The following graph shows total funding by quarter over time in Insurance Technology. Funding in Q4 2019 was $1.61B – similar to Q4 2018 when total funding was $1.5B and 23% less compared to Q3 2019.

Total funding by quarter

Source: graph taken from Venture Scanner, data as of Jan 7, 2019

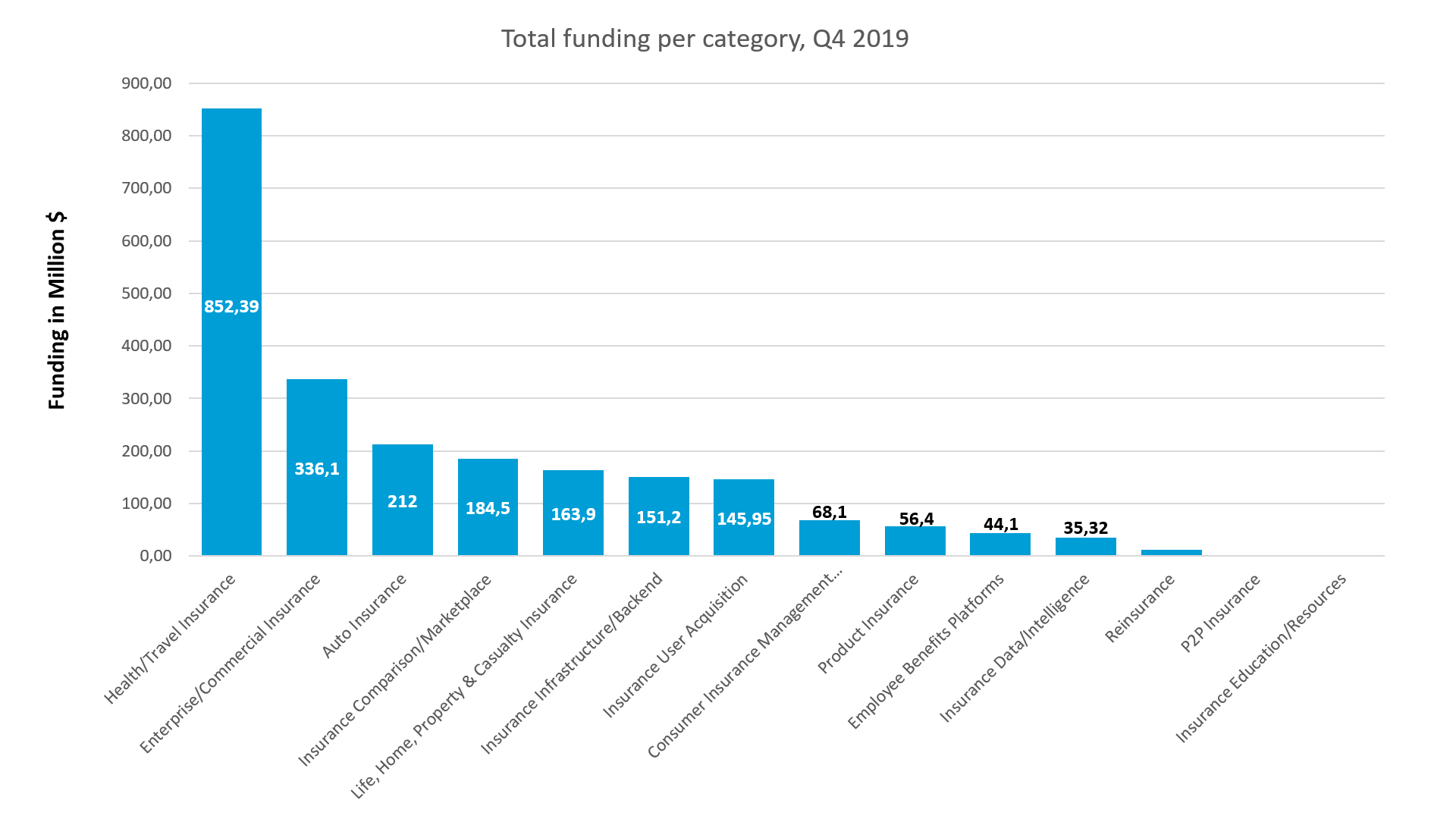

In Q4 2019 the biggest amount raised was in Insurance Health/Travel Insurance category with $852M. Next comes the Enterprise/Commercial Insurance category with $336M followed by Auto Insurance with $212M in funding.

