IoT is a relevant trend for the insurance sector. A few years ago, it has been estimated that that in a normal day another 127 devices are connected to the Internet each second. Moreover, this trend is growing exponentially nowadays.

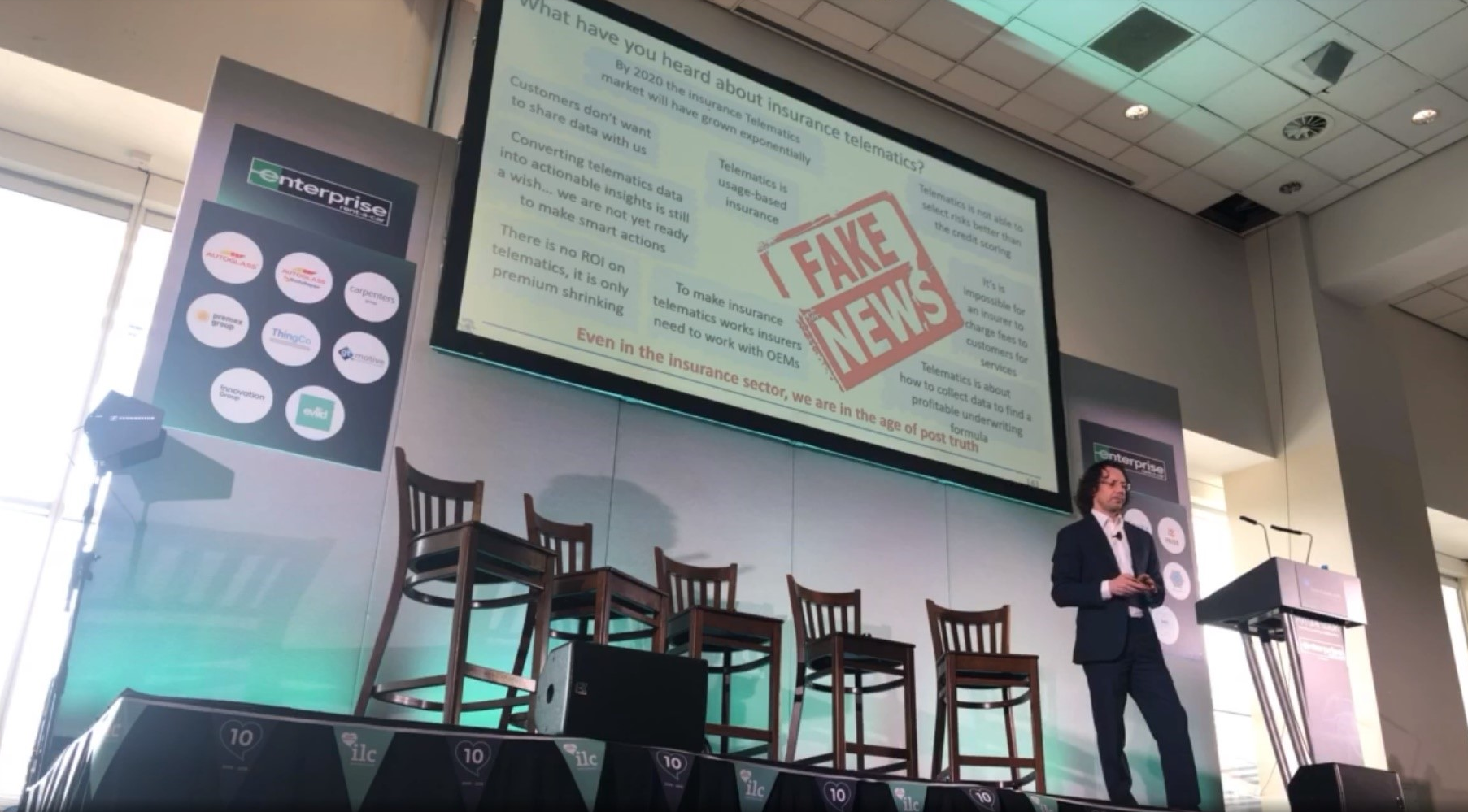

The world of IoT-based services integrated into the insurance offer is one of the areas in which many global insurance groups are currently working. Unfortunately, how to use this technology has been largely misunderstood as of today. The common sentences you can hear at conferences about insurance IoT can be defined as “fake news”…we can affirm we are in the age of post-truth even in the insurance sector.

