The efforts of Insurers are being oriented more and more towards associating auto insurance with services (based on telematics data)

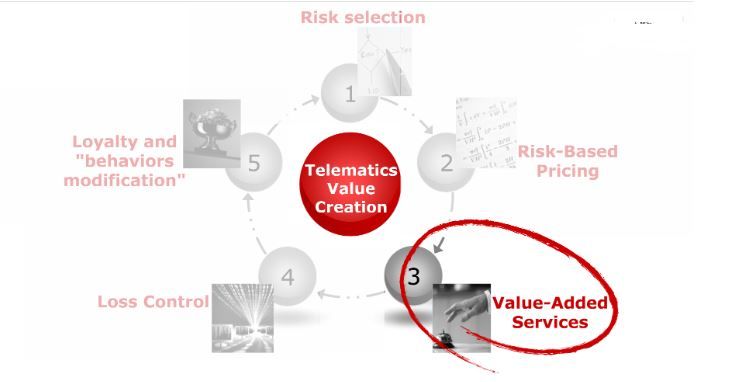

The black box makes it possible for Insurers to enrich their auto insurance value proposition by adding services built upon data provided by telematics. This is an element to be taken in consideration when evaluating the overall ROI of a telematics program. On the one hand, these services represent a way of de-commoditizing the car insurance policy and are also a source of income. On the medium/long term, this characteristic will become more and more important because of the de-risking trend in the MTPL business –due to the technological progress when it comes to security and connected cars. On the other hand, the delivery of these services is generating a growth in the number of interactions with the client and it also helps in creating a richer connection between company and client. This shift in the ways of interaction between client and Company presents great potential and the evidence for this come from many customer satisfaction surveys: there is a clear link between customer satisfaction and the level of interaction with the Company. This is true both for Italy and at an international level.

Motor Insurance Telematics is mainstream in Italy representing 15% of motor insurance sales and renewals. [ Click to Tweet]

In this new service “eco system”, Insurers will find themselves forced to co-compete (that is collaborate and compete) with different actors which are active in connected car sector. As seen in the above-mentioned examples, Italy is at the moment one of the most advanced countries in terms of service development connected to telematics. This creates the perfect conditions for the consolidation of approaches driven by the Insurance Companies in a country where blackbox policies have become a mainstream element (as opposed to niche): at the end of 2014 telematics have represented 15% of motor insurance sales and renewals in Italy (reaching a peak of 40% in some areas of the country), as underlined by the picture below based on recent statistics provided by IVASS.

There are three macro categories when it comes to services:

- Informational services related to the UBI (Usage Based Insurance)policy, typically delivered through a smartphone app or a dedicated area on a website. These services concern: quantification of pricing adjustment at the moment of the contract renewal based on previous driving behavior; coaching and advices regarding the style of driving; advices on how to save more while behind the wheel; gamification approach that allows a comparison of one’s own driving style with that of other friends. Canada-based company called Intact and Discovery which is based in South Africa, can be considered among the most advanced examples that currently use this type of approach. According to recent data made available by a telematics service provider, 4 out of 5 clients owning a telematics insurance policy check put their driver score at least once a month. Furthermore, there is evidence that remote coaching programs can lead to concrete results in modifying driving behavior.

- Product offers related to the client’s own automobile - like Discoveryhas done in South Africa with the Tires or the Allstate Rewards - orinsurance policies sold “on the go” using data collected from the boxes installed on cars (reverse geocoding). Tokyo Marine (Japan-based) - together with telephone operator NTT Docomo - have implemented an innovative way of fruition of the insurance, proving that impulse “cross-selling” of low-value insurance coverage is a valid approach.

- Services related to the customer journey experienced by the owner of a connected car.

An ecosystem of services for the owner of a connected car driven by the Insurer. [ Click to Tweet]

The services for the connected car

There is a vast array of services that can be developed within the connected car “ecosystem” and the technology is moving fast. There are new start-ups and innovative business models popping up everywhere around the world. To cite just a recent Italian example, there is WoW – a digital wallet created by CheBanca!- which have integrated a parking payment service called Smarticket.it.

Focusing on services more close with the insurance offer, the value propositions could be observed on the three stages of the customer journey:

- While driving. Services include services such as bad weather alert, speeding alert, dedicated concierge and even an alert that is activated if the car leaves a pre-defined “safe area” (family “control” options for young or old members of the family). Discovery’s approach in this field is highly relevant and includes an anti-theft service that signals to the client if the driver has a different driving style compared to the usual one;

- In case of crash. Here the Italian market is considered to be an international best practice because of how it has perfected the usage of telematics data to manage services. Many Companies here have invested in creating a valuable customer experience by involving partners specialized in assistance. The solutions provided in case of an incident start with a proactive attitude in contacting the client and - depending on the gravity of the event - continues with sending help directly at the place of the incident and takes care of all the logistic and case management problems that can arise. Innovation is now focusing more on simplifying the FNOL (first notice of loss) procedure in case of car accidents. One such example is Ania, Italian Association of Insurers, which has announced for 2016 the launch of a new app meant to dematerialize the FNOL.

- When parked. Other than locating and recovering the car in case of theft, the blackbox can send alerts when the vehicle is moved or damaged in any way. This also allows to actually locate a parked vehicle. There are three Italian companies - TUA, Cattolica, Cargeas – that have recently launched innovative value propositions in this direction. One of the best practice on this way is the street sweeping alert by Metromile.