Welcome to the first post in our new Insurance/Insurtech content series! Here we examine the top internal and external challenges facing the insurance industry, as revealed by our Trend Map, for which we gathered over 1000 survey responses from insurance players around the world and consulted over 50 industry thought-leaders. You can find a breakdown of our survey respondents, details of our methodology and bios of our contributors by downloading the full Trend Map here.

It's a tough time for the insurance industry right now, with a complex raft of issues to deal with over the coming years, from regulatory and climatic change through to adverse market factors, legacy systems and the rise of Insurtech. Indeed, one of the problems we had surveying the industry was the sheer variety of potential challenges that respondents might name.

For this reason, we drew up a shortlist based on our periodic research within the insurance community. And, as not all challenges are directly comparable, we split them out into ‘external’ and ‘internal’ challenges, creating two separate hierarchies:

- External Challenges: issues in the wider world that necessitate a response from the industry if the industry is to survive and thrive

- Internal Challenges: whatever stands in the way of that response’s successful implementation

For example, 'Increased regulation' might require changes from insurers and other industry participants (external challenge); however, 'Lack of company-wide dedication to core priorities' might prevent these necessary changes from actually happening (internal challenge).

We then asked all our survey respondents – encompassing carriers, intermediaries, solution providers, associations and regulatory bodies – to rank these external and internal challenges in order of importance, giving us an idea of what the industry regards as the biggest hurdles ahead.

External Challenges

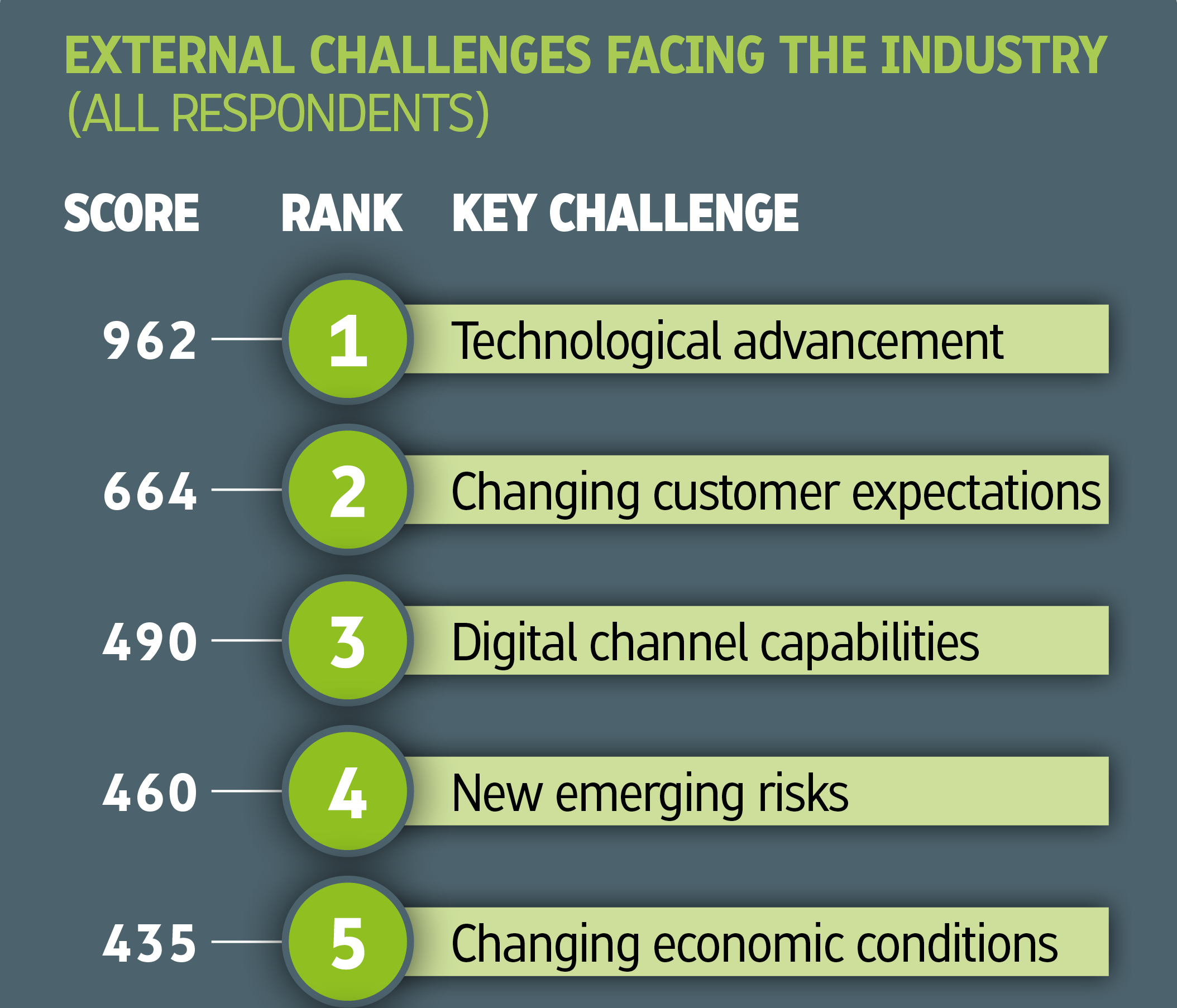

Our external challenges table points to 'Technological advancement' as by far the greatest external challenge, followed by 'Changing customer expectations' and 'Digital channel capabilities'.

