The insurance sector is becoming more innovative. Various initiativesand projects launched around the globe are proof of that: from the classic “call for ideas” and corporate venture capital to innovation labs and accelerators that involve the largest insurance companies. According to CB Insights, InsurTech —which involves rethinking one or more steps of the insurance value chain through the use of technology — received $650 million in funding in the first quarter of 2016, and the number of transactions more than doubled compared with the same period in 2015.

#InsurTech investment in Q1 2016 more than doubled [ Click to Tweet]

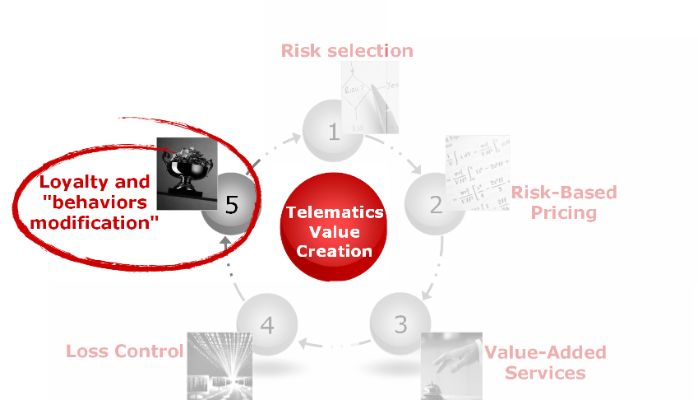

The Italian insurance sector represents an interesting case history about InsurTech. Italy has the most advanced experience in combining the car insurance contract with hardware (the black box) and using that data throughout the insurance value chain. According to the Bain Telematics, Connected Insurance & Innovation Observatory—a think tank that Bain & Company developed with ANIA, AIBA and other insurance and non-insurance partners to help spread innovation culture in the insurance sector—telematics penetration reached 16% of all cars insured in Italy by the last quarter of 2015.

In Italy this type of approach is already mainstream, in contrast with other countries, where it is still a niche value proposition. By looking at the Italian best practices, one can identify certain critical success factors. The most important element is telematics’ capacity to improve the insurance bottom line: A significantself-selection effect exists on customer acquisition and material savings related to claims settlement (provided that adequate processes are in place and use the telematics information). The second aspect is represented by the benefit of introducing value-added services around the driver journey. The key element for both the client and the distributor is the partial kick-back of the value generated by the telematics approach on the insurance bottom line to both the client (via a discount) and the distributor (via additional fees).

The current discussion of how telematics will evolve focuses on gamification and reward mechanisms: mechanisms to manage client engagement and retrocession prizes other than insurance premium discounts. For example,Allstate in the US has adopted a score- and prize-based system related to driving behavior. The international best practice is undoubtedly Vitalitydrive, the approach through which Discovery (South Africa) has managed to create a motor-telematics policy based on driving behavior. In this case, the cash-back incentive for gasoline bought from partner gas stops replaces the premium discount.

By comparing gamification use cases with Italian best practices, insurers can retain an incremental quota of generated value, through telematics solutions that provide rewards financed by partners instead of through premium discounts. This approach requires the creation of an ecosystem of partners to provide a tangible value for the customer.

Rewards can be effective ways to steer behavior if they are built on mechanisms that result in frequent interaction with the client. From this point of view, the integration of monitoring driving behavior and the reward-system mechanism has a greater influence on behavior than a tariff that calculates the renewal premium based on those same variables.

#InsurTech: Reward is the new black [ Click to Tweet]

The stakes are high for the insurance sector, and the auto insurance mandate has created the conditions for insurance companies to become relevant actors within the ecosystem. That said, the insurance sector faces a double challenge: first, to introduce this type of creative thought inside the product development process and second, to become equipped with competencies and instruments that enable the management of both gamification dynamics and the partner ecosystem. These challenges are forcing insurance carriers to start thinking and acting like InsurTech entities.