Source: based on Venture Scanner data from Oct 4, 2019 to Jan 3, 2020

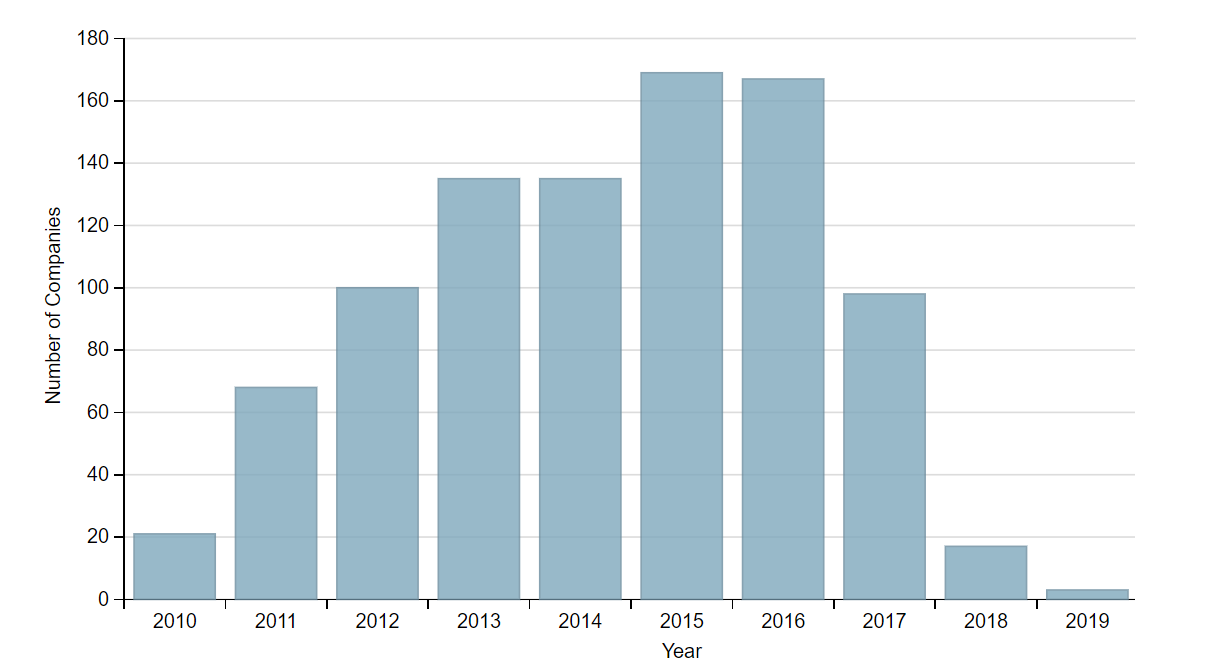

Looking at the number of insurtech start-ups founded in the last decade, one will notice a decline starting with the year 2016. Since then the number of new companies has steadily declined to only 3 new start-ups in 2019 according to Venture Scanner.

