Insurers who can anticipate and plan for change can create their own future. Others will need to be agile enough to recognise and adopt similar strategies. But how can you cut through the buzzword beehive and focus on what can truly transform your business?

Insurance Nexus set out to investigate the global state of insurance: from the latest tech trends to regional opportunities. After 50 interviews with the industry’s leading commentators and a wide-ranging international survey with over 1000 respondents the Global Trend Map aims to capture information about the megatrends at work in today’s insurance industry: Low Interest Rates and Soft Market Conditions, the Complexification of Risk and the clarion call for Customer-Centricity.

The report, created by Alexander Cherry - Head of Research at Insurance Nexus, which can be downloaded here, also takes a look at cutting-edge technologies like AI, IoT and Blockchain, to name just a few, and, as no two regions are the same in these most fast-paced of times, an interactive world-map lets you quickly explore what’s going on in the world’s major regions: Europe, North America, Asia-Pacific, LatAm, the Middle East, Africa and Central Asia.

Despite its little-deserved reputation as the sleepy corner of financial services, insurance can be a disorientating industry to work in as Insurers and Insurtechs alike seek to keep on top of not just cyclical adjustments but also massive seismic shifts in the business.

What are the main challenges that the insurance industry faces today?

The report looks at external challenges and internal ones in order to bring a 360 degrees perspective of the insurance sector as seen by insurtech experts and sector specific respondents.

Source: The Insurance Nexus Global Trend Map

The overall results for external challenges indicate that 'Technological advancement' is by far the greatest overall external challenge, followed by 'Changing customer expectations' and 'Digital channel capabilities'. 'New emerging risks', 'Changing economic conditions', 'Increased regulation' and 'Increased competition' make up the middle tier. Further down we have 'New entrants to the market', 'Catastrophe risk', 'Absence of a clear strategy' and 'Climate change'. Then, comfortably in last position, we find 'Lack of company investment'.

So what then is the picture, if any, that we see emerging? The top-three challenges, notably, form a clear constellation: changing consumer behaviour patterns, especially the desire for digital channels, certainly underlie insurers’ preoccupation with technological advancement to a considerable degree. We would therefore say tentatively that the interface between customer and insurer is going to be one of the key battlegrounds going forwards, not just in the trivial sense of online portals and chatbots but rather as the ability of insurers and other industry participants to make every part of their operation work for the customer. The midtier challenges – essentially market factors – are certainly significant but represent the pointy end of ‘business as usual’ rather than the digital, customer-centric paradigm shift we see coming into focus at the top of the challenges table. This shift falls broadly under the remit of ‘digital transformation’, which we have seen at work in many recent initiatives at major insurers, both internal and external to their organisations.

“Technology has always been a key enabler within the insurance sector. In today’s highly customer-centric world, organisations that want to thrive will do so through digital excellence; meaning by combining unique customer experiences and omnichannel distribution mechanisms, as well as by reinventing interactions across the insurance value chain, despite legacy constraints”, says Sabine Vanderlinden, Managing Director at Startupbootcamp.

Source: The Insurance Nexus Global Trend Map

As for the internal challenges, it seems that'Lack of innovation capabilities' and 'Legacy systems' are neck and neck and leading the pack. 'Finding & hiring talent' and 'Siloed operations' make up the middle tier, with 'Lack of company-wide dedication to core priorities' and 'Mergers & acquisitions activity' a long way behind at the bottom of the table.

These results are consistent with the picture we saw emerging from our exploration of the external challenges; for a 'Lack of innovation capabilities' to be the leading internal challenge indicates first and foremost the industry’s strong will to innovate, which is part and parcel of many insurers’ and industry participants’ current digital transformation projects. Supporting this view is the low position attained by 'Lack of company-wide dedication to core priorities' – it’s clear that what is missing is neither the intention nor the investment to change (lack of investment was rated the industry’s lowest external challenge), rather it is the capabilities to make it happen.

“These challenge tables perfectly illustrate and explain the fundamental conundrum of the global insurance industry; the acceleration of technological advances coupled with expanding sense of consumer entitlement and their rapidly evolving tech-driven behaviour is causing older and slower-to-change insurers to struggle mightily in playing catch-up and has made them vulnerable to newcomers and disruptors”, Stephen Applebaum, Managing Partner at Insurance Solutions Group, comments.

In order to read more about how the top internal and external challenges vary on a regional basis (for North America, Europe, Asia-Pacific and LatAm) you can download the full report here.

What are the insurer priorities?

