At the end of our previous post on the Internet of Things, we pointed to the all-importance of customer-centricity for the success of today's insurance products. This is because the 'disruption' to which incumbents are responding is customer-driven ... The extent to which insurers survive – and thrive – will depend on how well they can keep up with the ever-evolving needs of today’s consumers, needs that are increasingly being set outside of insurance, especially by retail and consumer electronics.

Marketing and Customer-Centricity

In this first part, we approach the topic of marketing and customer-centricity at insurance carriers by looking two principal measures: customer performance and customer priority. We finish with a look at customer loyalty, and how distribution affects the customer relationship.

- Customer performance: how well insurers believe they are meeting customer requirements; key measures are customer-centricity, 21st-century customer expectations and customer engagement

- Customer priority: the relative emphasis insurers are placing on the customer, in terms of money, time, staff and training resources

The following stats are based on the survey at the heart of our Global Trend Map; a breakdown of all respondents, and details of our methodology, are included in the full Trend Map, which you can download for free at any time.

"Listening to the 'voice of our customer' is traditionally not a strength of insurance companies. It’s almost as if customers are speaking a foreign language. Increasing competition and transparency together with changing expectations, especially of a younger generation, will force us to learn our customer´s language quickly."

Monika Schulze, Global Head of Marketing at Zurich Insurance

In our earlier post on insurer priorities (Insurance Trend Map #3: Insurer Priorities), we saw Customer-Centricity identified as a major priority by carriers worldwide. However, despite this high priority level, the general trend among carriers is of dissatisfaction with current customer performance, as we will now explore.

Measures of customer priority and measures of customer performance therefore stand in stark contrast to each another, and there is in fact nothing surprising in this; if carriers were already meeting their customer-centricity aims, then they certainly wouldn’t be focusing on it as such a problem ...

Some Measures of Customer Performance

Exhibit A: Only 45% of insurers and reinsurers believe their organisations are truly customer-centric …

While the above stat is an indictment of present levels of performance at carriers, it does indicate a strong will to change. It is better to admit that you have a problem than to falsely believe your customer relationship will take care of itself!

Different insurance lines produce similar scores on this measure, except for Life, which lags somewhat. The reason for this may well be the historic lack of touch-points in Life insurance, something we touch on again in our forthcoming feature on Claims (read ahead by downloading the full Trend Map straight away).

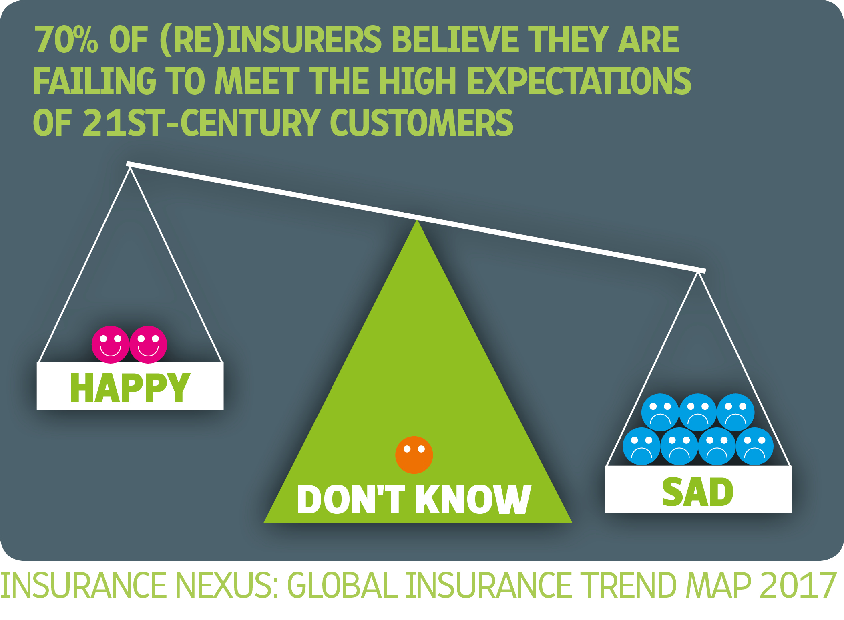

Exhibit B: As we see in the infographic below, only 20% of Insurers & Reinsurers believe they are meeting today’s high customer expectations.