Number of companies founded over time

Source: graph taken from Venture Scanner, data as of Jan 7, 2019

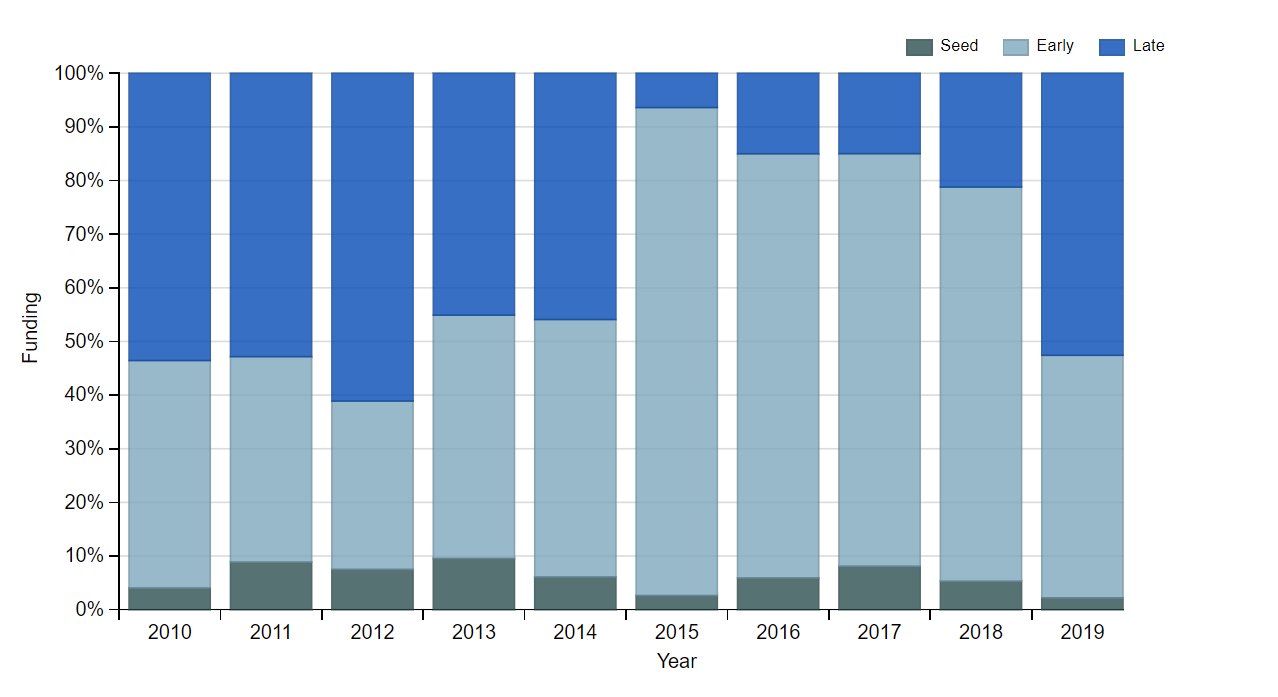

This decline in number of start-ups is correlated with the funding stage concentration over time: in 2019 47,4% of funding was seed and early stage while the majority was late stage funding (see image below).