'New emerging risks', 'Changing economic conditions', 'Increased regulation' and 'Increased competition' make up the middle tier. Further down we have 'New entrants to the market', 'Catastrophe risk', 'Absence of a clear strategy' and 'Climate change'. Then, comfortably in last position, we find 'Lack of company investment'.

"Technology has always been a key enabler within the insurance sector. In today’s highly customer-centric world, organisations that want to thrive will do so through digital excellence; meaning by combining unique customer experiences and omnichannel distribution mechanisms, as well as by reinventing interactions across the insurance value chain, despite legacy constraints."

Sabine VanderLinden, Managing Director at Startupbootcamp

So what then is the picture, if any, that we see emerging? The top three challenges, notably, form a clear constellation: changing consumer behaviour patterns, especially the desire for digital channels, certainly underlie insurers’ preoccupation with technological advancement to a considerable extent.

We would therefore say tentatively that the interface between customer and insurer is going to be one of the key battlegrounds going forwards, not just in the trivial sense of online portals and chatbots but rather as the ability of insurers and other industry participants to make every part of their operation work for the customer. The mid-tier challenges – essentially market factors – are certainly significant but represent the pointy end of ‘business as usual’ rather than the digital, customer-centric paradigm shift we see coming into focus at the top of the challenges table.

This shift falls broadly under the remit of ‘digital transformation’, which we have seen at work in many recent initiatives at major insurers, both internal and external to their organisations. Many insurers have for instance, like Allianz in November 2015, founded some form of digital transformation unit. Likewise, a number of major players have set up venture-capital arms in order to foster digital innovation outside of their four walls – like AXA Strategic Ventures.

While insurance was for a time considered the sleepy corner of financial services in terms of digitisation, tech and innovation, we now see a host of transformation and innovation projects underway, and the money is flowing. This is borne out by the fact that 'Lack of company investment' was, by some way, the lowest-ranked challenge in the industry. Insurers and other industry participants may or may not be successful in their digital transformation – but this will likely be decided by factors other than their willingness to invest in it.

Download your complimentary copy of the full Trend Map here.

Internal Challenges

The results for internal challenges show 'Lack of innovation capabilities' and 'Legacy systems' neck and neck and leading the pack. 'Finding & hiring talent' and 'Siloed operations' make up the middle tier, with 'Lack of company-wide dedication to core priorities' and 'Mergers & acquisitions activity' a long way behind at the bottom of the table.

These results are consistent with the picture we saw emerging with the external challenges; that 'Lack of innovation capabilities' should be the leading internal challenge indicates first and foremost the industry’s strong will to innovate, which is part and parcel of many insurers’ and other industry participants’ current digital transformation projects.

In keeping with this is the low position attained by 'Lack of company-wide dedication to core priorities' – it’s clear that what is missing is neither the intention nor the investment to change (lack of investment was rated the industry’s lowest external challenge), rather it is the capabilities to make it happen. And these capabilities fall short in three perennial areas that turn up once again in our internal challenges table: systems, staffing and silos.

"These challenge tables perfectly illustrate and explain the fundamental conundrum of the global insurance industry; the acceleration of technological advances coupled with expanding sense of consumer entitlement and their rapidly evolving tech-driven behaviour is causing older and slower-to-change insurers to struggle mightily in playing catch-up and has made them vulnerable to newcomers and disruptors."

Stephen Applebaum, Managing Partner at Insurance Solutions Group

Find out more about how these internal and external challenges vary by geography – for Europe, North America, Asia-Pacific and LatAm – in our Regional Profiles, by downloading the full Trend Map here.

Additional Challenges

Our survey respondents had the opportunity to provide any additional challenges they felt we had missed. Responses were colourful and varied but some that stood out were:

- Prevailing low interest rates

- Insurtech / disruptors

- Cyber-risk

- Loss of agents / disintermediation

- Change management

- Lack of strong leadership

Conspicuous on this list is Insurtech; while this was not explicit in our shortlist of challenges above, it nonetheless cuts across them (in particular, 'Technological advancement' and 'Lack of innovation capabilities', our two leading external and internal challenges respectively). There is indeed plenty of talk on the air about an impending shake-up of traditional insurance models...

Join us for our next post – Insurance Nexus Global Trend Map #2: Insurtech Perspectives – where we look at market sentiment regarding new entrants and consider, beyond all the talk, just where the industry is at right now. Or, if you'd like to find out straight away, you can download your free copy of the Trend Map whenever you like.

Download your complimentary copy of the full Trend Map here.

The original article was published on Oct. 27, 2017, at this link.

For any inquiries relating to the Insurance Nexus Global Trend Map, this on-going content series or next year's edition, please contact:

Alexander Cherry, Head of Research & Content at Insurance Nexus (alexander.cherry@insurancenexus.com)