We note that this proportion (20%) is lower than the 45% claiming to be customer-centric; this implies that, while a customer-centric approach is necessary for strong performance, it is by no means sufficient and that there are plenty of customer-centric carriers who are nonetheless falling short of expectations.

Exhibit C: 70% of insurers and reinsurers are unhappy with their level of customer engagement …

Insurance has, rightly or wrongly, always been an industry with infrequent customer touch-points. However, in today's always-on world, the possibilities for customer engagement are boundless. The widespread dissatisfaction with current levels of customer engagement, while obviously showing up shortcomings, bodes well for the future of the industry.

A Note on Customer Priority

We cannot discern any conclusive regional trends across our measures of customer performance... However, we can say tentatively that Europe and Asia-Pacific lead North America as far as customer priority is concerned (though all regions are naturally giving high priority to Customer-Centricity). This regional lead is based on interviews with local industry representatives, which we present later in our Regional Profiles (read ahead here), as well as on the below stats from our earlier posts:

- Europe led our regions in its focus on Customer-Centricity (Europe’s score was 56/60, compared to North America’s 51), as tabulated in Insurance Nexus Global Trend Map #3: Insurer Priorities

- The Chief Customer Officer role was very important in Asia-Pacific but relatively insignificant in North America, as we saw in Insurance Nexus Global Trend Map #4: Services, Investments and Job Roles

At the beginning of this post, we pointed out that customer performance and customer priority stand in an inverse relationship to each other, and we hypothesised that prioritisation of the customer is driven by poor performance. If European and APAC carriers are indeed trying harder – albeit only marginally – to raise their customer game than their North American counterparts, then we might conclude that, for whatever reason, the customer relationship in the former two regions is more ‘problematic’ than in the latter. And what underlies this is, we believe, the nature of insurance distribution.

Customer Disruption = Distribution Disruption

Insurers worldwide are chasing consumers via new channels and with new products, and the fundamental reason they are having to do this is that emerging (digital) channels have given incumbents and newcomers alike access to their traditional client base. This customer access is the fundamental enabler of 'disruption': what was once a relatively captive market is now in flux.

"The consumer is used to a really personal experience now, and that is exactly the same as when they’re buying a pair of shoes online. They’re used to being able to get something if they want it, where they want it and at the cost they want, including complete information like the exact half hour it’s going to turn up in their house and what colour it is."

Charlotte Halkett, former General Manager of Communications at Insure The Box

The less stable traditional distribution channels are, the more (unwanted) competition insurers must deal with and the harder they must fight to boost customer performance; at the end of the day, ‘poor performance’ is really only poor performance relative to one's competition.

Off the back of this, we predict that channel disruption will be marginally greater in Europe and Asia-Pacific – who are prioritising the customer most forcefully – with traditional models remaining relatively more intact in North America. We will find out for sure when we review our stats on Distribution in our next post – or if you'd like to read ahead straight away, simply download the full Trend Map at any time.

"The insurance business hasn’t changed significantly over the last 100 years – however, in the last 10 years, the digitisation of sales and servicing has led to a significant shift towards customer-centricity. There are new and dynamic ways to sell, new market entrants and advanced ways to service customers who provide instant feedback."

Ash Shah, Regional CIO and Chief of Staff Property & Casualty at AXA Asia

While we have tentatively grouped Europe and Asia-Pacific together with respect to their ‘problematic’ customer relationship, which in any case we explore further in our next post (on Distribution), we should point out one very obvious respect in which this relationship varies greatly between them.

Europe is, like North America, a developed, relatively saturated market, where the retention and optimum conversion of existing customers is vital not just for growth but for survival. In Asia-Pacific on the other hand, carriers are not just concerned about keeping existing customers but also accessing, for the first time, millions of consumers new to insurance.

Considering this, it is still better on balance to group Europe and North America together, and their shared focus on existing customers is borne out in our stats on loyalty. Loyalty is certainly of high importance around the globe, as we see from our chart below, but we can reveal that North America and Europe lead Asia-Pacific on this measure.

In Asia-Pacific, loyalty and retention are certainly not unimportant; but, with lots of market share up for grabs (in particular from tapping the enormously populous emerging-market segments), too much focus on loyalty may result, down the line, in insurers finishing with a smaller slice of the pie.