Funding stage concentration over time

Source: graph taken from Venture Scanner, data as of Jan 7, 2019

Source: graph taken from Venture Scanner, data as of Jan 7, 2019

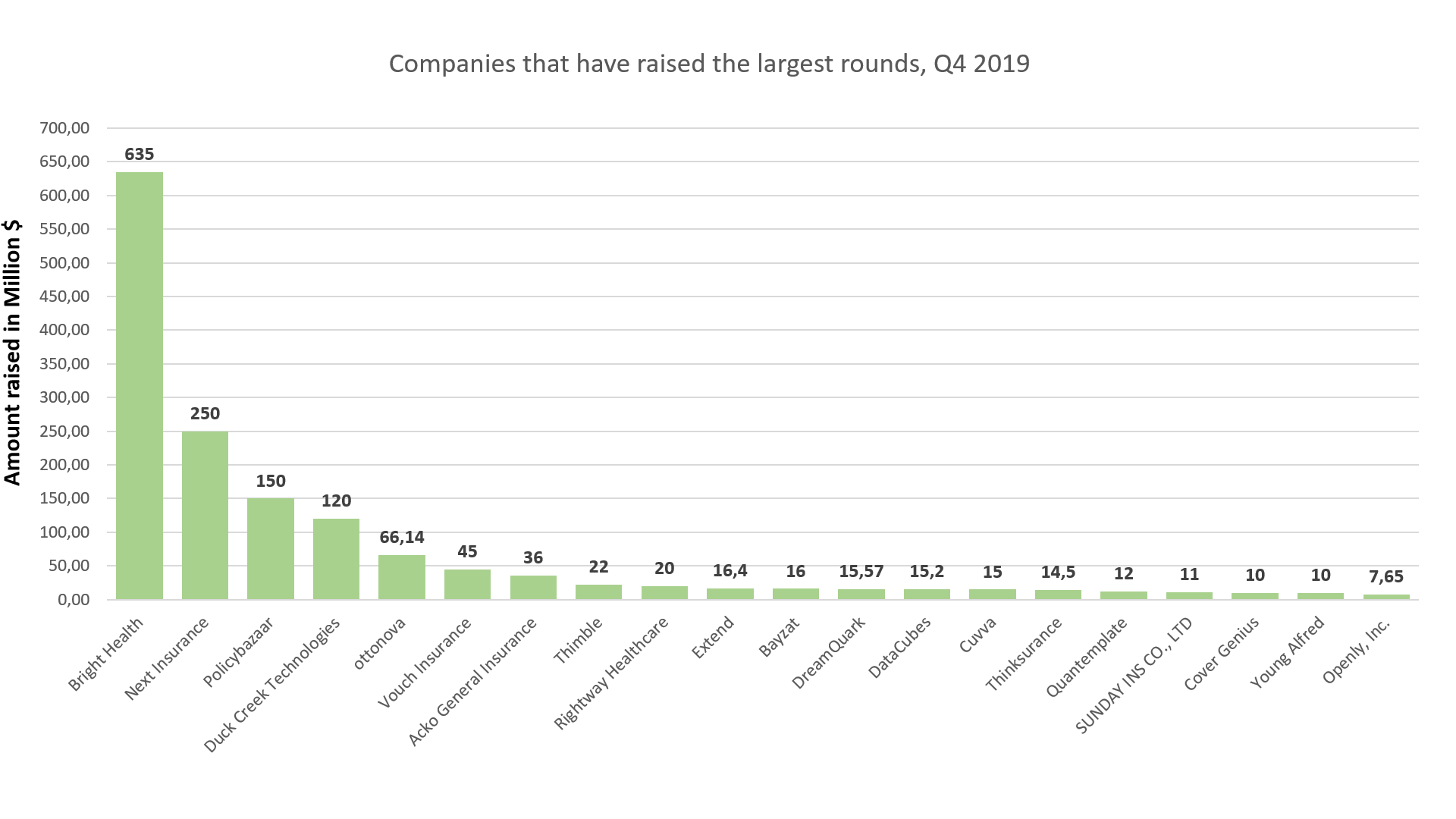

The table below highlights the companies that have raised the largest rounds in Q4 2019.

Source: based on Venture Scanner data from Oct 4, 2019 to Jan 3, 2020

With headquarters in Minneapolis, Minnesota, Bright Health offers health insurance that connects users to various physicians and healthcare services. Through individual, family and Medicare Advantage plans, members can access services like health rewards programmes or personalized care teams through a tech platform consisting of web tools and a mobile app.

In this latest Series D round led by New Enterprise Associates (NEA), the company raised $635M on Dec 17, 2019. With a total of $1.075B raised to date, Bright Health said that the new funds would be used for expanding its products, regions and users. The startup will do so through new hires and continued work on its tech platform.

Next Insurance closed a Series C round of $250M on Oct 7, 2019 with Munich Re Ventures as Lead Investor. The start-up sells insurance products to small businesses, The new financing round valued the three-year-old startup, which has raised $381 million to date, at more than $1 billion, the startup said. The money will be invested in building new products and expanding its customer initiatives. Next Insurance offers a wide range of insurance coverage to more than 1,000 unique types of business. It has amassed over 70,000 customers in the U.S., the only market where it currently operates. Next Insurance aims to become a one-stop insurance shop for micro and small business insurance needs. Its insurance plans and products are designed to cater to the business sectors that are often overlooked by general insurers.

Policybazaar is India's largest insurance aggregator website founded in 2008, with $496.6M raised to date. They are specialized in making comparative analysis of the insurance products of various insurance policies based on price, quality and key benefits. The company raised a series G round of $150 M this November with Tencent Holdings as lead investor.

Duck Creek Technologies is a provider of SaaS-delivered enterprise software to the property & casualty insurance industry based in Boston, Massachusetts. On Dec 9, 2019 the company raised $120M in private equity from 4 lead investors: Temasek Holdings, Neuberger Berman Group, Insight Partners and Dragoneer Investment Group. The Duck Creek suite of SaaS solutions provides insurance carriers with open and highly-configurable applications across core areas of their businesses, such as policy administration, billing, claims, analytics, industry content, distribution management, and reinsurance management – all key to their digital transformations. The investment will serve for continued investment into its business and to repurchase equity from certain existing investors.

