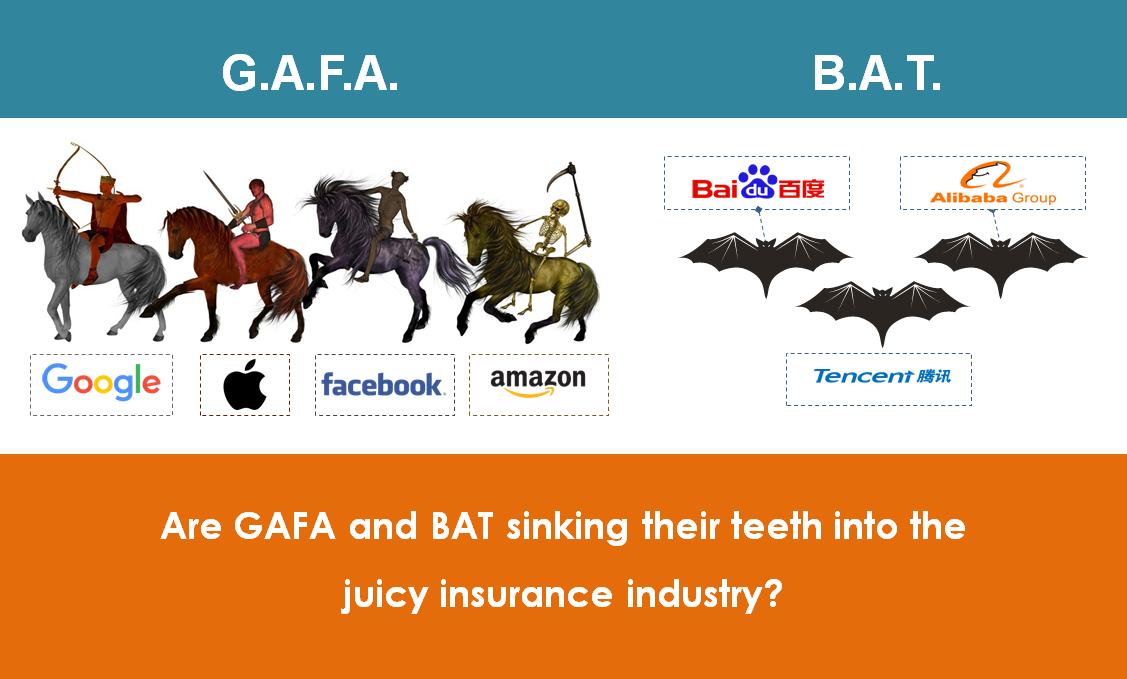

Given recent moves made by some of the world’s biggest tech players in the insurance industry, the moment has come to put them under a microscope. And how better way to do that than ask our 50insurtech influencers some key questions and get some key insights into how the close future might look like. We’ll give you a series of four questions presented in four separate posts and here we are with our first question for today:

Do you think GAFA (Google, Apple, Facebook, Amazon) and BAT (Baidu, Alibaba, Tencent) will act in the insurance sector?

Steve Tunstall: They already have. GAFA somewhat slowly compared to BAT. Alibaba has been the driving force behind the world’s most successful insurtech ZhongAn. Baidu and WeChat will inevitably follow.

Sam Evans: Yes, many are already active.

Matteo Carbone: Yes, many are doing things in the insurance field. Some of them are selling advertising to insurers, other are providing them devices or partnering on specific services – some days ago Allstate and Waze announced a partnership for roadside assistance – other are selling some insurance covers together with the product they are selling, something not so different from the light insurance coverage you don’t remember to have with your credit card. I think they will try to do something more serious on the sector in the future…but will be an experience not easy at all for them. Google dirtied their boots on the auto insurance distribution and went home soon. They also have enough money to close their current enormous lack of insurance knowledge buying an insurance carrier in each country, but I think their culture could kill this Insurer. There is a brilliant interview with the Guidewire’s CEO highlighting why this culture doesn’t fit with the insurance business fundamentals. So from my point of view, their impact will not be so scary as you represent them in that picture, their threat will not be relevant enough to keep Insurance executives up at night.

Jim Marous: The tech giants don’t want to become insurance companies, but they will not hesitate to offer better customer experiences in insurance. Leveraging their data and analytics, they will create clearinghouses for best-in-class Solutions.

Andrea Silvello: Yes for sure, in fact some of them are already doing so.

Tim Attia: Yes.

Nigel Walsh: Act or are Actors in the sector yes. I have long maintained I don’t believe they will enter the sector in the same way as a traditional carrier (e.g. with capital and regulatory requirements to meet). However we should be under no illusion that they will play an increasingly important role for both insurers and retailers alike whether it’s a direct or indirect partnership or joint venture.

We have a lot to learn from them in their respective areas eg – google and its use of data & insights, Amazon from a flawless execution, Facebook for their community and Apple for their brand value. And Baidu, Alibaba and Tencent for their sheer speed to execution at scale. 10 years ago we could have said these guys have the benefit of no legacy, but not today. Today they have a lot of history and baggage to carry and it’s important to see how they manage and manourve this so well in today’s environment.

From all of them we should learn how to run fast, hard, try things and move on. Most of these players are at a scale that carriers can aspire to have.

.

Robin Smith: Yes, and we’ve already seen it happen with the recent announcement by Amazon that they are recruiting Europe-based insurance professionals. As GAFA and BAT all attempt to enter the smart home device and autonomous vehicle markets, you’ll see the logical progression to insurance products in the long-term. This may not happen in the short-term, but as you can already see Amazon is dipping their toes in the insurance waters. The Google Compare experiment was a not a huge success, but it shows that it’s on their radar, and it seems to me that Google is no down and out with its foray into insurance.

Paolo Cuomo: Yes, but no hurry.

Spiros Margaris: In my opinion, it’s a given that the tech giants will increasingly take a big piece of the banking and insurance business by offering low hanging banking and insurance fruits to their customers.

Denise Garth: All of them will or already are acting in the insurance sector in different ways and will continue to expand their engagement. The digital capabilities they demonstrate are clearly making the difference for them to win customers through better experiences and newer products, while constantly optimizing their own operating models. Their use of big data, artificial intelligence, microservices architectures, cloud computing and growing ecosystems are changing the fundamental economics and the rise of what is called the platform economy. These companies are creating digital, online structures that enable a wide range of activities and have opened the doors to radical changes in how we work, socialize, create value in the economy, and compete for profits … even in insurance.

Time is of the essence. The GAFA, BAT and other companies (even some new insurance startups) are rapidly redefining customer engagement, far outpacing the insurance industry in their ability to provide experiences that match expectations. Redefining the business of insurance to meet a rapidly changing and growing set of new needs and expectations and to capture the market and revenue growth opportunities unfolding has never been more important for the insurance industry.

Mark Breading: Yes, but perhaps not in the ways that people think. In some respects, they have already begun to act in the insurance sector. Google tried their hand as a digital agent/comparison shopping site with Google Compare. Although that venture was shut down, it is very likely that they gained valuable experience in the industry. Facebook has partnered with insurers (such as AXA) to increase their digital/social presence. And Apple has worked with IBM to develop an insurance mobile app. These are just small steps, but there is definite involvement.

Stay tuned for the next three posts featuring answers from our 50insurtech influencers to pressing questions for the insurance industry. Remember to subscribe to our newsletter in order to stay updated.