Distribution

While current market opportunities for insurers – and for Insurtechs – require a good product to sell, a large part of the story is about accessing customers via their preferred channels. So the topic of distribution is a natural follow-up to our last post on Marketing & Customer-Centricity.

The pre-digital era was characterised by more of a captive, sellers’ market, in which customers had little choice but to seek insurance via their agent of choice, who in turn would funnel work to a small number of large incumbents, generally ignoring new entrants.

Over the past years though, we have seen either the outright emergence or the rapid expansion of a number of non-traditional channels, encompassing direct-to-customer channels offered by insurers, new Insurtech propositions, aggregator sites and affinity partnerships with major brands and retailers.

So how exactly has this sea-change in distribution changed the game for incumbents? ...

Since the start of the internet, the insurance industry has invested in and expanded its digital channels from company websites to comparison sites, aggregators, social media and more – all in an effort to capture new business. At the same time, insurance remains a complex product that is hard to research, buy and use. This is an enormous problem for the insurance industry because every gap and point of complexity is a giant bull’s-eye for alternative channels, Insurtechs and new MGAs.

"Those who can make insurance easier for customers to understand and buy stand a good chance of capturing business from companies whose processes remain complex. In today’s new digital world, it is not about any single channel but rather about a multichannel approach that is based on consumer choice."

Denise Garth SVP of Strategic Marketing, Industry Relations and Innovation at Majesco

The emergence of new channels has raised the stakes for incumbent insurers, nimble newcomers and players outside of insurance alike, all of whom have an opportunity to capitalise or, otherwise, get left behind. In this installment, on Distribution, we examine:

1. The rise of the digital direct channel

2. The expanding role of affiliate partnerships

3. The importance of cross-channel consistency for insurers

4. Carriers' omnichannel strategies

5. The impact of aggregators

6. How distribution is driving disruption

1. Going Direct-To-Customer

72% of insurers sell to customers directly…

We can see that the direct channel has become a totally mainstream concern for insurers. Interestingly – and based on our segmented stats – North America appears to trail on this measure compared to our other regions, in conformity with our prediction from the our last installment, on Marketing and Customer-Centricity: namely that channel disruption is potentially less in North America.

The strong showing for direct channels in Asia-Pacific is interesting as, from our broader research with contacts in the region, we know the market there to be heavily intermediated, with a strong reliance on agencies and, in particular, bancassurance. For example, recent research from Swiss Re and LIMRA indicated that the direct channel does not exceed 10% of total share in any APAC national market apart from China.

For this reason, we should bear in mind that our stat indicates the existence of the direct channel rather than its volume. Nevertheless, for a healthy number of APAC insurers to have established a direct channel, despite what remain for now relatively low volumes of business, indicates how strategic this channel is perceived to be. We may remember as well, from our priority tables, that Asia-Pacific led our other regions on Distribution Diversification, which adds weight to this trend (see Insurance Nexus Global Trend Map #3: Insurer Priorities).

"The reach of this digital transformation goes way beyond the elimination of 'the middle man' from a distribution point of view. The direct digital channel dominates very few markets and deals only with compulsory insurance. In the vast majority of markets, a multichannel-oriented customer continues — with variations from country to country — to choose at least at some point of the customer journey to interact with an intermediary."

Matteo Carbone, Founder & Director at Connected Insurance Observatory

While many customers in many circumstances may prefer the direct channel to the agency path, insurers should not necessarily place all their strategic eggs in this one basket. Insurance has always been sold, as they say, and never bought, so any portal for buying insurance, however slick, is at a disadvantage by its very nature.

The way to get insurance products into customers’ hands may in fact be to integrate them into other products that are bought, whereby the insurance becomes part of a bundle or an add-on.

This philosophy has boosted the popularity of affiliate channels, which, in addition to taking even more friction out of the process, also bypass any issues that may exist with consumer trust, by tying the insurance to a trusted brand that consumers know, respect and perhaps already interact with daily or weekly.

Access the full Trend Map free of charge here ...

2. Expanding Affiliate Channels

89% of insurer respondents are increasing their distribution through affiliate partners …

Current examples of affiliate channels are major retailers, such as Tesco in the United Kingdom and Falabella in South America, but theoretically the affiliate channel could include just about anything, with the insurer effectively becoming an API that other consumer applications can plug into, like for instance ride-sharing and taxi apps for travel insurance.

