The insurance industry is undergoing a period of profound adjustments, and the insurtech world is quickly becoming a valid alternative to the traditional business models and applications. The interest in the insurtech industry has drastically increased over the last few years, reaching a media coverage 8x higher and an investment level three times bigger with respect to 2014.

Insurtech startups and initiatives are then disrupting the existing supply chain and classical insurance roles making the boundaries blurrier. They are fostering ecosystems where several players positively interact and modularly redesign and integrate different value propositions.

According to Matteo Carbone, founder of the Connected Insurance Observatory, the innovations can be divided into seven macro areas (awareness, choice, acquisition, use, recommendation, IoT, and peer-to-peer) and insurtech initiatives should be evaluated based on their profitability, proximity to clients, persistence (i.e., the increase in renewal rates), and productivity.

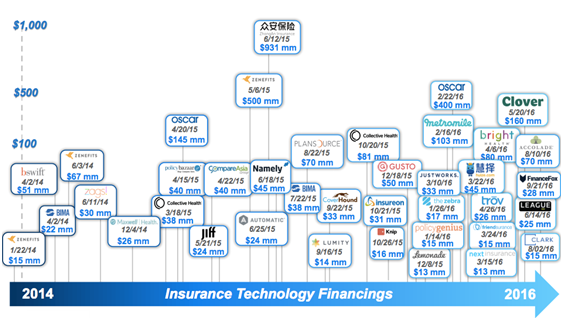

Relevant initiatives and different insurance technology trends are also shown in the more extensive and complete report that tracks down all the recent developments and trends in the space (“Prepare for the InsurTech Wave: Overview of Key Insurance Technology Trends”), which also lists the recent funding deals and the breakdown of the geographic concentrations of insurtech startups.

Source: FT Partners

Organized by the Italian Bank Association (ABI), the Bancassicurazione Forum 29-30 September has become a point of reference for the Italian insurance market. The purpose of this years’ event is discussing the strategic challenges that the insurance sector will be facing in the next couple of years.

Connected Insurance refers to insurance solutions that use sensors to gather real-time information about the current state of a risk, data which it then uses along the insurance value chain. Investments in the connected insurance market have surpassed two billion dollars – take for example Oscar ($400M), Ping a Good Doctor ($500M) and Metromile ($191M) – one reason for which it will be one of the main topics to be discussed at the event.

Also present at the Forum, the start-up Neosurance, winner of the IoT Newcomer prize at IoT Europe Awards in London this year. Dario Melpignano, Founder and CEO of Neosurance, will be discussing with other leaders of the industry about how insurtech is currently setting the stage for a whole new range of opportunities to come for traditional insurance businesses and especially for those who are capable of recognizing the trend.

Matteo Carbone, who is actively participating in the discussion at the Forum Bancassicurazione 2016 event, claims that “the number of insurance policies on telematics black box is nowadays around 4.8 million in Italy and only 3.3 million in US, but this gap is going to increase further because by 2020 Italy will reach more than 12 million contracts”. Carbone also believes telematics could boost the market penetration of home insurance in the Italian market, because “as of today, 22% of Italian households that have no home insurance are inclined to buy it if it were connected insurance.

Among others present at the Forum, Pasquale Ambrosio (KPMG), Davide Bevini (BPER Banca), Isabella Fumagalli (BNP Paribas Cardif), Umberto Guidoni (ANIA), Paolo Veca (Gruppo Helvetia), e Gianluca Zanini (AXA Italia).

Neosurance, which has recently participated together with AXA Lab at VivaTech Paris, proposes to the insurance companies a system based on push sales of micro insurance: a quick and practical solution to get insured with just one touch of the screen and it’s all based on contextual information gathered from the user’s environment. Neosurance was co-founded by Digital Tech and Neosperience, having the privilege to be part of the Connected Insurance Observatory where it had the opportunity to exchange ideas with some of the top insurance companies. Neosurance is begining to build a reputation as the innovative start-up that will change insurance standards: by making use of of “intelligent” technologies and the virtual assistant concept, the platform will allow insurers to offer policies that are customized to the client’s actual short-term needs.