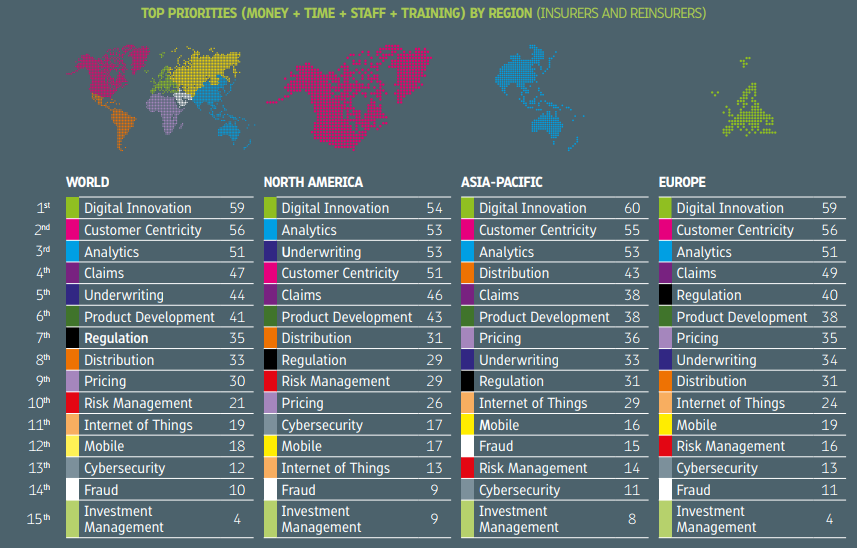

Having examined industry challenges and touched on the role of new market entrants, the report also looks at where insurers are setting their priorities for the next 12-18 months. The fifteen key priority areas are scored and ranked overleaf – both globally and for the three key regions.

Source: The Insurance Nexus Global Trend Map

Digital Innovation tops the list internationally as well as in our three key regions. This result complements what we saw with the challenges – if 'Technological advancement' and 'Changing customer expectations' were perceived as the key external challenges in the industry, then it makes sense for Digital Innovation to be respondents’ key priority, with Customer Centricity not far behind. Investment Management is the lowest-ranked priority across the board – most likely an indication of enduring low interest rates.

Investment prognosis

Source: The Insurance Nexus Global Trend Map

Insurance Nexus asked Insurer & Reinsurer respondents to indicate qualitatively, on a sliding scale, how much they expected investment to change in each of the priority/service areas we have been considering. Respondents saw investment increasing in almost all areas, which may indicate a slight bias towards bullishness. That said, the order of the different service areas should be a fair indication of which ones are most likely to attract whatever additional budget is available over the coming 12-18 months. In addition to being the key services sought over the next 12-18 months, Digital Innovation and Analytics are also seeing the largest increases in investment over this period. Investment in Internet of Things (which came in overall 3rd place among services sought) shows minimal increase. So, it would appear that Digital Innovation and Analytics are attracting large and increasing investment from Insurers & Reinsurers, whereas Internet of Things is attracting large and steady investment. As we saw in the earlier chart, Product Development was a relatively unimportant category when considering global demand for third-party services, with only 19% of carriers seeking services in this area – nonetheless, it here displays one of the highest increases in investment (4th place), suggesting that it may become a more significant category in the future.

The second main section of the Global Trend Map is theme-led, and examines eleven key technologies and activity areas, some vertical and some horizontal. Stand-out technologies are Analytics (under which we include AI and Machine Learning) and Internet of Things.

Analytics

Insurance, relying as it does on predictions about complex future events, has always been a data-hungry, data-driven industry. The big-data explosion of the past decade is therefore something that insurers have followed with keen eyes: according to IBM, the world generates 2.5 quintillion bytes of data every day, with 90% of the world’s data having been created in the last two years.

While insurers, and most companies for that matter, have for a fair while had more data than they’ve known what to do with, analytical and machine-learning models are now sufficiently mature and sophisticated for them to start reaping the much-heralded rewards of the big-data revolution. This is not without its challenges though, with silos and legacy systems in particular acting as a drag on innovation.

When posed the question whether their analytics strategy coordinated across their organisations, the results were encouraging, with 57% of all respondents indicating that their analytics strategy is coordinated across their organisation. The trend across our different company types is similar to the one we saw in the investment/focus question above – unsurprisingly, as coordination is vital to gain maximum value from increasing investment and focus, and often represents a large investment in and of itself. We thus see 59% of Insurers coordinating, 54% of Brokers & Agents and 55% of Technology Partners, with Reinsurers once more taking the lead (77%).