The scale that incumbent insurers can offer in this channel may put them in good stead against their Insurtech competitors; large affiliates can benefit themselves from the brand equity of household-name insurers (in comparison to the unknown quantities of new players) and the resultant selling partnership will likely prove more successful for all involved.

"We're looking into partnerships with companies from different sectors: how we can plug in, bringing the insurance dimension and being the insurance carrier, while the partner does all the front-end customer-facing stuff. And as I like to call it, we're just a third-party API."

João Neiva, Head of Innovation, IT and Business Change at Zurich Topas Life

Another important indirect channel – but one on which we have not gathered stats – is bancassurance. While the concept is making headway in emerging markets, it has been out of fashion in Western markets over the past decade. The interest expressed this January by Italian bank Intesa Sanpaolo in a tie-up with Assicurazioni Generali shows the concept is not dead – but this deal was nonetheless scrapped the following month.

3. The Omnichannel Grail: Consistent Multi-Channel Experiences

As of today, many insurers operate both direct-to-customer and affiliate channels alongside their traditional agency channels. Whatever the blend of channels that customers ultimately come through, it is important for insurers to offer a consistent experience across all of them (a consistent experience need not necessarily entail an identical one).

It’s bad enough if one channel offers a comparatively poor or irregular service, this is then compounded by the fact that consumers are increasingly – as in retail and e-commerce – using multiple channels as part of their research and decision-making process, and an inconsistent (or in any way confusing) experience will lead valuable customers to bounce or churn.

In certain segments, a majority of customers may well come through a broker/agency channel for the foreseeable future, but it would be unwise to ignore the role of the direct channel in ‘prepping’ them and to neglect obvious re-engagement points during the process that can recall, reinforce and build on the online experience.

"We believe that this is an opportunity for brokers and intermediaries to innovate and continue to create new sources of value for their B2C and B2B segments. For instance, identifying and carving out new and emerging B2C (micro-insurance, flood, non-standard risks, risk pools / schemes, older generation / retirees) and B2B (IP based start-ups, cyber, supply chain, cross-border liability, terrorism) needs, and creating innovative channels to access them."

Sam Evans, Managing Director at Eos Venture Partners

While much of insurers’ backroom tech can be aligned across channels, the face-to-face element in indirect channels can prove more challenging to coordinate, especially as we are here dealing with a multitude of different selling organisations with a multitude of different working cultures.

This is not to say that the face-to-face element is a tale of lost opportunities and inefficiencies – if it’s put to work effectively, there’s seldom a better way to create lasting customer engagement and upselling opportunities.

So, is Your Customer Experience Consistent Across Channels? ...

Customer experience (CX) professionals in insurance are chasing the same ‘omnichannel’ grail as their analogues in other digitally disrupted industries, like retail/e-commerce, that is: to ensure that customers enjoy the same product and service experience regardless of which channel they come through. Let’s start by seeing how well Insurers currently perform in this regard:

Only 23% of insurers believe their customer experience is consistent across channels …

There is clearly still a long way to go before omnichannel is the norm in insurance, and the steady addition of new channels will further complicate matters for insurers chasing channel consistency.

"Insurers’ infrastructure, which has been built over literally hundreds of years, never anticipated having multiple channels of communication to support, so insurers are scrambling to learn how to do that."

Stephen Applebaum, Managing Partner at Insurance Solutions Group

From our regional segmentation, we can reveal that Asia-Pacific trails our other regions on this measure. This is likely a consequence of the pursuit of new channels in the region (as we noted with the prevalence of the direct-to-customer channel): it is more difficult to maintain consistency across a multitude of emerging channels than across a core of traditional ones.

4. Do You Have an Omnichannel Strategy?

The creation of an explicit omnichannel strategy is the first step of many towards being able to offer a consistent customer experience (CX) across channels.

62% of insurers have an omnichannel strategy…

It is encouraging to see that the majority of insurers do have formal omnichannel strategies, and this should go a long way towards raising the low percentage of insurers currently able to offer a consistent customer experience across channels.

It will likely be a number of years before today's omnichannel strategies yield concrete results and, as we pointed out, the continuing complication of the distribution landscape through the addition of new channels will mean insurers must run just to stay where they are.

"Most insurers are still focused on e-commerce but the leaders are developing longer-lasting relationships by using their digital capabilities to gain enhanced customer knowledge and harnessing that information to profile customers more effectively, fine-tune underwriting and deliver customised solutions."

