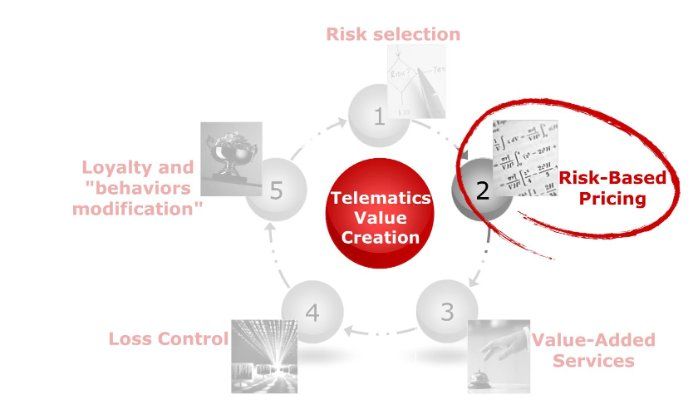

One of the most well known telematics benefits is the possibility of incorporating the information registered by the box into the parameters of the MTPL tariff (UBI)

The traditional underwriting of the RCA policy is based upon a “snapshot” of certain static variables which belong to the client and his or her vehicle – the impact and weight of this snapshot on the pricing is determined by the analysis of the claims historical series of the company – and the renewal comes after make the same type of “snapshot” after 12 months.

Telematics is becoming more and more used as a way of changing this approach and going more towards an individual pricing of risks, which used the “movie” of the client driving behavioral during the year: it’s enough to think that already today more than half of the products which have a blackbox and which are present on the Italian market have a Usage Based (UBI) tariff (the rest of these telematics products on the market do not have any variable component linked to telematics information, only an up-front flat discount). The ways in which this type of data can be used within the tariff mechanism are multiple and they fall into three main categories:

- The commercial approach, that is telematics seen as an option on the existing tariff or as a stand-alone product;

- The client’s value proposition can be a “real individual pricing” – based upon the calculation and charge of the fee corresponding to that particular client and which is applied during the year – or a fixed discount level for the first year and the “promise of a discount” which becomes a concrete proposal regarding a renewal based on the driving behavior registered in the previous 12 months;

- The type of variables incorporated within the tariff – which can either refer only to the km traveled (PAY AS YOU DRIVE) or can also take into consideration a wider range of data regarding the driving behavior (PAY HOW DRIVE).

PAY AS YOU DRIVE (PAYD)

This type of product requires having a pricing based upon km travelled and represents the most commonly utilized UBI tariff approach on the Italian market: around 80% of UBI products currently use a “kilometer” approach.

This approach is focused on a pretty wide niche of the portfolio and is based upon a discount created especially for those clients who don’t use their cars often: for example the California-based Metromile starts from the client’s profile – based on traditional static variables – in order to determine the monthly fixed cost and the fee per kilometer; then, each month, they measures with the box the “amount of risk exposal” (number of kilometers) and consequently charges the client for the kilometers travelled. When evaluating the "amount of risk exposal”, product innovation is moving towards assigning a different importance to the kilometers travelled based on the time of day and the type of road.

Based on the results of the benchmark which considers the PAYD solutions spread all over Italy, it can be concluded that 30% of the cases telematics is an option on traditional policy and 40% of the cases have some form of adjustment of the premium during the year, thus offering an individual pricing to the client immediately from the first year.

PAY HOW YOU DRIVE (PHYD)

This approach allows a much better exploitation of the true telematics potential in order to define the adequate price for each client and being based not only on the “amount of exposure to risk” but which manages to take into account the “real level of risk” in connection to actual driving behavior. Also this brings major benefits when it comes to influence the behaviors and to the acquisition and retention of less risky customers, not to mention the switch from a niche-based approach to one which can be applied to the whole client portfolio. Studies have been made by telematics players regarding multi-annual driving behavioral dataset show that the capacity of risk discrimination is highly elevated with respect to static variables: the 10% most risky clients identified on the base of behavioral telematics variables account for 40% of the total claims while the same analysis based on traditional variables usually intercepts only the 25-30% of claims.

A very interesting example is the policy launched these months by Direct Assurance (Axa Group) in France: the product is composed of a self-installing telematics box which is sent to the client’s home and a monthly payment of the premium: the client’s cost is adjusted from month to month based on his or her driving behavior (may vary between +10% and -50% with respect to the first months’ premium).

By observing the various International PHYD tariff experiences, the range of variables which are considered is wide: starting with travelled kilometers (having a different weight based on road type, time of day, day of the week, weather conditions) and moving on to the intensity and length of breaking patterns, cornering and acceleration; respecting of speed limits and time spent behind the wheel, ultimately the familiarity with the roads and also the use of the mobile phone while driving. It becomes clear at this point, how the growth of this type of solutions – which today still represent only a small part of the millions of telematics insurance policies which are in circulation worldwide – will appoint more and more the ability to extract insights from the big data as the key element of the competition between Insurance Companies. On this perspective can be explained the acquisition of Mydrive – English start-up focused on client profiling based on advanced motor telematics data analytics – announced last month by Generali Group.

This article originally appeared in the Insurance Daily n. 738 Edition