“There will be much more data from structured and unstructured data sources in the future – a huge challenge! 'Past developments are a good representation of future uncertainty' will not be replaced but solutions with AI-tech (big data) in combination with smart data strategies will enable insurances to make decisions based on models and evidence.”, says Andreas Staub, Managing Partner at FehrAdvice.

Analytics is a very broad category with applications across almost every part of insurance, from underwriting and marketing through to fraud and claims, as well as on the investment side of the business. After focusing on two areas of insurance work, Underwriting and Claims, the Global Trend Map captured a snapshot of analytics maturity at the start and at the end of the policy ‘lifecycle’.

Source: The Insurance Nexus Global Trend Map

The donuts above indicate the share of analytics work (as a proportion of the whole) being undertaken by respondents working in the areas of Underwriting and Claims – this is an intuitive way to compare the prominence of different flavours both within, and between, these two areas. A larger proportion of the analytics work undertaken by Underwriting respondents appears to fall at the early stage of the adoption curve (descriptive and predictive) and a smaller proportion at the later stage (moving towards machine learning and AI), when compared to respondents working in Claims. This implies that Claims either encourages more advanced analytics than Underwriting – which seems unlikely – or that, for whatever reason, it leads Underwriting on analytics maturity.

Internet of Things

The possibilities of the Internet of Things for insurance are boundless, from turbocharging underwriting models and using sensor data for preventative messaging to usage-based products and dynamic pricing. While other technological advances often represent the optimisation of an established insurer capability (as with many applications of analytics, for instance), IoT is fundamentally enabling insurers to rewrite the rules of the game by moving from risk protection to risk prevention.

Source: The Insurance Nexus Global Trend Map

IoT is such an open-ended technology that we further asked the respondents to specify those areas of insurance they thought would benefit the most. The areas that come out on top are Analytics (81%), Customer-Centricity (68%), Pricing (64%), Digital (61%), Claims (60%) and Underwriting (59%). The clear lead for Analytics is understandable given the symbiosis in which these two technologies stand. No IoT means limited data for analytical models; no analytics substantially weakens the business case for IoT. Overleaf, we explore some of these key IoT beneficiaries in a bit more depth and observe how they mesh together as part of today’s emerging Usage-Based Insurance (UBI) model.

Source: The Insurance Nexus Global Trend Map

“Connected insurance is a big opportunity in commercial insurance but it won’t come overnight. It’s the less mature use case today because it’s more difficult to figure out the commercial or industrial process, how to put sensors on that process and how to get at the data. But the opportunity to change the product’s structure, the paradigm you are using to insure that kind of risk is really large, it’s impressive.”, said Matteo Carbone, Founder & Director at Connected Insurance Observatory.

As we see above, there is a substantial gap between our leaders, Auto (80%), Home (71%) and Health (64%), and our stragglers, P&C/General (44%), Commercial (33%) and Life (29%). However, the current primacy of the personal lines should in no way blind us to the potential of IoT for commercial lines, which, despite not attracting quite the same media attention to date, remains huge.

The final part of the report is dedicated to synthesizing the three ‘megatrends’ that emerge from the research conducted by Insurance Nexus.

Source: https://www.linkedin.com/pulse/introducing-insurance-nexus-global-trend-map-alexander-cherry

The first megatrend is a cyclical shift; the latter two could justifiably be termed paradigmatic:

- Worldwide low interest rates coupled with soft market conditions

- The complexification of risk in today’s increasingly globalised societies

- Distribution disruption and insurance’s customer-centric ‘turn’ After exploring our three megatrends, we round things off with a cursory look towards the future and what we can reasonably expect from the meeting between the legacy insurance industry and the growing Insurtech sector.

Get your copy of The Insurance Nexus Global Trend Map in order to see the full analysis of the three “megatrends” as indentified by Insurance Nexus.

In the app age, it is no longer clear what is more important to starting a successful insurance operation: knowledge of insurance or experience with doing business web-first. Obviously, having both would be the best-case scenario, which is why there is plenty of mileage in Insurer-Insurtech tie-ups, and this is a theme that has recurred time and time again in our conversations with industry representatives.

2017 will be a key year, with most ecosystem players (some more belatedly than others) having grasped the opportunities, the threats and the ground on which things will be decided (namely the customer relationship). We are entering the middlegame, so to speak, of the Insurer-Insurtech confrontation.

What is the structure of the Insurance Nexus Global Trend Map? #InsuranceMap

- Global Trends: Get to grips with the sea-changes turning the global insurance industry on its head!

- Key Themes: Whatever your technology area or department, from product development and claims to IoT and AI, get the latest updates here!

- Regional Profiles: Industry change is coming thick and fast, and no two places are the same… Get the low-down on the state of insurance around the world!