Michael Quindazzi, Business Development Leader and Management Consultant at PwC

5. Attack of the Aggregators!

Our final question on distribution relates to the role of aggregators like UK-based comparethemarket.com, US-based comparenow.com and Singapore-based GoBear. These have burgeoned since the millennium, inserting an extra distributional step between insurers and their prospective clients, and have had a major impact on the market (just like comparison sites in other industries) both in terms of the overall business model and from a branding and customer-relationship perspective. By allowing, and encouraging, customers to pit insurers against each other on a price-by-price basis, these sites have further commoditised insurance lines and driven down premium prices and margins.

"The process of buying insurance can be simple – go online, compare the relevant information, select an insurer and pay. But three days later you get a 22-page printed policy at home, written by a lawyer. As a layman, you’re totally lost. What customers really want are simpler and easy-to-understand products so that they regain trust in this industry. Get that trust and it will drive revenues."

Andre Hesselink, CEO at GoBear

Due to a variety of factors, including marketing budgets and regulation, the effects of aggregators are neither uniform across lines nor across geographies. For example, according to a recent survey of consumers by consultancy Finaccord, over 40% of respondents in the UK had taken out car insurance via an aggregator, compared to only 5% in the US and Canada.

The impact of aggregators can be felt across the whole ecosystem, so we asked all our respondents to specify how big an impact they are having on their organisations. Overall 14% indicated a large impact, 29% a medium one, 37% a small one and 20% none at all. As we can see from the infographic above, a relatively small proportion of the ecosystem is heavily affected, although the impact is being widely felt (more than three quarters of respondents citing some impact).

From our regional segmentation, we can reveal that Asia-Pacific trails on this measure. As we have pointed out, while many insurers there do have digital channels, the overall volume of business being done this way is still quite low – and this potentially explains the lower regional score. However, as insurers in the region actively build and promote their direct capabilities, we expect aggregator impact there to quickly catch up.

6. Distribution: The Fulcrum of Market Disruption?

We suggested in our previous post on Marketing and Customer-Centricity that changes to distribution are what fundamentally lies behind today's changing customer expectations and behaviours (specifically the internet and the rise of digital for everything from research to commerce).

"The most important driver of success for Insurtech start-ups has been distribution. Distribution in insurance (more specifically in personal lines, but increasingly so in commercial lines) is getting disintermediated as data becomes increasingly transparent between the buyer and seller."

Sam Evans, Managing Director at Eos Venture Partners

Based upon this, we predicted that traditional channels might be marginally more intact in North America than elsewhere – as an explanation for this region's marginally lesser prioritisation of the customer (as we saw from our priority tables in Insurance Nexus Global Trend Map #3: Insurer Priorities). Our reasoning: if new channels are the fundamental enablers of disruption, the more stable the traditional channels are, then the less disruption insurers will face and therefore the less forcefully they will have to prioritise the customer.

So, what do our regional stats on distribution reveal? ...

We noted above that the direct-to-customer channel is less prevalent in North America than elsewhere, so it would indeed appear that traditional distribution is – marginally – more intact here.

This strength of traditional channels translates into lower levels of lost business for North American carriers. Indeed, in our earlier post on Insurtech – Insurance Nexus Global Trend Map #2: Insurtech Perspectives – where we introduced the 'disruption score', only a quarter of Insurers & Reinsurers in North America reported losing market share to new entrants (compare 47% in Asia-Pacific).

We explore the North American distribution landscape further, with insights from in-region commentators, in our dedicated Regional Profile on North America (access all 7 Regional Profiles by downloading the full Trend Map here).

The model we are applying is one in which distribution disruption leads to customer disruption and thereby to a complete re-evaluation of the customer relationship... So, what can this tell us about Europe and Asia-Pacific?

Let us start with Asia-Pacific: on the distribution level, we encounter a high incidence of direct channels, low channel consistency and a high priority allocated to Distribution Diversification (as we saw from our priority tables in Insurance Nexus Global Trend Map #3: Insurer Priorities). And following this through, we find a corresponding degree of disruption on the customer level, with APAC respondents scoring high on measures of customer priority (as we saw in the previous section on Marketing and Customer-Centricity).