Ottonova is a private, fully digital health insurance provider founded in June 2017 and based in Germany. The start-up raised $60M in a Series D on Nov 26, 2019, bringing the company’s total funding to $85M.

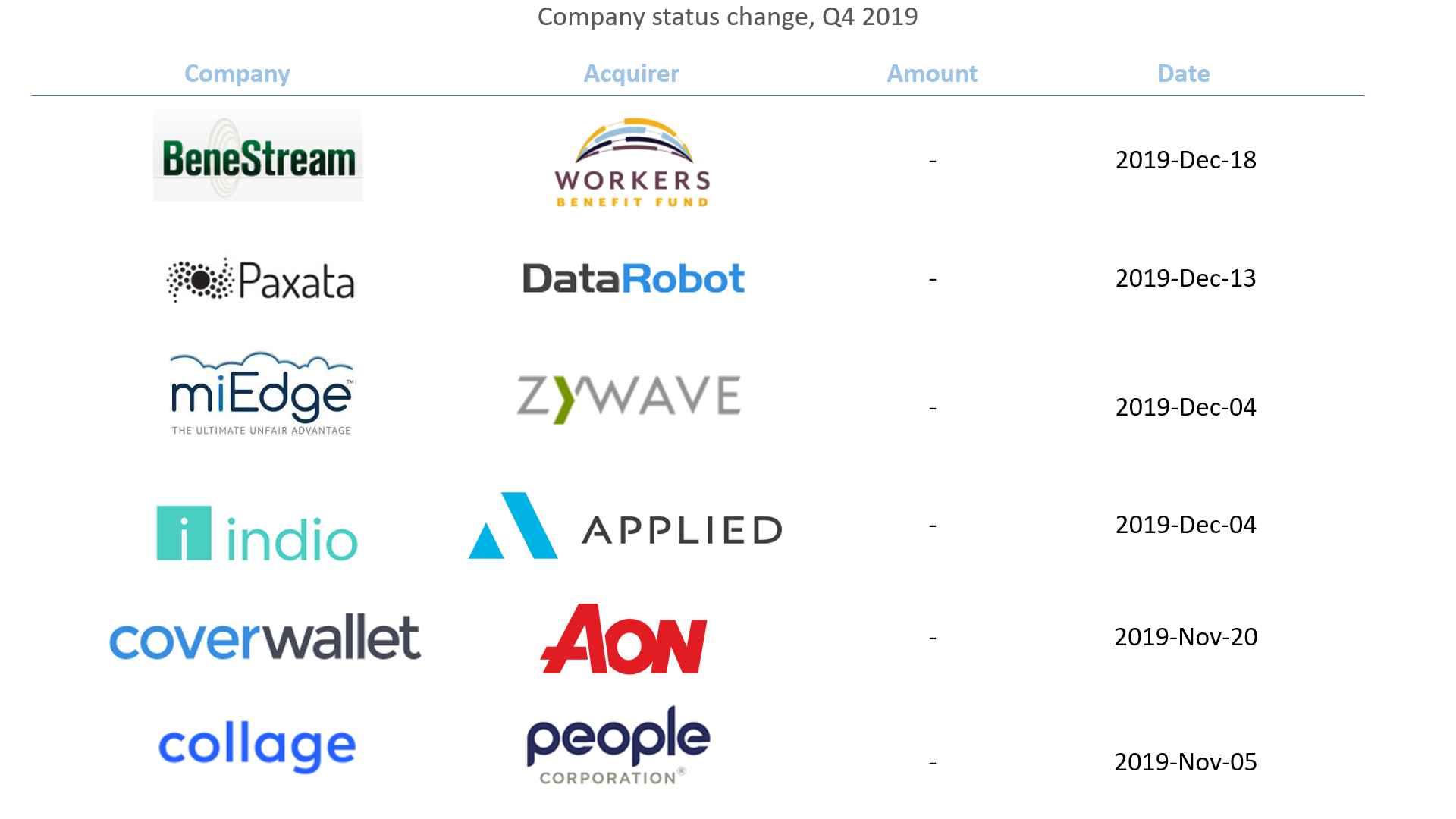

The table below shows companies that have exited or shut down in Insurance Technology in Q4 2019.

Source: based on Venture Scanner data from Oct 4, 2019 to Jan 3, 2020