I’ve been lucky to work with some of the few players that have been successful in the usage of IoT in their offer. These players are selling insurance IoT products through their traditional distribution channels and these products are bundles between insurance coverages and IoT based services. Many of these players have been able to get the service paid for by the policyholders, based on the research of the IoT Insurance Observatory, an insurance think tank which has aggregated almost 60 insurers, reinsurers and tech players between North America and Europe.

Those who, using this type of technology, have managed to develop a product with a portfolio of a significant size and considerable level of penetration, have had a very specific approach in using the services, which first of all allows them to give clients interesting storytelling that justifies additional fees. The successful cases have been able to sell a service to customers, allowing the insurer in broad terms to cover the technology costs. This is the case, for example, of car telematics in Italy and of the South African Discovery Drive, these represent the global best practices in terms of penetration of the telematics solution on the book of auto business: the customer finds himself buying a product that offers proactive telematics-based roadside assistance along with a wide range of services at an annual cost, the black box is lent to the policyholder.

VALUE SHARING WITH CLIENTS

All the insurance products, that have succeeded with an IoT approach, have a sharing mechanism with customers of this economic value.

From this point of view, in many cases, the data that a company uses to provide the services, has an impact on the technical insurance aspects. In auto insurance telematics, for example, data is needed to provide proactive assistance, to provide traffic information, as well as information to find the whereabouts of a car. But this data can also be used to manage claims better and avoid fraud, to influence the customer’s driving style, or to establish more accurate pricing. On top of that, if you focus the storytelling of your offer on some tailor-made services, there is automatically a self-selection of those who accept this product. All these elements – I call them five value creation levers (fees for services, loss control, change of behaviors, risk-based pricing, and risk self selection) - allow an auto insurer to generate a material amount of additional value on the insurance income statement. All the successful product have built their adoption sharing part of the value with the policyholders (discounts, rewards, cash back, …).

The same is going to happen with homeowner insurance.

DYNAMIC PRICE ON THE BASIS OF BEHAVIOUR

In the life sector the discourse is different. The IoT Insurance Observatory mapped more than 20 initiatives over the course of 2018, and there are more failures than successes. However, there is a best practice that has managed to integrate data from wearable devices, with contextual data on customer behavior that is collected in a variety of ways. This best practice is the South African Discovery. They have succeeded in creating life insurance products where the client's price increases year by year as a result of age, but the price could stay stable or even decrease if the customer physical activity is sufficient. Another use case is a US company that has managed to implement a quotation process where the customer, who requests a quote, finds the option to share the data he has collected on his physical activity in order to obtain a personalized offer.

COMMERCIAL LINES STILL AT AN EXPERIMENTAL LEVEL

Going back to the non-life lines of business, many of the successful IoT-based approaches on the personal lines can be applied to the commercial lines. However, applications in this area are still experimental. I expect these experimentations to end in complete IoT insurance products before in the US market than in European ones, but it will take a few years before significant portfolios are created. The areas in which the most interesting experiments are being presented are workers’ compensation and commercial property. In the world of SMEs it will be necessary to focus on the specialization of the offer on single sub-sectors: it is one thing to talk about schools, another about residential skyscrapers, and yet another about offices. Another area with a relevant potential is the insurance offer for the manufacturing sector. This is due to the Industry 4.0 megatrend. A technological trend that is not yet fully mature. However there are already some members of the IoT Insurance Observatory who are scouting 4.0 technologies. The possibilities of being able to leverage them in the insurance field are extremely significant, but we are still only at a theoretical stage. It is a new theme. In this context, the need for installation and tailoring of the technological and service components on the premises of a company will be one of the key aspects.

THE WORLD OF ECOSYSTEMS

One of the areas that the largest international insurance groups are monitoring most closely is ecosystems. As of today, the IoT usage in the insurance field has represented an option on an existing product which is sold through the existing channels of a company, and bundle services paid by customers. The technology is a closed option created by the insurer by choosing its own black box, the set of sensors, the app, or the specific wearable items. This way, the insurer is able to obtain the data necessary to optimize its own use cases. If we would like to be MECE, we can think about the five / six areas represented above: mobility, home, welfare-family, leisure, work, to which may be added an additional field of savings/ ALM management. To understand how an Insurer could interact with emerging ecosystems is one of the key issues that will be addressed in the coming years by the IoT Insurance Observatory. I think that rather than imagining which insurance product to offer, the first issue to address is how to sell customer products related to offers that come from the ecosystems.

Insurers cannot stop the IoT megatrend. They can only decide to leverage this data or to ignore it.