It is clear therefore that APAC insurers know they are in trouble and that they are trying proactively to meet the 21st-century consumer head on. This is very much in line with our ‘disruption score’ for the region, whereby 47% of in Asia-Pacific stated that they were losing market share to new entrants, a high score in which fear may well play a considerable role.

Europe is an interesting case. Distribution-wise, we note solid adoption of direct-to-customer channels, and the continent has in many ways been a pioneer in its use of affiliate channels and aggregators (we explore these themes in more depth in our Regional Profile on Europe – read ahead here). In our previous post on Marketing and Customer-Centricity, we characterised the customer relationship here (along with Asia-Pacific) as being marginally more ‘problematic’ than in North America, based on the forceful prioritisation of the customer we found here.

Does this mean that Europe finds itself in the relatively more ‘disrupted’ camp, along with Asia-Pacific? ... Not necessarily.

Casting our minds back to our earlier post on Insurtech Perspectives, we cannot help but notice Europe’s low 'disruption score' of 23% (much lower than Asia-Pacific's, in line with North America), meaning that, at least in carriers' perceptions, relatively little market share is currently being lost. One way to square this with our foregoing observations on the distribution and customer situation in Europe would be if European insurers were rising better to the challenge of serving customers across a complex distribution landscape than their counterparts in Asia-Pacific.

This would imply that Europe is perhaps slightly ahead of the curve and has had some time to adjust. In line with this hypothesis is the low prominence of the Chief Customer Officer role among recent or forthcoming appointments at European insurers (contrasting with its importance in Asia-Pacific), as we saw in Insurance Nexus Global Trend Map #4: Services, Investments & Job Roles. Our inference from this is not that customer-related roles do not exist in Europe (after all, Europe allocated the highest overall priority to Customer Centricity out of all our regions – see Insurer Priorities) but rather that they are not of such recent creation.

So, we can tentatively conclude that, while Europe and Asia-Pacific are both undergoing distribution- and customer-driven disruption, Europe has entered deeper into this – there is, as such, no wholesale panic regarding lost market share through new entrants. In this sense, Europe would be not so much the most disrupted as the longest-disrupted of our key regions.

It will be interesting to observe how the sense of disruption in Europe, North America and Asia-Pacific waxes and wanes as the market develops. The characterisation we have attempted here is based on fine gradations and, with the global market fluctuating as it is, there is no reason to believe development in any region will be linear. We return to these issues – and to the perennial question of disruption – in the Regional Profiles section with which we close the report (read ahead here).

"Technology is changing more rapidly today than ever, which is changing the nature of risk. The distribution of insurance products and services is poised for rapid change. Agents and Brokers will have a role to play as the distribution model changes. Those agents and brokers that are willing to adapt will thrive, those that rely on the old methods will continue to be successful until they wake up one day and they are not."

Steve Anderson, President at the Anderson Network

As insurers around the world become more proactive in their pursuit of the customer, we are left with the question of the brokers and agents who hitherto have been the face of the insurance industry.

Intermediaries still hold the cards in many customer segments and business lines – especially for complex, high-value products in Life and Commercial – and can play an important role more broadly as part of the omnichannel ‘mix’. And, before we write them off too hastily, we should remember one thing: while intermediaries no longer own distribution in the strictest sense, it is debatable whether carriers will want to take all aspects of customer-servicing in house just because they can.

"Chatbots and guided conversations – in the not-too-distant future – will significantly change the role of agents and brokers when providing insurance knowledge and resources to policyholders. Expert advice will still be needed, but chatbots and guided conversations will provide much of the basic information to the digital-savvy consumer anytime and anywhere."

Steve Anderson, President at the Anderson Network

For insurance players big and small, distribution is the key to getting in front of today's customers, in the sense either of tapping totally new segments or of fighting off competitors' threats to the existing book. However, if you cannot follow up on your promises across the customer life-cycle, then all that top-of-funnel work will have been in vain. In our next installment, we look at what is perhaps the most high-stakes customer touch-point of them all: Claims. And of course, if you wish to read ahead straight away, you can simply download the full Trend Map for free whenever you like.

Access the full Trend Map free of charge here ...

For any inquiries relating to the Insurance Nexus Global Trend Map, this on-going content series or next year's edition, please contact:

Alexander Cherry, Head of Research & Content at Insurance Nexus (alexander.cherry@insurancenexus.com)